Author: Nick Shaheen Source: Bankless Translation: Shan Ouba, Jinse Finance

For a long time, the mainstream narrative of cryptocurrencies has revolved around speculation, price volatility, and regulatory challenges. But beneath the shadows of hype and fear, a true transformation is happening: cryptocurrencies are quietly solving one of the world's biggest financial problems - access to financial services.

Over 1.4 billion people worldwide are unbanked. This is not because they do not want banking, but because where they live, financial infrastructure is a privilege, not a universal reality. They face corrupt financial institutions, exorbitant remittance fees, unstable currencies, and even complete financial censorship. In many emerging markets, the traditional banking system not only fails to help people but actively works against them.

This is where cryptocurrencies come into play. The value of cryptocurrencies lies not in ETF narratives or Federal Reserve meetings, but in the real world, where people genuinely need a permissionless, borderless, censorship-resistant financial alternative. What they need is "de-banking".

Lebanon, Nigeria, and Turkey: Banking System Collapse and the Rise of Cryptocurrencies

Lebanon and Turkey present two equally compelling stablecoin use cases.

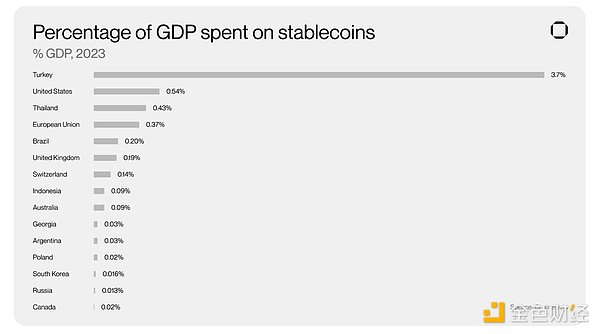

Turkey has long faced currency devaluation, leading to it becoming one of the countries with the highest stablecoin trading volume relative to GDP (3.7%).

Many Turkish citizens have adopted USDT as their primary store of value, rather than the Turkish lira (TRY). Key trends include:

• 57% of Turkish stablecoin users increased usage in the past year, with 72% expecting to increase further.

• Converting stablecoins to US dollars is the most common use, followed by cross-border payments, purchasing goods, and receiving salaries in USDT.

• Ethereum is the most frequently used blockchain by Turkish users, followed by Binance Smart Chain, Solana, and TRON.

• USDT dominates the market due to its trustworthiness, liquidity, and long-term stability.

The Turkish government's stance on cryptocurrencies oscillates between restriction and acceptance, with capital controls making it difficult to obtain dollars through traditional banking channels. As a result, USDT (especially on the TRON chain) has become an unofficial parallel financial system, providing financial stability for Turkish citizens in an environment of rapid local currency depreciation.

Lebanon, once a financial center in the Middle East, has now become a typical case of fiat system collapse. The country's banking sector collapsed in 2019, with deposits locked, withdrawals restricted, and lifelong savings trapped in frozen accounts.

Lebanese citizens suddenly discovered that their US dollar deposits were converted to "Lollars" (local dollar deposits) at an artificially set exchange rate, far below the actual dollar value. Inflation skyrocketed, and the banking system became a financial "hijacking" mechanism.

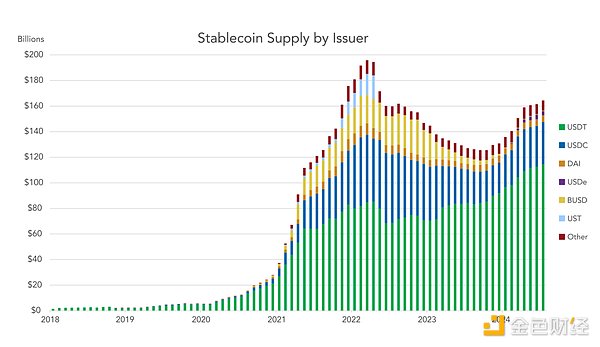

At this point, stablecoins became a lifeline. The usage of Tether (USDT) and USD Coin (USDC) surged, as Lebanese citizens needed a way to store wealth and conduct transactions that bypassed the collapsing banking system.

Today, Lebanon has one of the highest per capita cryptocurrency usage rates globally, with stablecoins no longer being speculative tools, but survival tools.

These cases demonstrate that stablecoins are not just hedging tools or speculative assets; they are increasingly becoming necessities in regions with financial instability, authoritarian control, or limited global banking services.

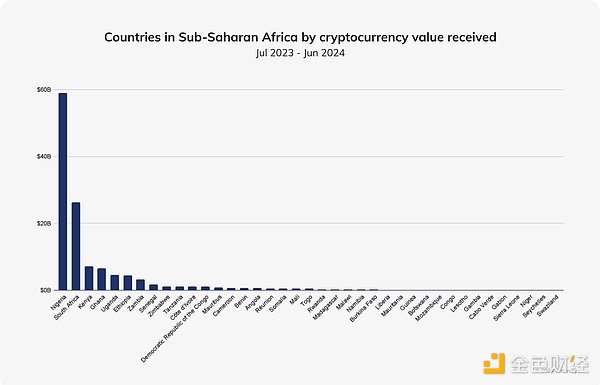

Meanwhile, Nigeria has become a pioneer in stablecoin adoption. Due to severe foreign exchange shortages and banking restrictions, Nigerians are turning to USDT in record numbers. Nigeria leads in stablecoin penetration among emerging markets, with users frequently using stablecoins for remittances, trade settlements, and savings.

Platforms like Yellow Card and Binance have transformed USDT into a crucial component of Nigeria's financial system, helping individuals and businesses circumvent the lack of US dollar channels.

Stablecoin Proliferation: The True Entry Point for Cryptocurrencies

Globally, stablecoin usage far exceeds DeFi and NFT transaction volumes. In emerging markets like Lebanon, Nigeria, and Argentina, people are not buying ETH for yield farming, but converting funds to stablecoins to escape broken financial systems.

Stablecoins are the "Trojan horse" for cryptocurrencies entering the global financial system. In places where banking systems are unstable or even hostile to citizens, people are finding ways to self-custody dollars without relying on traditional banks.

Stablecoins represent cryptocurrency's most successful story - a market with annual settlement volumes of $5.28 trillion, growing consistently without being affected by Bitcoin cycles. They are used as digital dollars, bank account alternatives, and tools for financial freedom in regions with collapsing monetary systems.

If cryptocurrencies can solve real-world problems for billions of people, their narrative will shift from speculative assets to necessities. And that is the true path to widespread adoption.