Trump’s economic policies have created a lot of uncertainty over the past few months, which has dampened stock markets and shaken investor confidence. But with the U.S. facing a massive $7 trillion debt maturities and high yields, theorists wonder whether Trump’s tariffs could force the Federal Reserve to cut interest rates.

BeInCrypto spoke to Erwin Bolroder, policy director at the European Blockchain Association, and Vincent Liu, chief investment officer at Kronos Research, to understand why Trump is using tariff threats to boost the purchasing power of American consumers. But they warn that the risks far outweigh the benefits.

The US Debt Dilemma

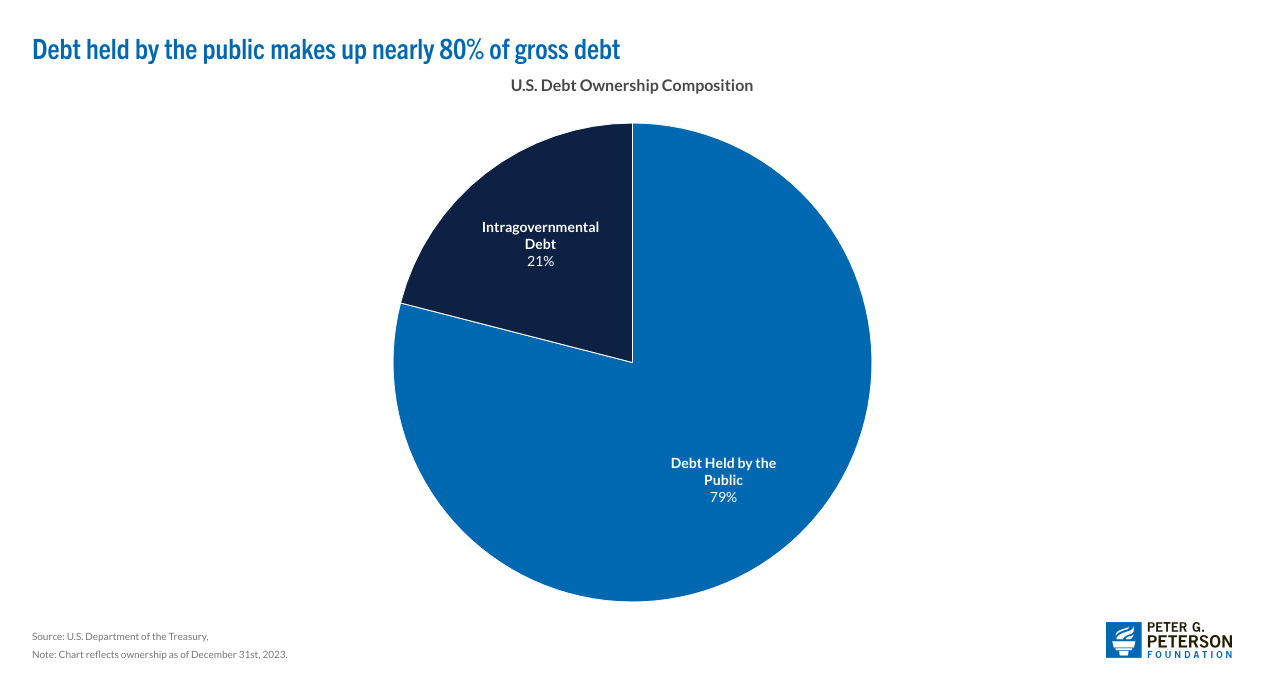

The United States currently has a national debt of $36.2 trillion , the highest in the world. This figure reflects the total amount of money the federal government has borrowed to fund past spending.

That means the U.S. owes a lot of money to foreign and domestic investors, and it has to repay certain loans within a few months.

When the government borrows money, it issues debt securities such as Treasury bonds, bonds, and notes. These securities have a specific maturity date. Before that date, the government must repay the principal amount borrowed. In the next six months, the United States will have to repay about $7 trillion in debt.

The government has two options: it can use available funds to pay off its maturing debt, or it can refinance it. If the federal government chooses the latter, it will have to borrow additional money to pay off its current debt, which will further increase the already growing national debt.

Direct refinancing seems unlikely, as the US has a history of choosing refinancing options, but current high interest rates complicate refinancing.

High interest rates, obstacles to debt refinancing

Refinancing allows the government to extend its debt so that it does not have to pay off old debt with readily available funds. Instead, it can issue new debt to pay off old debt.

However, the Federal Reserve's interest rate decisions have a major impact on the federal government's ability to refinance its debt.

This week, the Federal Reserve announced that it would keep interest rates between 4.25% and 4.50% . The Fed has been raising rates above 4% since 2022 to keep inflation in check.

This is good news for investors who expect higher yields from bonds, but it is bad news for the federal government. If it issues new debt to pay off old debt, it will have to pay more interest, which will strain the federal budget.

“In effect, on $7 trillion, a 1% higher rate is $70 billion in additional interest costs per year. A 2% difference would be $140 billion in additional costs per year. That’s real money that could be used to fund other programs or reduce the deficit,” Boloder told BeInCrypto. “The U.S. already has a national debt of over $36 trillion. Higher refinancing rates make the debt problem worse. More tax revenues have to be used just to pay the interest, which creates a vicious cycle of larger deficits and debt.”

This scenario suggests that the United States should proceed with caution in monetary policy. With debt maturities approaching and inflation concerns rising, the government should seek stability over uncertainty.

But the Trump administration appears to be going in the opposite direction by threatening higher tariffs on its neighbors. The main question is why?

Trump's Tariff Policy: Strategy or Gamble?

Trump has consistently pursued tariff policies throughout his first and second terms , targeting neighbors Canada and Mexico, as well as longtime rival China .

In his most recent inaugural address, Trump reaffirmed his commitment to this trade policy, arguing that it would bring money back to the United States.

“I will immediately reform our trade system to protect American workers and families. Instead of taxing our citizens to enrich other countries, we will impose tariffs and taxes on foreign countries to enrich our own citizens. To do this, I will establish an External Revenue Service to collect all tariffs, taxes, and revenues. This will pour vast amounts of money into our Treasury from foreign sources,” Trump said.

However, uncertainty over trade relations and retaliatory measures by affected countries inevitably led to instability, making investors sensitive to the news.

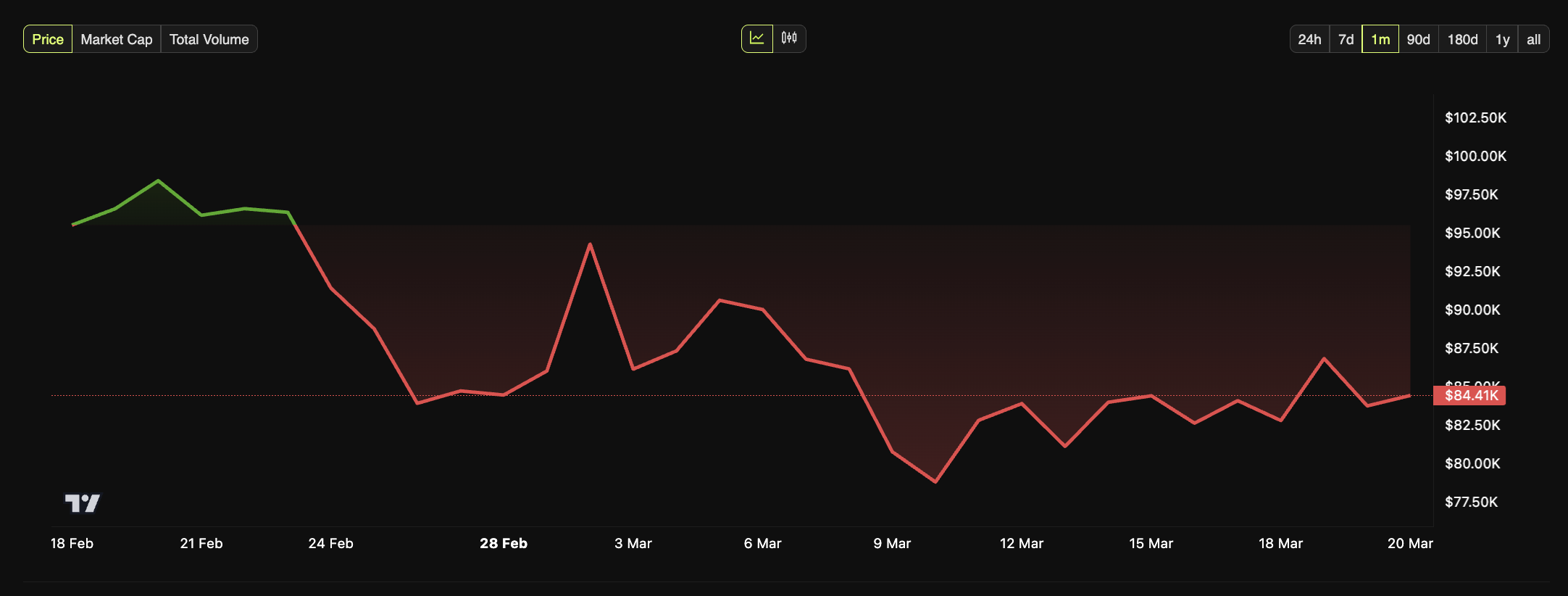

Earlier this month, markets experienced a broad selloff amid concerns over Trump’s tariff policies, sending U.S. stocks tumbling, bitcoin values dropping , and Wall Street’s fear index soaring to its highest level of the year.

A similar situation occurred during Trump's first presidency.

“Intentionally increasing economic uncertainty through tariffs carries great risk. Markets could overreact, causing a plunge and increasing the likelihood of a recession. This was seen in the 2018 trade war downturn.” – Liu

Whenever traditional financial markets are affected, cryptocurrencies suffer as well .

“In the short term, Trump’s production-first, America-first economy leaves digital asset markets exposed to high volatility and unpredictable policy inputs. Cryptocurrencies are not isolated from macro trends, and are increasingly trading in tandem with tech stocks and riskier conditions.” – Boloder

Some see Trump’s actions as reckless and capricious, while others see them as calculated. Some analysts see these policies as a means to force the Federal Reserve to cut interest rates.

Trump, tariffs affecting the Fed?

In a recent video, Anthony Pompliano, CEO of Professional Capital Management, argued that Trump is intentionally creating economic uncertainty to drive down Treasury yields.

The President and his team are intentionally crashing the market.

— Anthony Pompliano 🌪 (@APompliano) March 10, 2025

Is this a master plan or are we watching uncontrolled destruction?! pic.twitter.com/Tbc0M9Rjxu

Tariffs can act as taxes on imported goods, hindering trade relations and, as a result, increasing the cost of goods for consumers and businesses. These policies can be destabilizing to the economy, as they are often a major source of economic uncertainty.

As the market’s strong reaction to Trump’s tariff announcement suggests, investors are spooked by fears of a slowdown or recession . As a result, companies may reduce risky investments and consumers may limit spending in preparation for a surge in prices.

Investor habits can also change. As confidence in volatile stock markets wanes, investors may move from stocks to bonds in search of safe assets. U.S. Treasury bonds are considered one of the safest investments in the world. Therefore, this move to safe assets increases demand.

When demand for bonds increases, bond prices rise. This sequence of events indicates that investors are bracing for long-term economic uncertainty. In response, the Federal Reserve may be more likely to cut interest rates.

Trump accomplished this during his first term as president.

“The theory that tariffs can increase bond demand is based on the idea that fear can trigger market changes. Tariff uncertainty could trigger a selloff in stocks, boosting Treasuries and lowering yields, facilitating the refinancing of the $7 trillion US debt. This was demonstrated in the 2018 trade shock, when yields fell from 3.2% to 2.7%. However, with inflation at 3-4% and yields at 4.8%, success is not guaranteed. This requires tariffs that are credible enough to correct the market.” – Liu, BeInCrypto

If the Fed cuts rates, Trump can buy new debt at lower prices and pay down maturing debt.

This plan could also benefit ordinary American consumers to some extent.

Potential Benefits

Treasury yields are a benchmark for many other interest rates in the economy. So if Trump’s trade policies push Treasury yields down, that could have a knock-on effect. The Fed could lower rates on other loans, such as mortgages, auto loans, and student loans.

As a result, borrowing rates fall and disposable income increases, allowing ordinary Americans to contribute to overall economic growth through greater purchasing power.

“For American families, lower mortgage rates could mean significant savings in monthly payments on a new home or a refinance. For businesses, it could be easier to finance expansions or hire new workers if they can borrow at 3% instead of 6%. In theory, greater access to low-interest loans could spur economic activity on Main Street, which is consistent with Trump’s goal of stimulating growth,” Bolroder explains.

But this theory relies on investors reacting in a very specific way, which is not guaranteed.

“It’s a high-stakes bet with a narrow margin of error for success, depending on a number of economic factors,” Liu said.

Ultimately, the risks far outweigh the potential benefits. In fact, the consequences can be serious.

Inflation, market instability

The theory that market uncertainty is intentionally created relies on the fact that the Fed will cut interest rates . However, the Fed is keeping interest rates high to suppress inflation. A tariff war risks triggering inflation.

“If inflation spikes, yields could hit 5% and not fall. [Jerome] Powell is likely to keep rates on hold, which undermines the plan,” Liu said.

To this, Boloder added:

“If the plan fails and yields don’t fall enough, the U.S. could end up refinancing at higher rates and the economy could weaken. That would be the worst possible outcome.”

Meanwhile, tariffs directly increase the cost of imported goods, which is often passed on to consumers. This scenario increases the prices of various products, creating inflationary pressures that weaken purchasing power and destabilize the economy.

“Tariff-induced inflation causes every dollar you earn to buy less. This hidden tax hits low-income families the hardest, as they spend a larger portion of their income on the necessities that are affected,” Bolroder said.

In this situation, the Fed is likely to raise Treasury yields. This scenario could have serious implications for the U.S. job market economy.

Impact on jobs and consumer confidence

The economic uncertainty of tariffs could discourage companies from continuing to invest in the U.S. In such a situation, companies may postpone or cancel expansion plans, reduce hiring, and scale back research and development projects.

“The impact on employment is a major concern. Forcing interest rates lower by deliberately cooling the economy is inherently a dangerous game with high unemployment. When markets fall and business confidence weakens, companies often respond by cutting hiring or even laying off workers,” Bolroder said.

Rising prices and market volatility can also damage consumer confidence. These dynamics reduce consumer spending, which is a key driver of overall economic growth.

“Americans face higher prices and reduced purchasing power as a direct result of tariffs and uncertainty. Tariffs on everyday items, from groceries to electronics, are like sales taxes that consumers ultimately bear. These costs hit consumers at a time when wage growth may stall if the economy slows. So the extra cash saved from lower interest rates could be offset by higher prices for consumer goods and future tax increases,” Bolroder told BeInCrypto.

But the consequences aren’t limited to the United States. As with any trade dispute, countries are willing to respond, and have already done so in recent weeks.

Trade war… diplomatic tension

When Trump imposed a 25% tariff on goods coming into the United States from Canada and Mexico, both countries responded strongly.

Canadian Prime Minister Justin Trudeau called the trade policy “a very stupid move.” He announced retaliatory tariffs on U.S. exports and warned that a trade war would affect both countries. Mexican President Claudia Sheinbaum did the same.

In response to Trump's 20% tariffs on Chinese imports, Beijing retaliated by imposing tariffs of up to 15% on key U.S. agricultural products, particularly beef, chicken, pork and soybeans.

Additionally, 10 American companies have been placed on China's "Trusted Entity List," restricting their import and export transactions in China and making new investments difficult.

The Chinese embassy in the United States also said it was not afraid of the threats.

The fentanyl issue is a flimsy excuse to raise US tariffs on Chinese imports. Our countermeasures to defend our rights and interests are fully legitimate and necessary.

— Spokesperson发言人办公室 (@MFA_China) March 4, 2025

The US, not anyone else, is responsible for the #FentanylCrisis inside the US In the spirit of humanity… pic.twitter.com/OjvSEcZS6o

Besides harming international relations, tariffs would have other consequences.

Global supply chain disruption

A global trade war could disrupt global supply chains and harm export-oriented companies.

“From a macro perspective, there is fear of a global trade war escalating, which could have a boomerang effect on U.S. exports and manufacturing. This could lead to U.S. farmers losing export markets or factories facing more expensive raw materials. Such a global tit-for-tat could amplify the recession and strain diplomatic relations. Additionally, if international investors see U.S. policy as confusing, they could reduce their investment in the U.S. in the long run,” Boloder told BeInCrypto.

Inflationary pressures and economic downturns could push individuals to embrace digital assets .

“Also, if the U.S. pursues mercantilist policies that alienate foreign creditors or undermine confidence in the stability of the dollar, some investors may increase their allocations to alternative stores of value, such as gold or bitcoin , which could act as a hedge against a currency or debt crisis,” Boloder explained.

Consumers may experience shortages of essential goods, and businesses will face increased production costs. Businesses that rely on imported materials and components will be particularly affected.

High-Risk Strategy… Is It Worth It?

The theory that tariffs can create uncertainty and thus lower returns is a very risky and potentially damaging strategy. The negative effects of tariffs, such as inflation, trade wars, and economic uncertainty, far outweigh the potential short-term gains.

As product prices rise and companies cut staff to balance their books, the average American consumer will feel the consequences.