Donald Trump has concluded a press conference detailing his tariff plan for Liberation Day. Essentially, his administration plans to calculate existing tariffs on the United States and implement half of them.

These reciprocal tariffs will apply to all imports, regardless of initial industry tariffs, and impose at least 10% on all countries. Following this announcement, stock and cryptocurrency markets declined.

Trump's Liberation Day Arrives

Trump's Liberation Day has arrived, with broad U.S. tariffs announced, and markets are anticipating. In the live broadcast, Trump detailed tariffs to be imposed on various countries. In addition to fixed tariffs on automobiles, he explained the criteria for each country:

"At midnight, we will impose a 25% tariff on all foreign-made automobiles. Starting tomorrow, the United States will implement reciprocal tariffs on other countries. For countries that treat us poorly, we will calculate the total value of their tariffs and impose approximately half of what we charge them. It may not be reciprocal, but we could do so," he claimed.

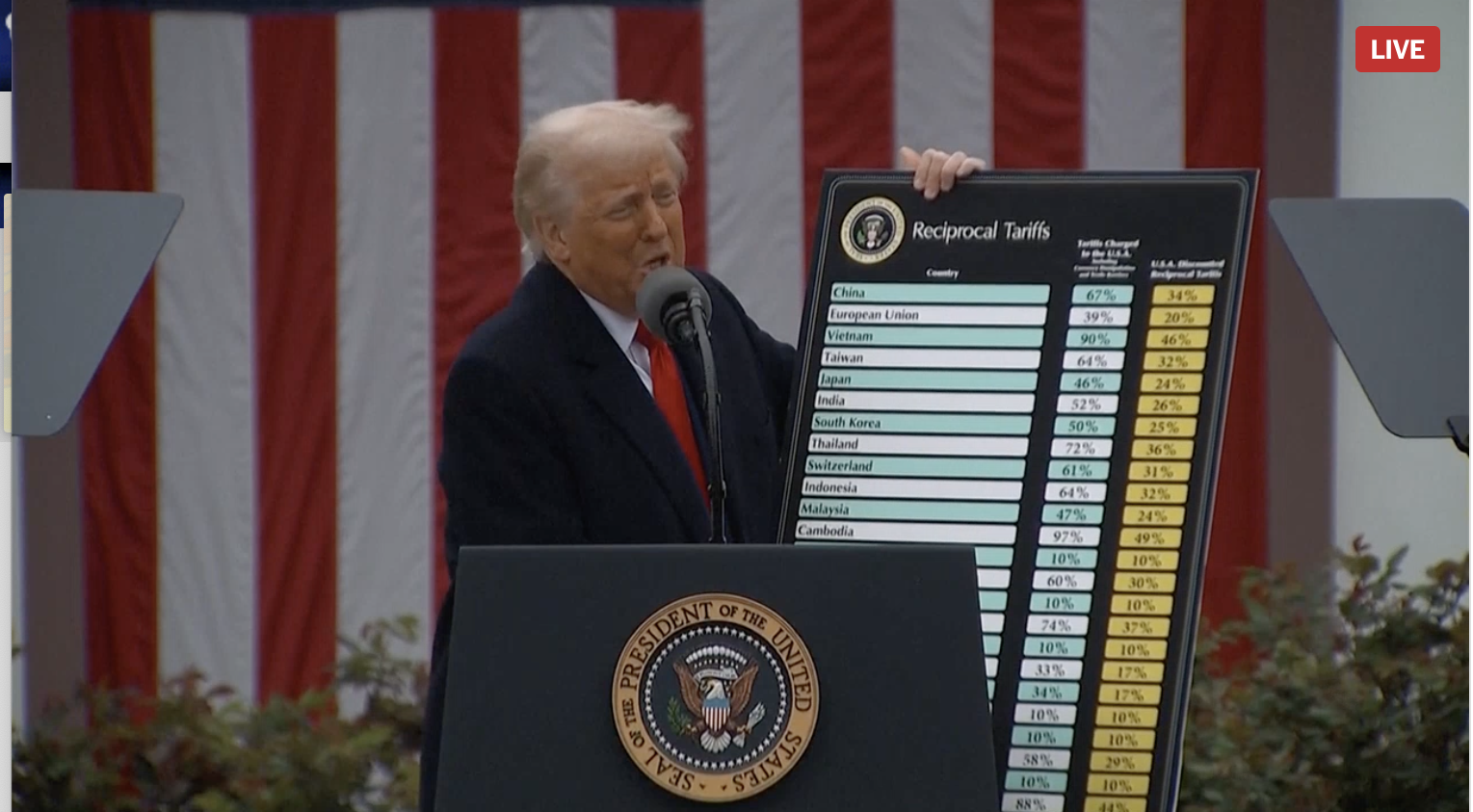

Trump argued that the Liberation Day plan is centered on reciprocal tariffs. Essentially, the administration is calculating tariffs from other countries on various industries like agriculture. Once the total amount of these tariffs is calculated, Trump will impose either half of that value or 10%, whichever is higher. He included a chart to visualize this.

Trump's Liberation Day plan includes strong tariffs on major allies and trading partners. He will impose 34% tariffs on China, 20% on the European Union, and 32% on Taiwan. Surprisingly, he also imposed 17% tariffs on Israel, which had just canceled tariffs yesterday, and did not mention tariffs on Canada or Mexico despite previous disputes.

Moreover, Trump's tariffs will apply to all imports, whereas original tariffs were often limited to specific sectors like grain or dairy production. This could provoke hostility from allies and trading partners who impose agricultural tariffs for domestic security reasons.

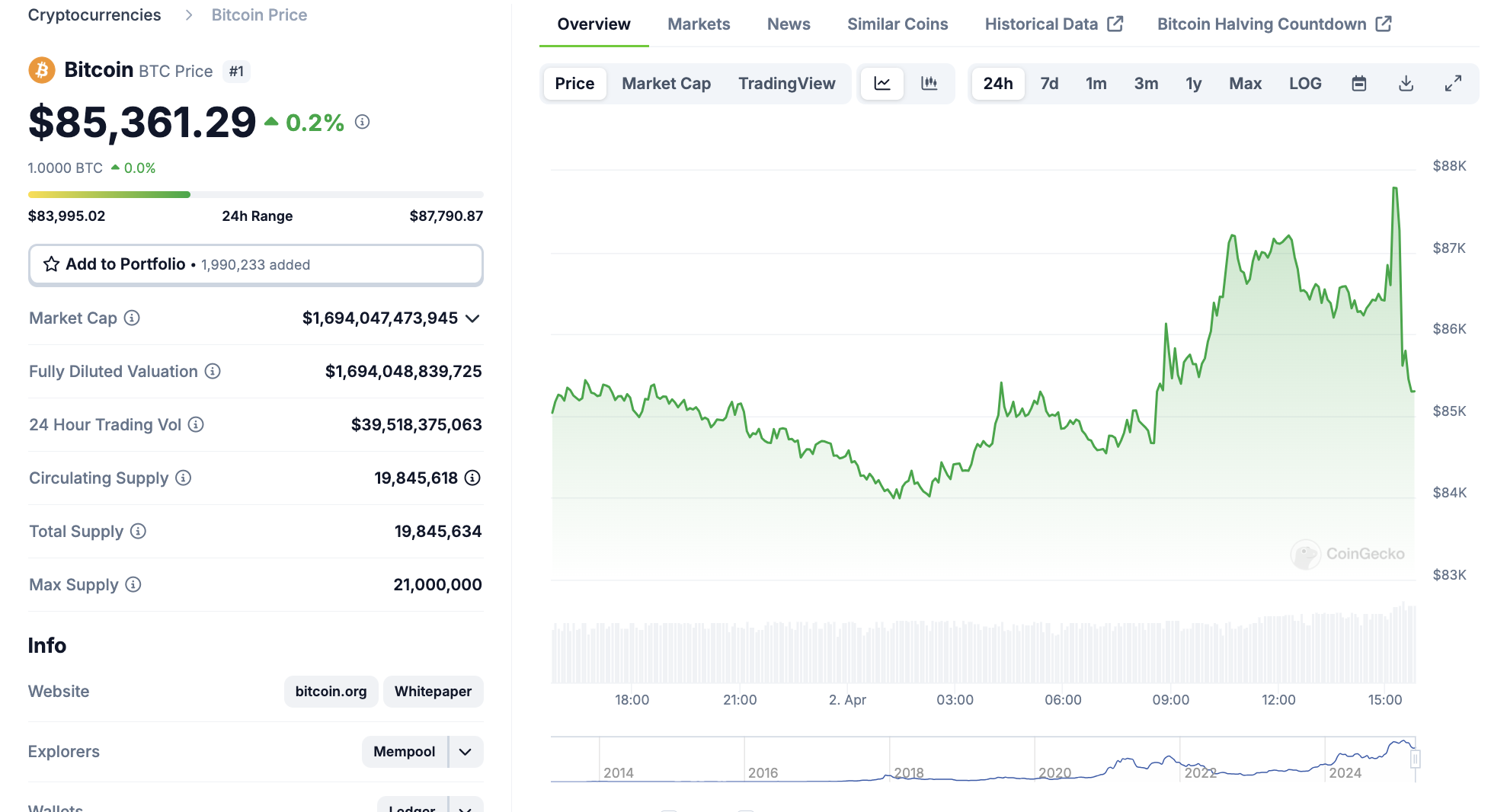

Uncertainty about Liberation Day significantly fueled fears of a U.S. recession. As Trump's speech progressed, stock markets plummeted, with Nasdaq-100 futures dropping 2.6% and S&P futures falling 1.67%. Bitcoin price similarly declined by about 1.4%.

Ultimately, Trump initiated the Liberation Day event after traditional financial markets closed, and his tariffs will take effect at midnight.

In other words, it may take a few more hours to assess the actual impact.