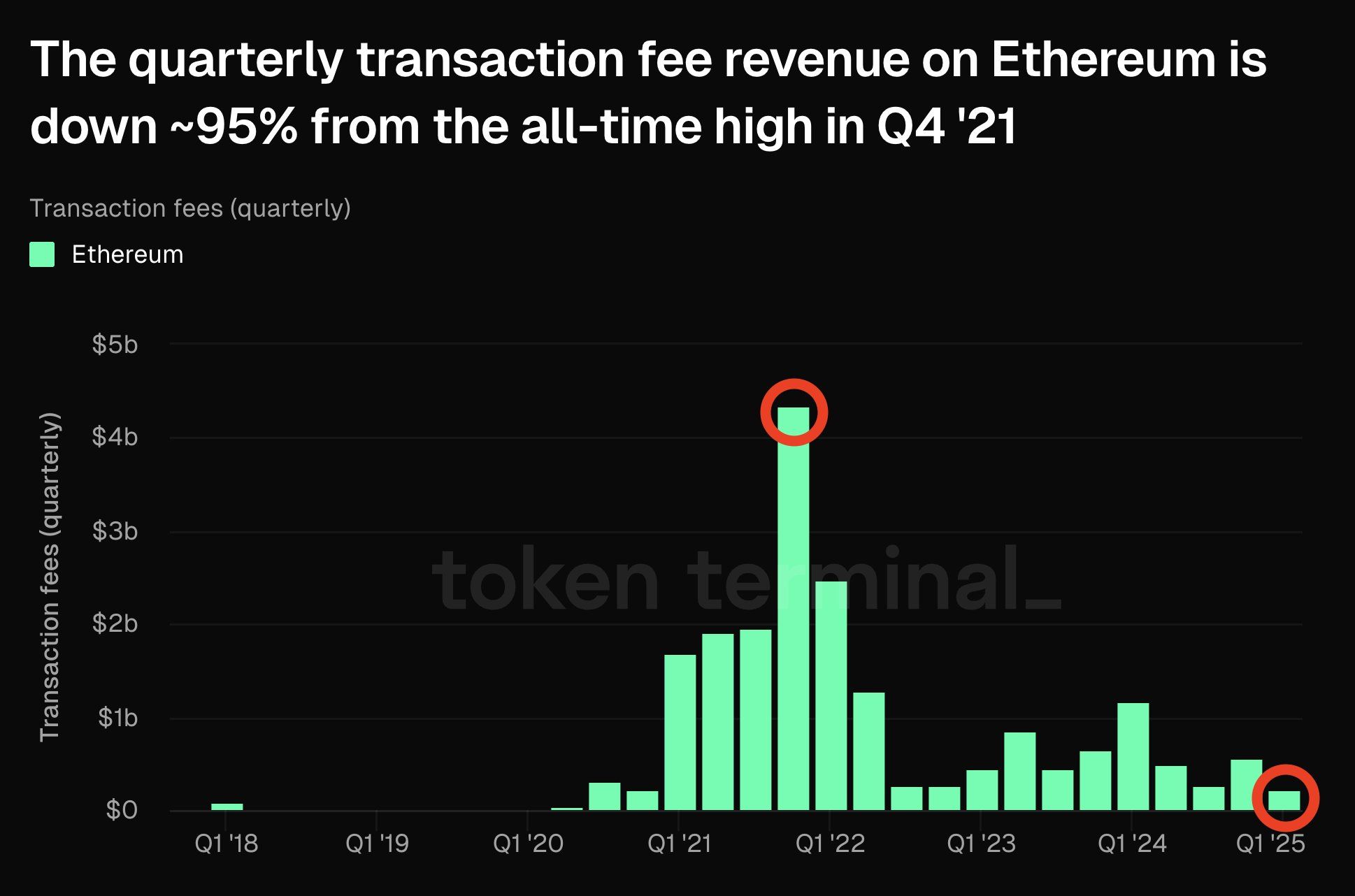

Ethereum (ETH), the second-largest blockchain by market capitalization, recorded a quarterly transaction fee revenue that decreased by approximately 95% from its all-time high in the fourth quarter of 2021.

This decrease is primarily attributed to the reduction in Layer 2 contribution and a sharp decline in Non-Fungible Token (NFT) market activity.

What Caused the Decline in Ethereum Transaction Fee Revenue?

Token Terminal recently highlighted this change in a post on X (formerly Twitter). According to their estimates, Ethereum's transaction fee revenue in the first quarter of 2025 is expected to reach around $217 million.

This figure represents a 95% decrease from the all-time high of $4.3 billion recorded in the fourth quarter of 2021. At that time, Ethereum's revenue, according to Bankless, increased by 1,777% year-on-year, surging from $231.4 million in the fourth quarter of 2020 to $4.3 billion in the last quarter of 2021.

Additionally, Ethereum's decentralized finance (DeFi) ecosystem showed significant growth in total value locked (TVL), decentralized exchange (DEX) trading volume, NFT sales, and Layer 2 TVL. However, the dynamics have since changed.

This is evident in Ethereum's recent performance. In 2025, monthly revenue has sharply declined, with January recording $150.8 million and February only $47.5 million. If the trend of decreasing transaction fees continues, March may also record similar low figures.

Moreover, in the fourth quarter of 2024, Ethereum generated only $551.8 million in transaction fee revenue, emphasizing the continued downward trend.

One of the main reasons for the decline is the shift to Layer 2 solutions. These solutions are gaining popularity due to their ability to process transactions off-chain while settling on the Ethereum mainnet.

Furthermore, the activation of EIP-4844 significantly reduced the cost of posting data on the Ethereum chain, lowering Layer 2 fee contributions. According to a CoinShares report, this upgrade made transactions cheaper but decreased the revenue collected by the Ethereum mainnet from Layer 2 activity.

"Layer 2 related fees, which were high in 2023 and early 2024, have decreased due to the cost savings introduced by EIP-4844." – CoinShares Report

The decline in Non-Fungible Token (NFT) activity also played a crucial role. The fourth quarter of 2021 was the peak of the NFT craze, with platforms like OpenSea recording monthly trading volumes in the billions of dollars. However, with diminishing interest, trading volumes and fee revenues have sharply decreased.

ETH Experiences Worst Quarterly Decline Since 2018

This decrease extends beyond transaction fee revenue. Ethereum's price has also shown a similar downward trend. After reaching an all-time high in November 2021, ETH has significantly fallen, currently down 58.8% from its peak.

Even during the election fervor, when many cryptocurrencies, including Bitcoin (BTC), recorded new highs, Ethereum failed to keep pace.

"ETH fell -40% in the first quarter, recording its largest quarterly loss since 2018." – An analyst wrote on X.

In just the past month, ETH has fallen 25.1%. At the time of writing, it is fluctuating around the $2,000 mark.