Bit has been in a downward trend since mid-January, and attempts to break this cycle have met with market resistance.

Recent price movements have suggested that the downtrend in BTC could worsen, but the current market situation shows the possibility of recovery.

Bit, a long ordeal

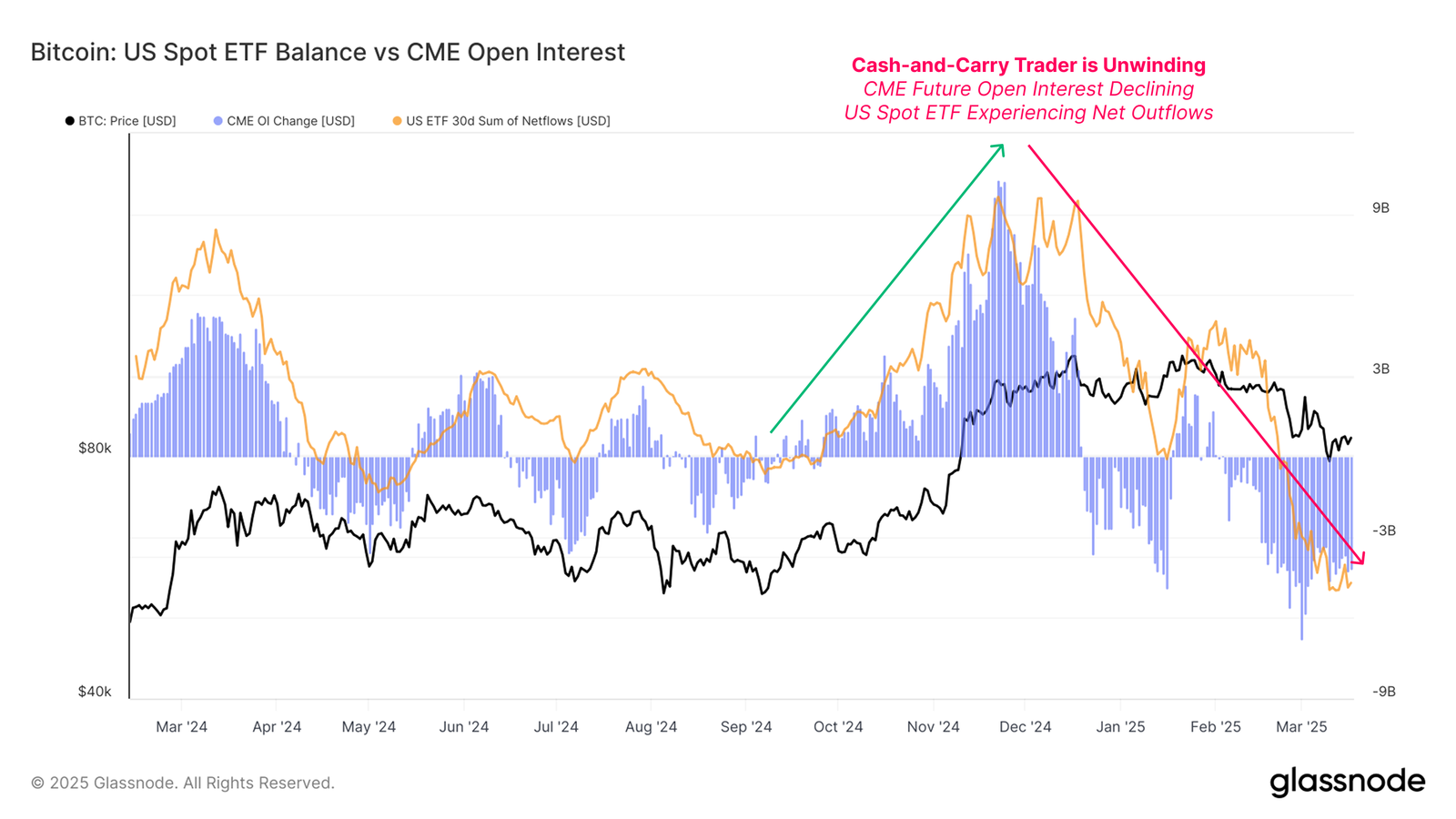

Strong evidence of the cash and futures arbitrage trade can be found by comparing the flow of funds into the US spot ETF and the open interest (OI) of CME futures contracts. As the market's long position bias began to weaken, the unwinding of this arbitrage trade became evident. Over the past month, this has resulted in record ETF outflows and 12-month lows in open interest.

These developments indicate short-term weakness, but have historically occurred ahead of market recovery phases. The reduction in outflows suggests that liquidity pressures are easing and investor sentiment is shifting towards accumulation. As market conditions improve, the unwinding of the arbitrage trade reaching saturation could provide the necessary support for a long-term recovery in Bit.

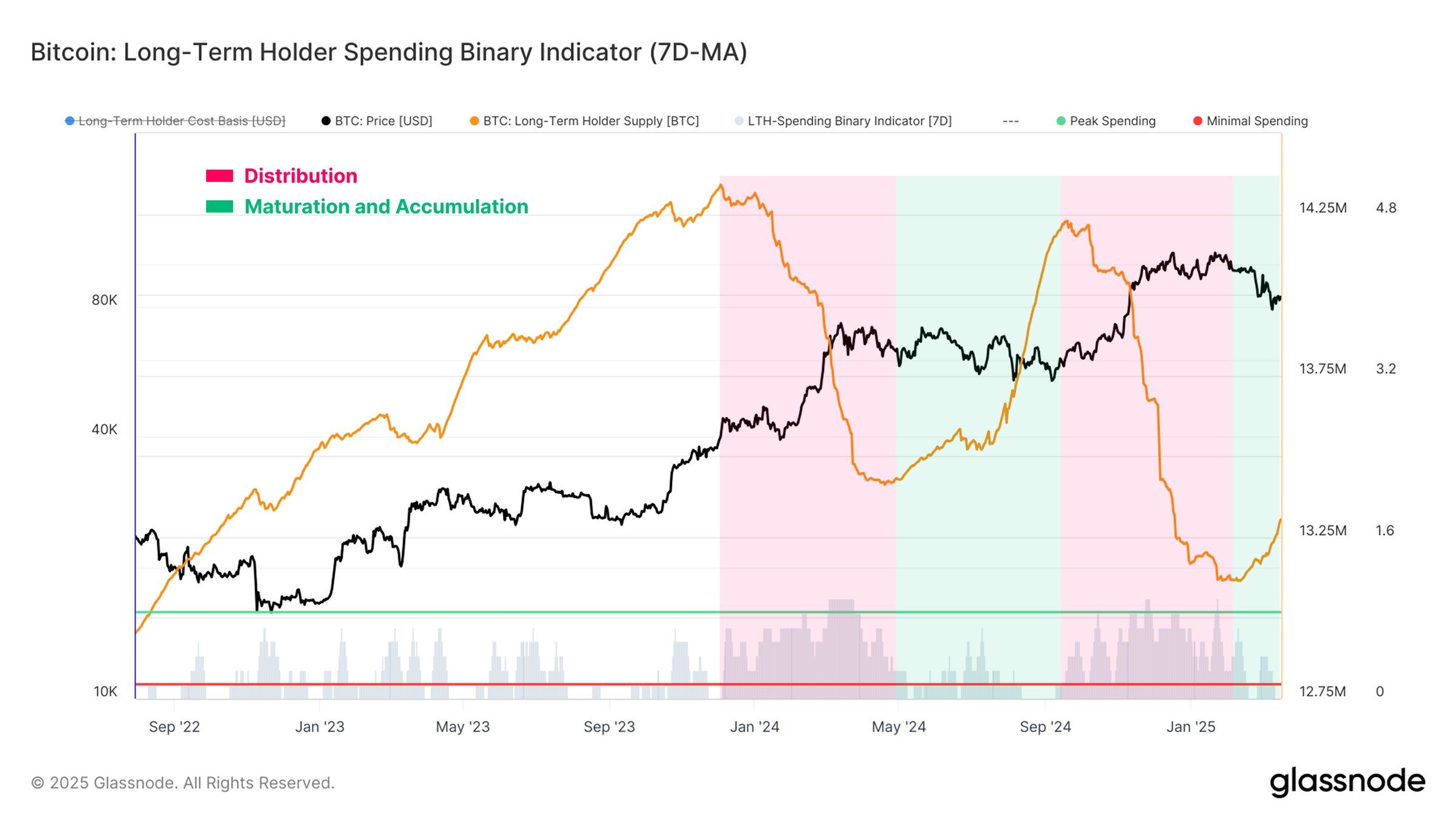

The slowing of the long-term holder (LTH) binary spending indicator suggests a shift in psychology. This metric tracks when a significant portion of Bit's long-term holders begin to spend their assets.

The slowdown in this spending behavior indicates that LTHs are less inclined to sell, reflecting greater confidence in holding during this volatile period. Historically, when this trend occurs, it leads to an accumulation phase as holders wait for more favorable market conditions.

The decrease in LTH spending activity may indicate that these investors are waiting for more favorable price movements, which could reduce selling pressure in the market. As LTHs choose to hold, the potential for a sustained rally increases, providing a foundation for Bit's recovery.

BTC price, seeking a breakthrough

Bit is attempting to break out of a two-month descending wedge pattern, which could provide an upward opportunity for the cryptocurrency king to surpass $90,000. Successfully breaking through the $89,800 resistance could confirm this breakout and initiate a new uptrend.

The aforementioned bullish signals support this optimistic outlook. If Bit successfully clears $89,800, it could rise to $95,761, recovering a significant portion of its recent losses. This could also boost investor confidence and strengthen momentum.

However, this bullish logic is at risk if Bit fails to break above $89,800 or does not surpass $87,041. In this case, the price could fall below $85,000 and head towards $80,000, invalidating the bullish scenario and potentially delaying a potential recovery.