EOS RAM: The Hidden Easter Egg of the Memory Market: EOS's RAM (memory resource) is a unique design, with on-chain storage relying on it, limited supply, and usage increasing with DApp growth. The foundation optimized the RAM mechanism, launching XRAM (extended RAM), allowing users to stake tokens for resources and share gas fees - and these gas fees go directly to BTC. This operation is mind-blowing, binding EOS with BTC and piggybacking on the "digital gold" hype. For example, users staking several hundred MB of XRAM can receive BTC-denominated gas fee shares, indicating ongoing RAM market demand, especially with new projects driving up its value. Some jokingly say: "RAM is more like an asset than EOS coin."

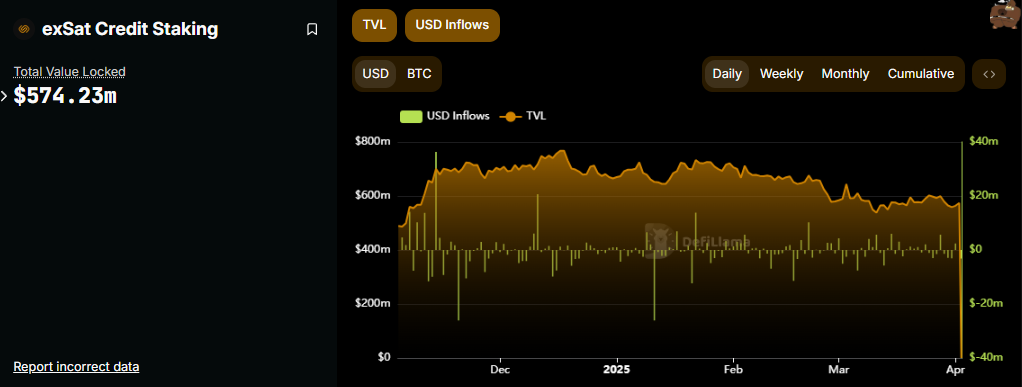

exSat: Bitcoin's 'EOS Add-on': exSat is a new attempt in 2024, using EOS's RAM to store BTC's UTXO data, aiming to solve Bitcoin's slow and costly transactions. Sounds cool: BTC can run smart contracts and DeFi, with EOS transforming into a "Bitcoin Layer 2". In March 2025, exSat locked 5,413 BTC, worth $587 million, far exceeding EOS mainnet's $174 million, becoming the ecosystem's new "leader". But problems persist: Bitcoin's mechanism doesn't support staking, and RAM capacity can't support a large-scale scene, with the community questioning: "Isn't this just drawing a big pie for BTC?"

1DEX: A Delayed Attempt at Decentralized Exchange: 1DEX is a new DEX launched by EOS, aiming to fill the DeFi gap. EOS mainnet is fast (1-second block time) and low-cost, theoretically suitable for trading, but its early resource model was too complex, driving developers away. Now 1DEX is making a comeback. 1DEX supports unique asset trading and cross-chain operations, but EVM compatibility isn't sorted, documentation is sparse, looking like a "half-baked product". Users on X complain: "If 1DEX had launched five years ago, EOS could have grabbed some market share, but now it's too late."

RWA: Vaulta holders will soon have the opportunity to access exclusive investments in tokenized real-world assets (RWA), including real estate, commodities, and stocks from traditionally illiquid markets. Strategic partnerships with leading tokenization platforms will unlock these complex financial products, significantly enhancing portfolio diversification and promoting a vibrant, liquid market.

Market Frenzy: The "Blood Recovery Moment" with Consecutive 30% Gains

On the day Vaulta was released (March 18), EOS surged 30%, jumping from $0.65 to $0.84. Today (April 1), it rose another 30%, breaking $0.8021, with technical charts showing a breakthrough of key resistance levels and trading volume surging. Some are shouting "back to $1.4". Even more dramatically, someone on X questioned: "Is EOS about to recreate the scene of saving the crypto market in April 2018?" Many newcomers might be confused, but old-timers remember: In April 2018, EOS soared from $5 to $23, with a monthly gain over 360%, effectively rallying the entire bear market for a month, becoming that year's "market savior".

Now Vaulta has risen 60%, with technical aspects perfectly aligned, inevitably sparking imagination - can this old horse perform another "dog-head rescue"? However, veteran players coldly laugh: "Just a pump and dump strategy." OKX and Binance pre-listed trading pairs, quantitative robots "synchronized price and volume", igniting FOMO emotions - is this consecutive rally a "duet" of foundation self-rescue and new concept hype, or a prelude to the 2018 miracle? The subsequent momentum will tell.

Three Behind-the-Scenes Drivers of the Surge

- Concept Hype: Vaulta's "Web3 bank" story is novel, with Bitcoin linkage and DeFi layout being speculative hotspots. When the news broke on March 18, trading volume surged 631%, with strong short-term buying pressure, and another 30% rise on April 1.

- Technical Signals: Daily breakthrough of the box, short-term trend looks bullish, attracting many traders. Some analysts even suggest breaking the descending triangle, with a target of $1.4.

- Foundation's Last Stand: ENF has been holding its breath these years, fighting lawsuits effectively, building some momentum with exSat and 1DEX, with rebranding as a concentrated release, forcibly giving EOS another lifeline.

BTC Shares from XRAM Staking: The Ecosystem's "Bizarre Highlight"

In the EOS ecosystem, XRAM stakers receive BTC-denominated gas fee shares. RAM, as a scarce resource, still has a market even with the mainnet half-dead, especially after exSat's launch increased demand. Gas fees going directly to BTC instead of EOS tokens suggest the foundation no longer relies on EOS tokens, and after Vaulta's replacement, governance functions may further weaken. This "bizarre mechanism" is a microcosm of EOS's transformation.

Can EOS Still Be Chased?

Short-term, if EOS holds $0.8, $1.4 is possible, potentially even reaching double digits. XRAM's BTC shares can sustain for a while, with tracking exSat's progress and flexible adjustment being a good strategy. But long-term prospects have three major weaknesses:

- Competitive Pressure: Web3 banking track isn't new, Ethereum has MakerDAO, Solana has Serum, EOS doesn't have technical advantages.

- Implementation Challenges: exSat and 1DEX sound fancy, but compliance and technical stability are questionable. Whether Vaulta's blueprint can be implemented is a big unknown.

- Trust Crisis: Block.one's "historical baggage" is too heavy, and no matter how hard the foundation tries, it's difficult to completely clear its name.

Conclusion

EOS's seven years reflect the crypto market's journey from enthusiasm to calm. $4.2 billion built a "technological utopia", but collapsed due to poor experience and chaotic management. After the foundation took over, RAM, exSat, 1DEX, and Vaulta became "self-rescue" strategies, keeping EOS "undead". This 30% surge is supported by new concepts and market sentiment, but how far it can go depends on whether Vaulta can tell a convincing story.

An old crypto saying: "EOS's biggest risk is that you don't dare to hold it." Facing this "old horse", whether you dare to bet depends on the size of your heart. Because on the blockchain track, human emotions are harder to predict than code. Your XRAM shares are still there, and EOS's marathon hasn't stopped - this $4.2 billion journey's endpoint, whether "bank" or "tombstone", will be revealed by time.