The Crypto Fear and Greed Index has recently rebounded from recent lows, reducing concerns about a bear market. However, several crypto stocks have recorded significant losses, and gold is soaring to all-time highs.

Persistent market volatility has fatigued short-term and speculative traders, helping to restore some stability. The latest US CPI report was better than expected and could aid in interest rate cuts for a long-term solution.

Has the Crypto Bear Market Been Avoided?

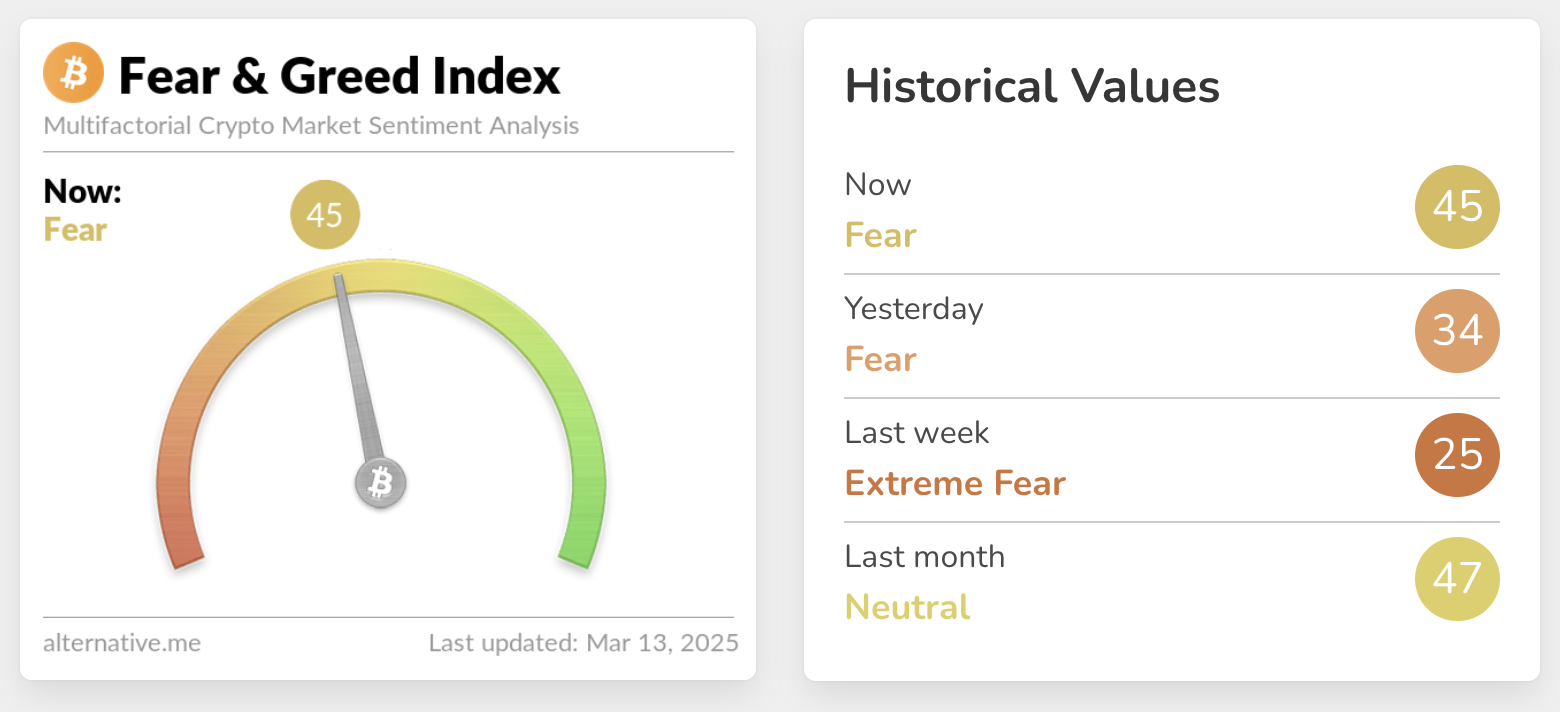

Over the past few weeks, rumors of a bear market have spread in the crypto space. Two weeks ago, the Crypto Fear and Greed Index reached its lowest level since the FTX collapse, and recession concerns have been shaking the market.

However, the index is now reporting a substantial rebound, and crypto traders are regaining confidence.

An important question remains about why this has occurred. Crypto investors have many reasons to fear a bear market.

Several corporations maintain substantial Bit holdings, and companies like Metaplanet, MicroStrategy, and Marathon have recorded double-digit declines in their stock prices this week.

Meanwhile, traditional assets like gold are surging.

Gold is a risk-averse asset, while crypto assets are generally considered risk-seeking. If the traditional financial markets are defined by recession concerns, this could negatively impact the crypto space.

However, a few points could reduce fears of a crypto bear market. One is that the February US CPI report was less bad than expected, which could spur US interest rate cuts.

After the report's release, Bit and other crypto assets have recovered slightly, and corporate BTC holders like Tesla have also seen some rebound. This optimism may be fragile, but it has helped sustain the market.

More importantly, the ongoing volatility in this market could bring some benefits. As President Trump expressed concerns about Canadian tariffs, it has sparked fears of a crypto bear market.

This has fatigued most of the short-term and speculative traders in this market. At least a portion of this market is showing cautious optimism, but all the elements of a bear market are still in play.

While a portion of the crypto market is showing cautious optimism, all the elements of a bear market are still in play. Rumors are circulating that Bit has entered a bear market.

The market may face serious obstacles, but it could also see interest rate cuts. Ultimately, a portion of the crypto market is showing cautious optimism.