Blockchain company Ripple urged UK policymakers to seize the opportunity to become a global leader in the digital asset sector.

Matthew Osborne, Ripple's Policy Director for Europe, stated at Ripple's recent London Policy Summit that panelists believe the UK has the financial expertise, infrastructure, and international reputation to lead this developing field.

UK's 'Second Mover Advantage'

Osborne noted in a blog post that one of the summit's key conclusions is that the UK has a "second mover advantage" in cryptocurrency regulation.

According to the post, the UK can adopt a more balanced and innovation-friendly regulatory framework by observing early efforts in jurisdictions like the EU, Singapore, and Hong Kong.

This approach can ensure consumer protection while promoting responsible industry growth.

"The UK has a significant opportunity in digital assets. As the consensus grows that blockchain technology will transform financial markets, the UK already boasts a world-leading competitive financial services center. With particular strengths in foreign exchange, capital markets, insurance, and professional services, the UK has all the foundations to become a global leader in the digital asset space." – Matthew Osborne, Ripple's European Policy Director

Panelists added that such clear rules would increase institutional trust, improve industry standards, and reduce systemic risks. However, they warned that the opportunity to act is closing quickly.

"The window of opportunity is narrowing, and a clear theme from industry participants is the need to provide regulatory clarity more quickly and urgently." – Blockchain company Ripple

The urgency stems from predictions that digital assets could account for up to 10% of global capital markets by 2030, potentially representing a value of $4 trillion to $5 trillion.

Osborne emphasized that the UK must act boldly and collaboratively to remove unnecessary legal barriers and create an innovation-friendly environment.

Meanwhile, panelists also highlighted another urgent issue: the lack of clarity on stablecoins.

Stablecoins are digital tokens pegged to fiat currencies like the US dollar and are essential to the broader cryptocurrency economy. As they are increasingly used for transactions, payments, and settlements, stablecoins have become the backbone of the digital asset ecosystem.

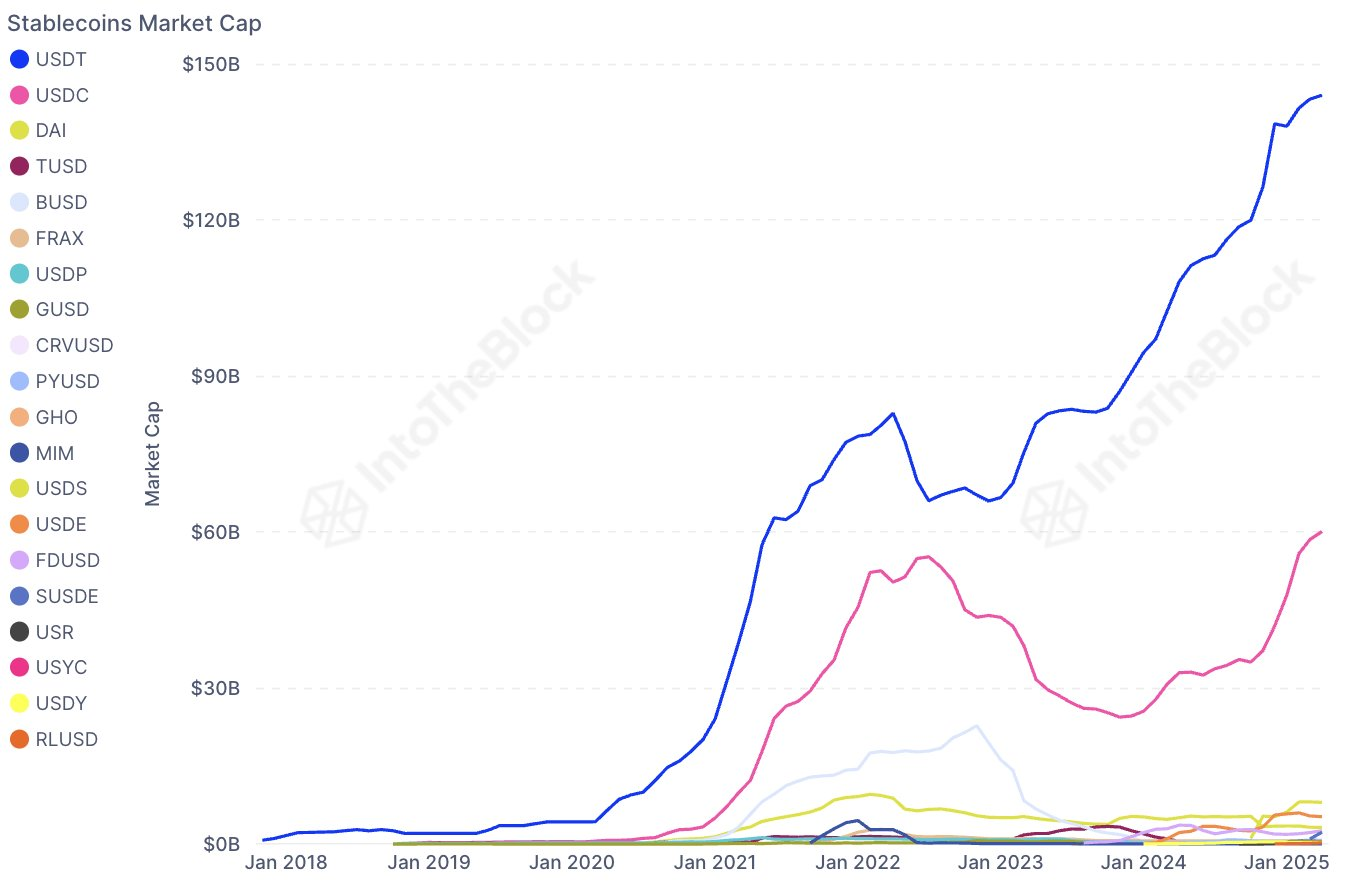

Stablecoins, currently exceeding $230 billion in market capitalization, are expected to grow further as adoption increases.

Considering this, there are calls for the Financial Conduct Authority (FCA) to quickly advance a stablecoin framework. Panelists emphasized the need for policies supporting both domestically issued and foreign stablecoins operating within the UK.