Despite last year's strong performance, market volatility has changed the outlook for the 2025 Bitcoin Exchange-Traded Fund (ETF). With major selling pressure continuing, almost all of the inflows received by the ETF in early 2025 have disappeared.

This decline, coupled with the continued drop in Bitcoin price, has made it difficult for the ETF to maintain momentum as investor sentiment changes.

Bitcoin ETF, a Major Disappointment in 2025

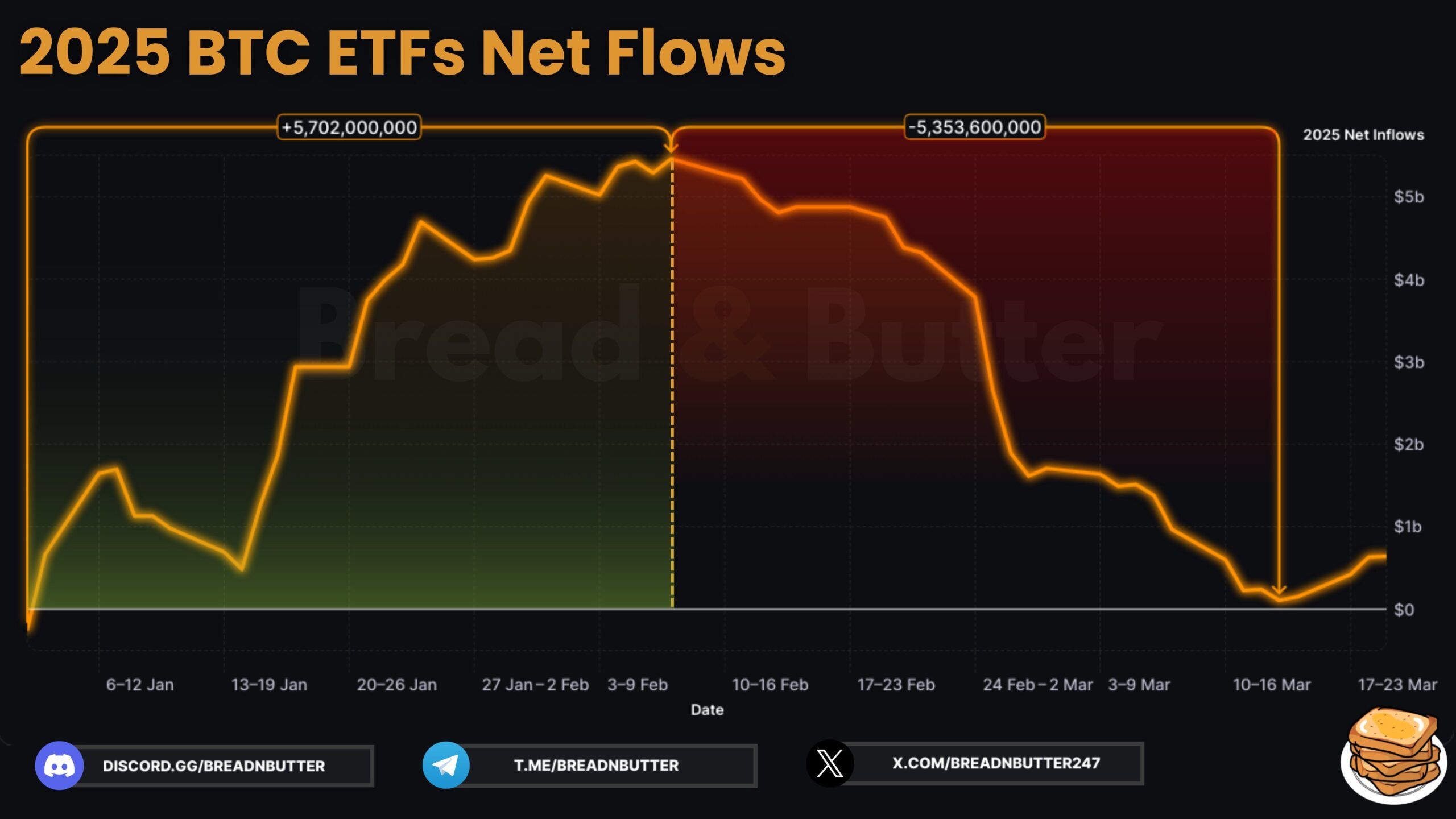

According to a post by Bread and Butter on X (formerly Twitter), the Bitcoin ETF showed a promising start this year. From January 1 to February 7, cumulative inflows reached $5.7 billion.

However, rapid large-scale selling followed, causing $5.3 billion in gains to disappear. As a result, annual net inflows plummeted to $106 million.

In fact, the largest weekly net outflow was recorded at $2.7 billion in the last week of February. Moreover, outflows have occurred for three months since the ETF started trading. February was the most notable, with the largest monthly outflow of $3.5 billion.

Nevertheless, the post revealed a positive change, mentioning that inflows to the Bitcoin ETF have resumed. Since March 14, the ETF has recorded consecutive inflow days, bringing net inflows to over $600 million compared to the beginning of the year.

Notably, on March 17, the BTC ETF recorded its highest single-day inflow in 41 days. In this new momentum, BeInCrypto emphasized that asset managers Fidelity and ARK Invest are contributing to the upward trend by purchasing significant amounts of Bitcoin.

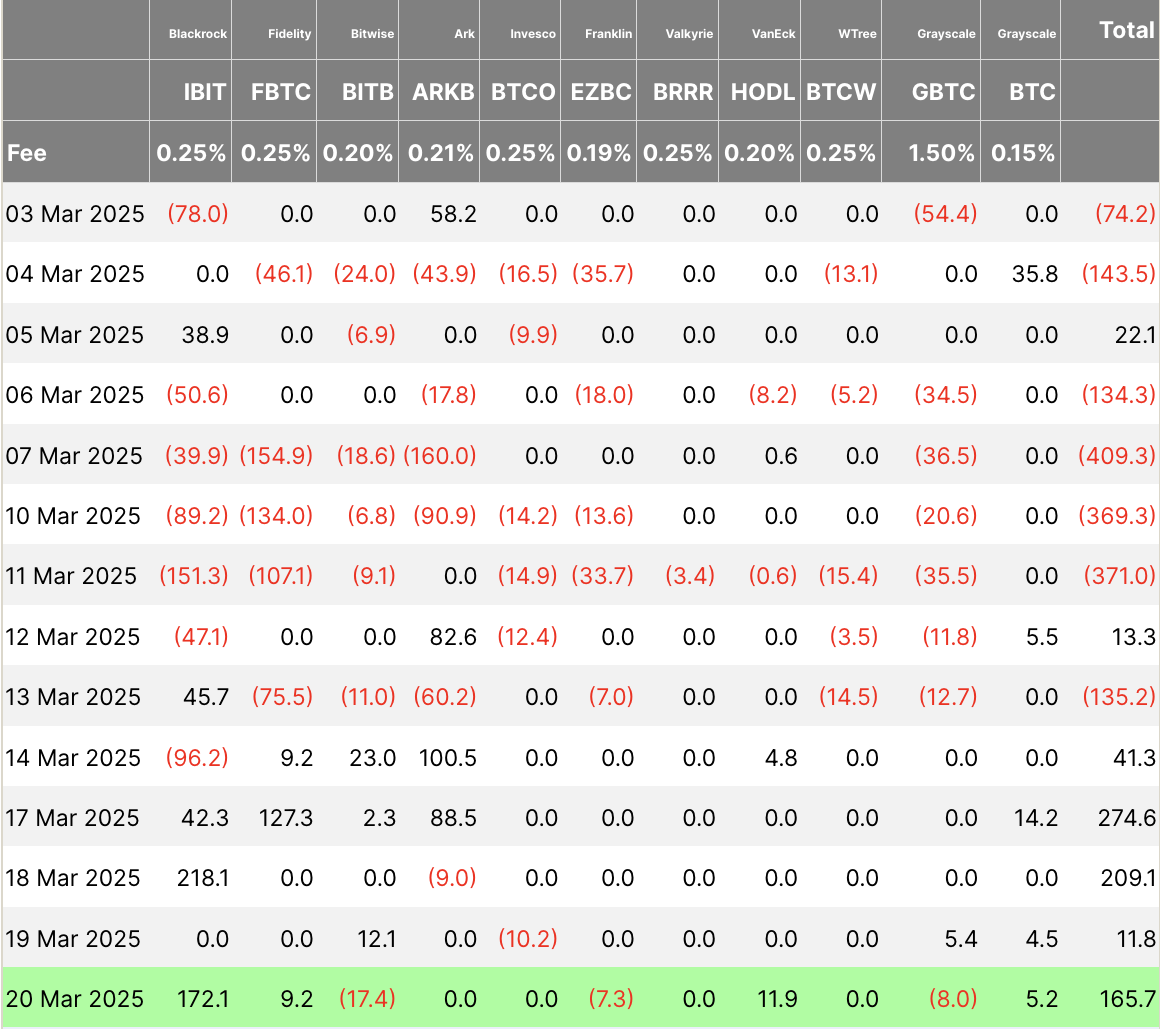

According to the latest data, the daily total net inflow on March 20 reached $165.7 million. However, this growth was not evenly distributed across 11 ETFs.

Only four ETFs recorded inflows, with the iShares Bitcoin Trust ETF (IBIT) leading at $172.1 million, followed by Fidelity Wise Origin Bitcoin Fund (FBTC) at $9.2 million, Grayscale Bitcoin Mini Trust ETF (BTC) at $5.2 million, and VanEck Bitcoin ETF (HODL) at $11.9 million.

Meanwhile, four ETFs had no inflows, and Grayscale Bitcoin Trust (GBTC), Bitwise Bitcoin ETF (BITB), and Franklin Templeton Digital Holdings Trust (EZBC) experienced outflows, reflecting mixed market performance.

"We need to wait and see if this is the beginning of a sustained rebound or just a temporary relief," the post read.

This occurred while Bitcoin's price continues to experience instability. The cryptocurrency has shown a notable decline, taking a significant hit due to changes in macroeconomic conditions.

According to BeInCrypto data, BTC declined by 12.1% last month and dropped 2.0% in the past 24 hours, trading at $84,147 at the time of reporting.

However, analysts suggest that the worst may be over. Former BitMEX CEO Arthur Hayes pointed to a potential upward turn, noting that his custom US bank credit supply index is rising.

"We're not done dumping, but the probabilities are moving more towards the upside," he said.

Market observers also compared Bitcoin to gold. They predict that BTC could follow a similar path and break out of the current "fake-out" stage. Others believe Bitcoin is caught in a bear trap that could end soon.