1. Whales bet 535.3 billion won on Bitcoin's decline ahead of the FOMC meeting

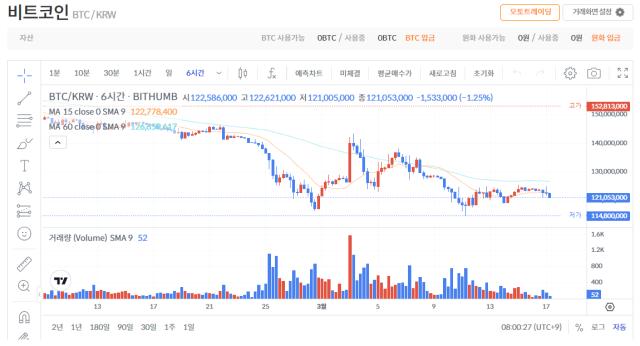

As the Federal Open Market Committee (FOMC) of the U.S. Federal Reserve holds a meeting on the 19th and announces a decision on the benchmark interest rate, a Bitcoin (BTC) whale bet on Bitcoin's decline on the 16th. According to data from on-chain transaction tracker Hyperscan, a large Bitcoin whale holding a large amount of Bitcoin has bet on a 40x short (decline) position with 4,442 Bitcoins in their wallet. The value of the Bitcoin the whale has bet on a short position is about $368 million (about 535.3 billion won).

2. Ton Coin surges up to 129% in two days on news of Telegram CEO's release

As news spread that Telegram CEO Pavel Durov left France seven months after being arrested there, Ton Coin (TON) recorded a surge of about 129% in two days. Ton Coin saw a rapid influx of spot buying, including a 67% surge in open interest in the futures market, recording around $3.4 as of 8 a.m. on the 17th based on CoinMarketCap.

3. U.S. Bitcoin Spot ETFs record net outflows of 55,348 Bitcoins in a month

Over the past month, about 55,348 Bitcoins have been net outflows from Bitcoin spot exchange-traded funds (ETFs) in the U.S. According to data from financial data platform Sosovalue on the 15th, 11 Bitcoin spot ETFs in the U.S. recorded a total net outflow of about $458 million (6.6616 trillion won) from February 6 to March 14.

4. Expert "Bitcoin to turn bullish from April, expected to reach new high before June"

Cryptocurrency expert Timothy Peterson pointed to Bitcoin's past bullish patterns through his X account on the 16th, predicting that Bitcoin could start a bull market from April and reach a new high before June. He said Bitcoin has shown a pattern of turning bullish in April and October in the past, and if Bitcoin succeeds in turning bullish in April this time, it could reach a new high before June.

Reporter Kwon Seung-won ksw@blockstreet.co.kr

As the Federal Open Market Committee (FOMC) of the U.S. Federal Reserve holds a meeting on the 19th and announces a decision on the benchmark interest rate, a Bitcoin (BTC) whale bet on Bitcoin's decline on the 16th. According to data from on-chain transaction tracker Hyperscan, a large Bitcoin whale holding a large amount of Bitcoin has bet on a 40x short (decline) position with 4,442 Bitcoins in their wallet. The value of the Bitcoin the whale has bet on a short position is about $368 million (about 535.3 billion won).

2. Ton Coin surges up to 129% in two days on news of Telegram CEO's release

As news spread that Telegram CEO Pavel Durov left France seven months after being arrested there, Ton Coin (TON) recorded a surge of about 129% in two days. Ton Coin saw a rapid influx of spot buying, including a 67% surge in open interest in the futures market, recording around $3.4 as of 8 a.m. on the 17th based on CoinMarketCap.

3. U.S. Bitcoin Spot ETFs record net outflows of 55,348 Bitcoins in a month

Over the past month, about 55,348 Bitcoins have been net outflows from Bitcoin spot exchange-traded funds (ETFs) in the U.S. According to data from financial data platform Sosovalue on the 15th, 11 Bitcoin spot ETFs in the U.S. recorded a total net outflow of about $458 million (6.6616 trillion won) from February 6 to March 14.

4. Expert "Bitcoin to turn bullish from April, expected to reach new high before June"

Cryptocurrency expert Timothy Peterson pointed to Bitcoin's past bullish patterns through his X account on the 16th, predicting that Bitcoin could start a bull market from April and reach a new high before June. He said Bitcoin has shown a pattern of turning bullish in April and October in the past, and if Bitcoin succeeds in turning bullish in April this time, it could reach a new high before June.

Reporter Kwon Seung-won ksw@blockstreet.co.kr