Bitcoin (BTC) had a difficult start in early 2025 and recorded the worst quarterly performance in 7 years during the first quarter.

This significant decline raised questions among investors about whether it is a time to buy or sell.

Bitcoin Q1 Performance, Lowest in 7 Years

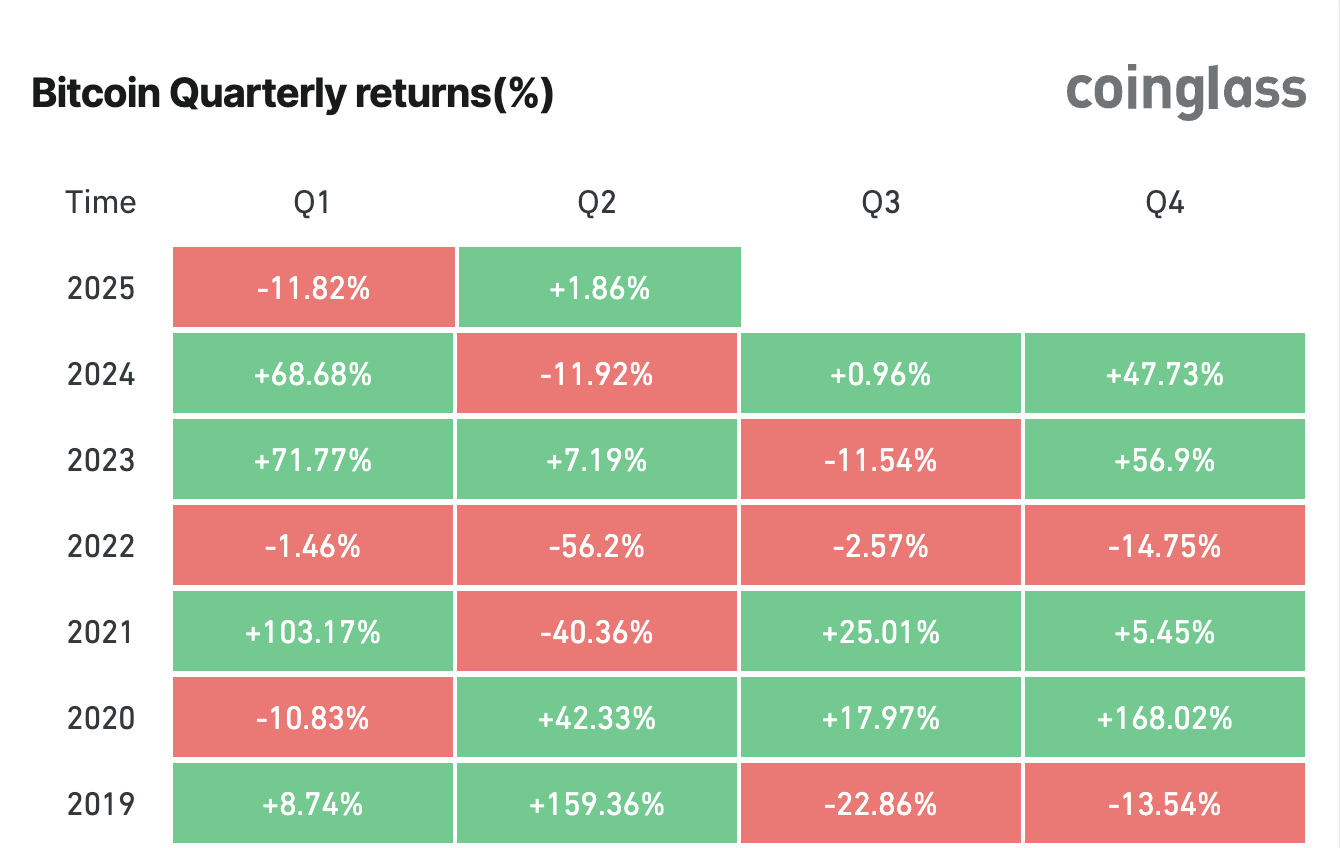

Bitcoin's performance in the first quarter of 2025 was the worst since 2018. 2018 was a brutal bear market where BTC lost over 50% of its value. According to Coinglass data, Bitcoin's first quarter performance decreased by 11.82%. In the first quarter of 2024, Bitcoin had recorded an increase of over 68%.

As of March 31, 2025, Bitcoin's price dropped from $106,000 in December 2024 to about $80,200 by the end of March 2025.

This decline reflects a combination of macroeconomic pressures and policy uncertainties, particularly after U.S. President Donald Trump's new tariff policies.

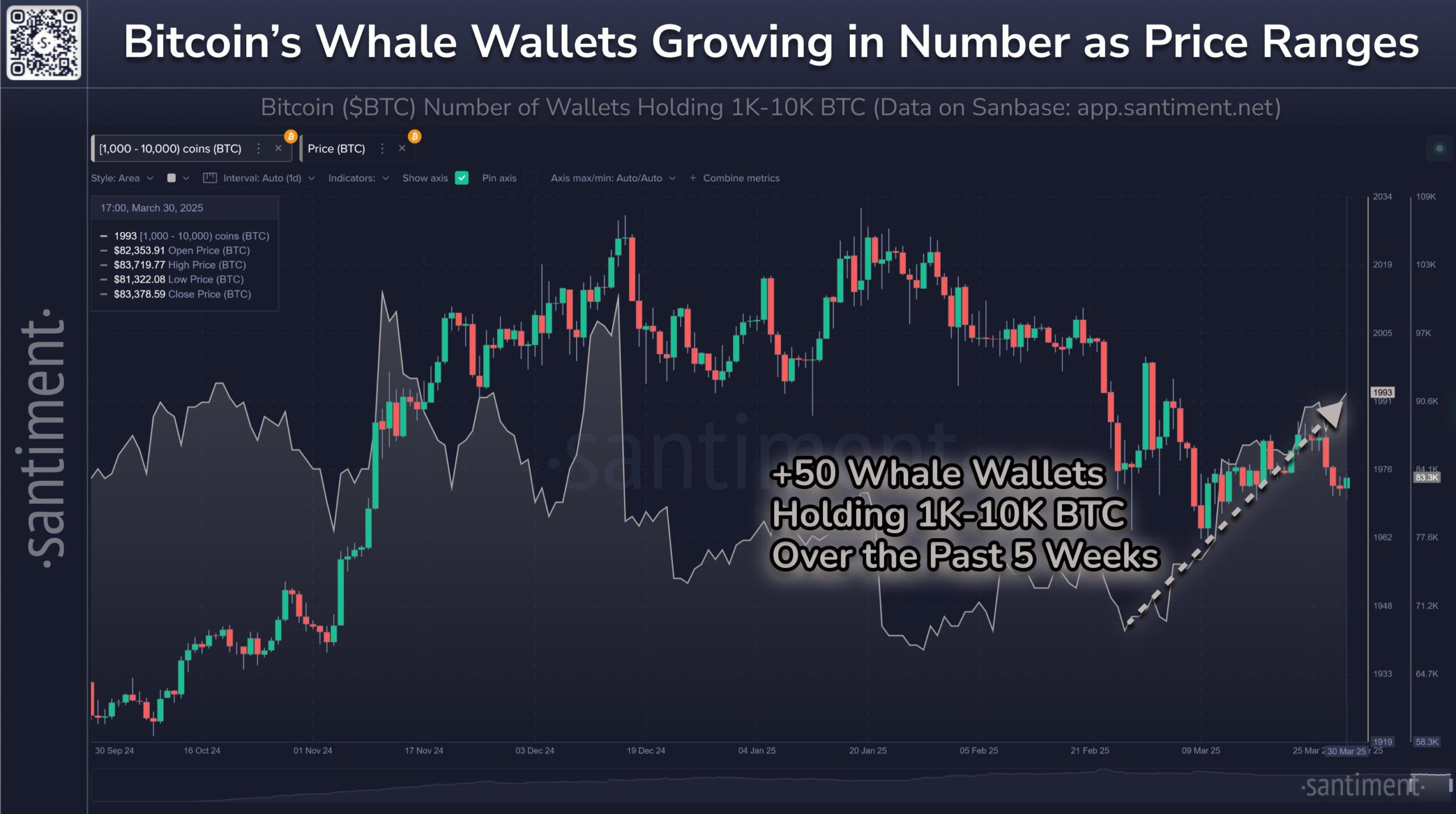

Against this bearish backdrop, on-chain data shows a contrasting trend: Bitcoin whales are accumulating. According to a post by Santiment on X on March 31, 2025, the number of whale addresses holding 1,000 to 10,000 BTC reached 1,993.

This is the highest number since December 2024, representing a 2.6% increase over the past 5 weeks, indicating growing confidence among large holders.

Glassnode reported that trading activity among Bitcoin holders with a 3-6 month holding period dropped to its lowest level since June 2021 on March 31, 2025. This decrease indicates that short-term holders are either remaining in or leaving the market, reducing selling pressure.

"BTC holder spending is at its lowest level since mid-2021. This inactivity reinforces that recent top buyers are maintaining their positions despite recent volatility," reported glassnode.

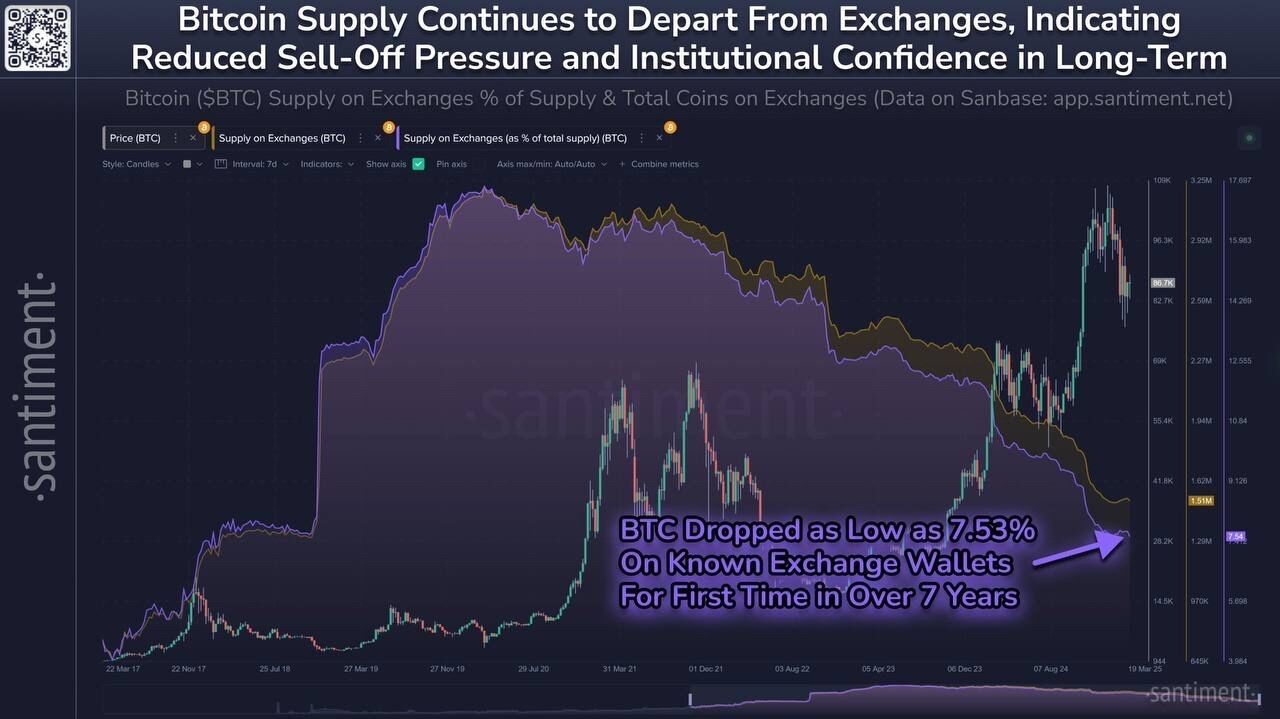

On the same day, Bitcoin's exchange supply fell to 7.53%, the lowest level since February 2018. Low exchange supply is often associated with long-term holding behavior and can create scarcity that may drive prices up over time. These indicators suggest Bitcoin may be entering an accumulation and consolidation phase.

Market analyst Axel Adler Jr. announced on X on April 1, 2025, that Bitcoin's selling pressure has been exhausted. Adler predicts a consolidation range in April and May, suggesting the market may stabilize before the next major movement.

Fidelity Research believes Bitcoin is gaining momentum for the next "acceleration phase". Fidelity's analysis, based on historical cycles, mentions that consolidation periods often occur before major price increases, driven by institutional adoption and Bitcoin's role as an inflation hedge.

This aligns with the whale accumulation trend and decreasing exchange supply, pointing to upward momentum in the medium to long term.