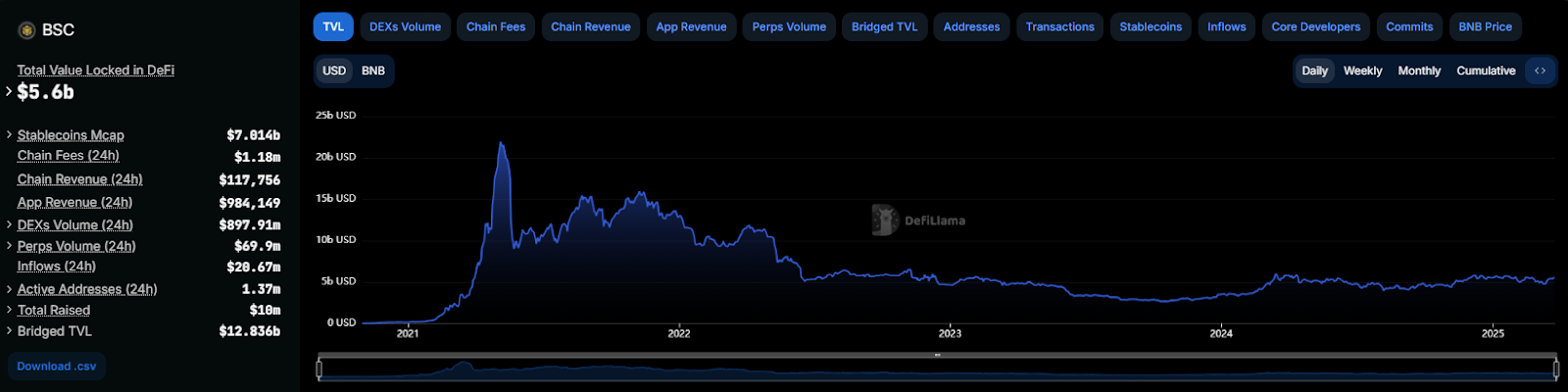

BNB Chain with $5.6 Billion TVL is Making a Dangerous and Crazy Bet.

On March 24, 2025, BNB Chain announced the launch of the third phase of liquidity incentive plan - a $100 million permanent liquidity support plan, which is another major strategic upgrade following the cumulative $4.4 million incentives in the previous two phases.

However, two conflicting comments erupted in the community -

'Binance finally gets it! This is the scale a public chain should have!' (12,000 likes)

'Laughable, suggest renaming it to BNB Harvesting Machine, old projects are worse than dogs!' (8,900 likes)

From the peak of $21 billion TVL to the current halved decline,BNB Chain is trying to reclaim the throne with this aggressive plan of 'exchange listing with fixed price + permanent liquidity pool'. If the reward funds flow to new coins on CEX, will the community not collectively escape, when arbitrageurs are celebrating, developers are silent, and whales shift to Solana? Is this $100 million gamble a strong needle for ecological revival or an adrenaline rush accelerating death?

As one of the most active public chains in the crypto world, BNB Chain currently has a Total Value Locked (TVL) of $5.6 billion, ranking third on the blockchain ranking, but still significantly lower than the peak of $21 billion TVL in 2021. This plan directly targets the core pain point of liquidity in the public chain ecosystem, attempting to reactivate ecological vitality through mechanism innovation and capital injection. This article will analyze the deep logic and market significance of this strategic decision from three dimensions: activity mechanism, ecological controversy, and breakthrough thinking.

- Data shows that of the current $5.6 billion TVL on BNB Chain, approximately 62% comes from community-led protocols like PancakeSwap and Venus. However, liquidity rewards are completely tilted towards new tokens on CEX, forming a "blood-sucking resource allocation" - using community-accumulated traffic and funds to feed new exchange darlings. This mechanism is triggering a "bad currency drives out good currency" effect.

3. The Death Spiral of Arbitrage Games

The trading path revealed by an anonymous market maker perfectly illustrates the harvesting logic:

Register new BNB Chain project → Create 10,000 token-holding addresses through airdrop → Collude with CEX to pay listing fees → Receive 50,000 BNB rewards → Use reward funds to pump trading volume → Sell tokens at high prices → Liquidity pool collapses

- If following this expectation, the number of new projects on BNB Chain might surge in the short term, but in the long run, it may trigger an ecological liquidity collapse.

- More fatally, the promise of "permanent liquidity lock" is becoming a joke. Since PancakeSwap V3 allows concentrated liquidity market making, arbitrageurs only need to concentrate 50% of BNB rewards in an extremely narrow price range to achieve loss-free extraction during token price surges and crashes.

Ecological Game: Prisoner's Dilemma Under Liquidity Carnival

The essence of this controversy is BNB Chain's strategic confusion between short-term data growth and long-term ecological health. From the mechanism design details, we can dissect three contradictions:

1. Confrontation Between Exchange Power and On-Chain Autonomy

- By making CEX listing the core reward standard, BNB Chain effectively cedes ecological discourse power to centralized exchanges. A second-tier CEX operator revealed: "Now, 80% of BNB Chain project white papers are focused on how to quickly meet token-holding address requirements, with technical roadmaps becoming mere appendices."

- This distortion directly leads to developer resource misallocation. Development funds originally meant for smart contract optimization are forced towards airdrop and volume farming services.A Chinese market team candidly stated: "We have to pay $20,000 weekly to 'address farms', otherwise we can't reach the 10,000 token-holder threshold."

2. Liquidity Illusion and Deviation from Real Needs

- Although planning to push BNB Chain's daily average transaction volume beyond $1.4 billion, dune analytics data shows that 68% of these transactions occur within the first 48 hours after CEX listing, with an average holding time of less than 3 hours. This "liquidity fireworks" creates nothing but false prosperity.

- True ecosystem participants are voting with their feet.A whale commented on Discord: "I've moved my entire BNB Chain position to Solana and Berachain; this has become a casino."

Breaking the Impasse: How to Prevent Liquidity Plan from Becoming an "Ecological Meat Grinder"

Facing escalating controversy, BNB Chain needs urgent correction from three levels:

1. Mechanism Level: Introduce Community Governance Weight

- Allocate at least 30% of reward distribution rights to on-chain DAO voting, focusing on supporting projects with outstanding performance in DEX depth, protocol revenue, and user retention, rather than purely chasing CEX listing numbers.

- Establish a "community contribution coefficient": Provide up to 20% additional rewards for older projects driven by community proposals (like PancakeSwap V4 migration).

2. Technical Level: Build an On-Chain Behavior Firewall

- Develop a token-holding address quality assessment model: Identify and eliminate fake addresses like airdrop farms by analyzing 20+ dimensions such as address activity, transaction frequency, and interconnectedness.

- Establish a liquidity exit circuit breaker mechanism: Automatically trigger BNB reward recovery when project on-chain selling exceeds 50% of reward amount.

3. Strategic Level: Reconstruct Value Distribution Coordinates

- Stop using centralized indicators like CEX listing numbers to measure ecosystem success, instead adopting native chain indicators like "DEX/CEX trading volume ratio", "independent developer growth", and "protocol net revenue".

- Learn from Solana ecosystem's "developer staking" model: Require projects to lock part of reward BNB in smart contracts, released in a step-based manner according to protocol TVL growth.

Ultimate Interrogation: Will BNB Chain Be a Casino Operator or a Republic Founder?

This $100 million liquidity experiment is essentially a sociological preview of the crypto world:When capital subsidies replace technological innovation as the ecosystem's main engine, public chains will inevitably degrade from a "value internet" to an "arbitrage dark web".

Liquidity can be built with money, but once ecosystem trust collapses, even millions of times the funds cannot redeem it.

Perhaps what BNB Chain truly needs to invest in is not $100 million in funds, but a thorough "on-chain Renaissance" - bringing developers back to center stage, letting community governance hold the scepter, and making every liquidity reward a fuel for value creation rather than an accelerant for financial fraud.

On May 5, 2021, BNB Chain's TVL once reached $21.9 billion, now reduced to $5.6 billion. In fact, the difference between the current $5.6 billion BSC and the previous $21 billion BSC was never about fund scale, but the value consensus accumulated by the community through code and trust over 1,420 days.