According to new data from Arkham Intelligence Intelligence, it appears that three major Bitcoin spot ETF issuers are purchasing large amounts of BTC. On the 2nd, the US Bitcoin spot ETF recorded net inflows of $220 million, and issuers seem to be anticipating a surge in demand.

Bitcoin has shown significant volatility in recent recent institutional investors show more leading cryptocurrency more than traditional financial markets.

Why are ETF Issuers Buying Bitcoin?

The cryptocurrency market experienced experienced broader liquidation today, with fears of a larger economic recession spreading widely. After Trump imposed significantly higher tariffs than expected, cryptocurrencies have shown declines similar to traditional financial stock markets.

The US spot Bitcoin ETF market shows that institutional demand could rebound in the short term.

"Donald Trump has imposed tariffs worldwide. So what? Grayscale is buying Bitcoin, Fidelity is buying Bitcoin, and Ark Invest is buying Bitcoin." – Arkham Intelligence mentioned on social media.

The renowned blockchain analysis platform Arkham Intelligence is not the only this Bitcoin ETF trend.. Bitcoin's price has been highly volatile over the past two days but has largely succeeded in returning to a consistent baseline.

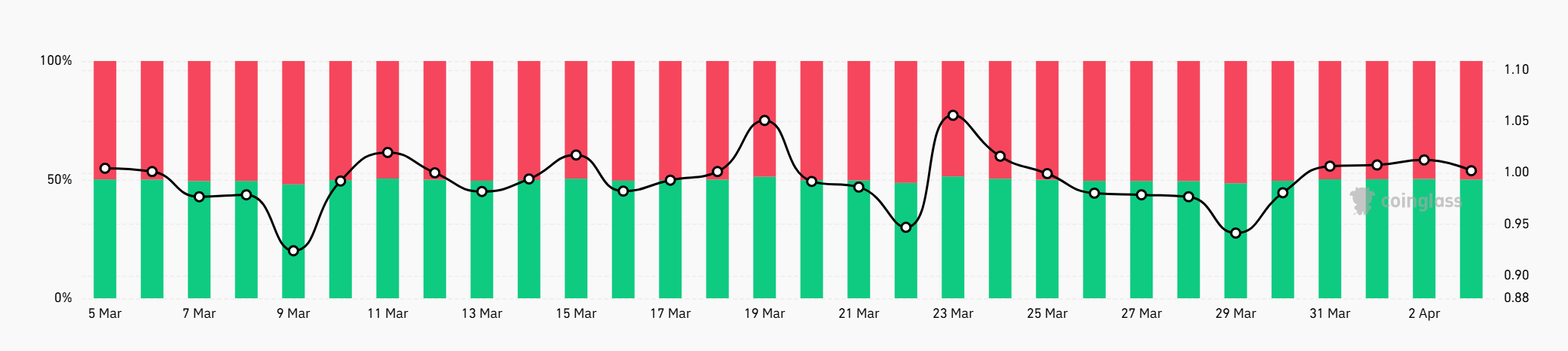

The asset's Longing-Short ratio was 0.94 last week and changed to 1 today. This indicates that investor positions are moving in a more balanced direction.

Previously, the market showed a slight downwithward with 48.5% Longing positions and 51.5% Short positions. Today, it is evenly divided with 50.5% Longing positions shows, indicating that investors have reduced their downward bias and taken a neutral stance.

Additionally, Bitcoin ETFs have shown good performance in other major areas. According to Soso Value's data, the entire asset category recorded category recorded net inflows of $220 million yesterday.

This means these companies anticipate increased demand in the near future. Many questions remain about tariffs, the cryptocurrency market, and the global economy.