Solana (SOL) has faced strong selling pressure and recently fell below $120, the lowest level since February 2024. It has declined more than 38% in the past 30 days, strengthening the downtrend.

With sellers firmly in control, SOL is now facing a test of crucial support levels. For a recovery to materialize, it needs to break above key resistance zones, which would signal a potential shift in momentum.

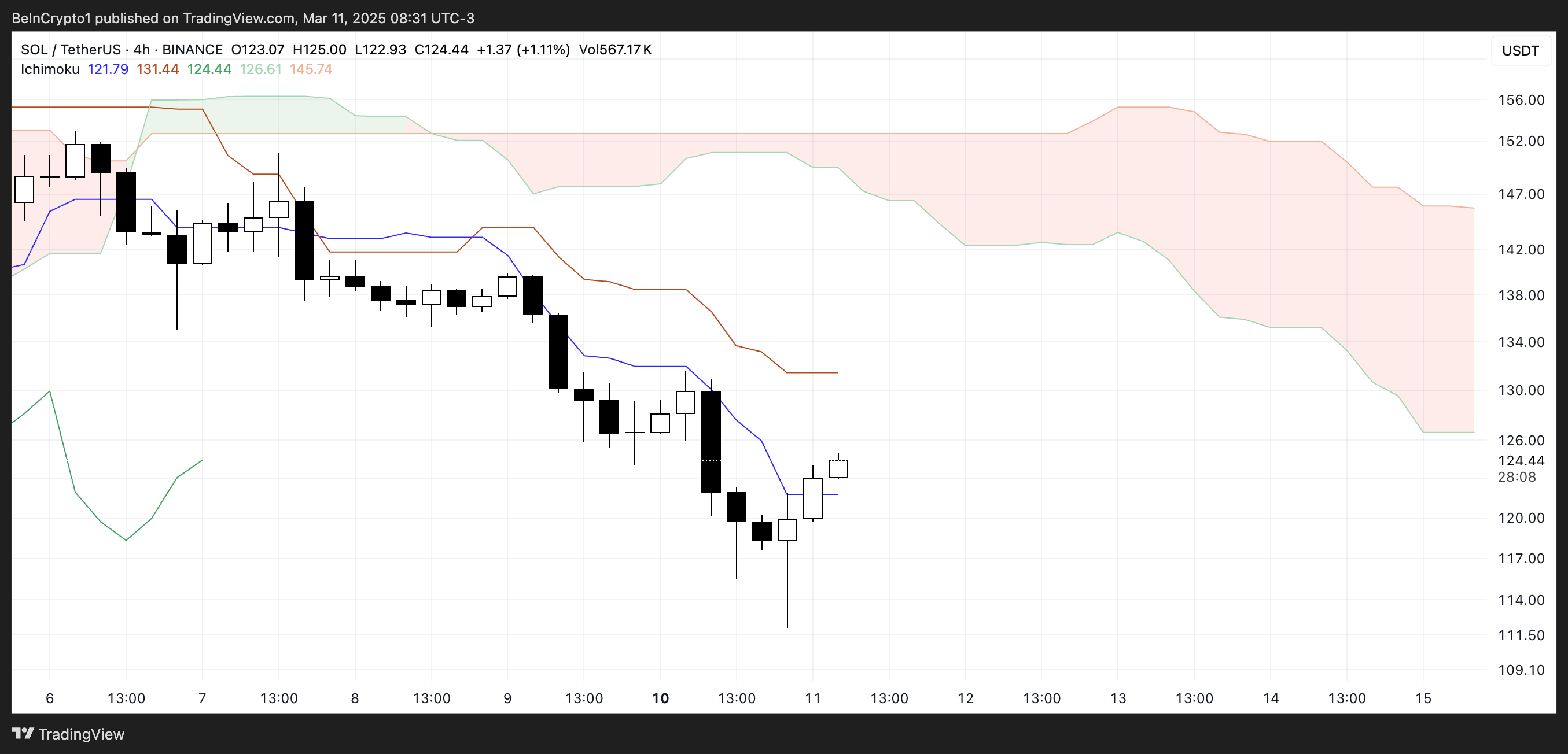

Solana Ichimoku Signals Bearish Outlook

The Solana Ichimoku chart shows the price currently trading below the blue Conversion line and red Base line, indicating the short-term trend remains bearish.

The price has bounced from recent local lows, but has not yet reclaimed these key resistance levels. Additionally, the Ichimoku cloud ahead is red, reflecting the bearish sentiment in the market.

The cloud itself is positioned well above the current price. Therefore, even if SOL experiences a short-term recovery, it is likely to face strong resistance around the $130-$135 area.

The Conversion line being below the Base line further supports the bearish outlook. This crossover typically signals a continuation of the downward momentum.

To show signs of a trend reversal, SOL needs to break above these two lines. Ideally, it should enter the cloud, which would indicate a potential transition to a neutral phase.

Until then, the bearish cloud ahead and the current weak price structure suggest that any rallies may be temporary before a broader downtrend resumes.

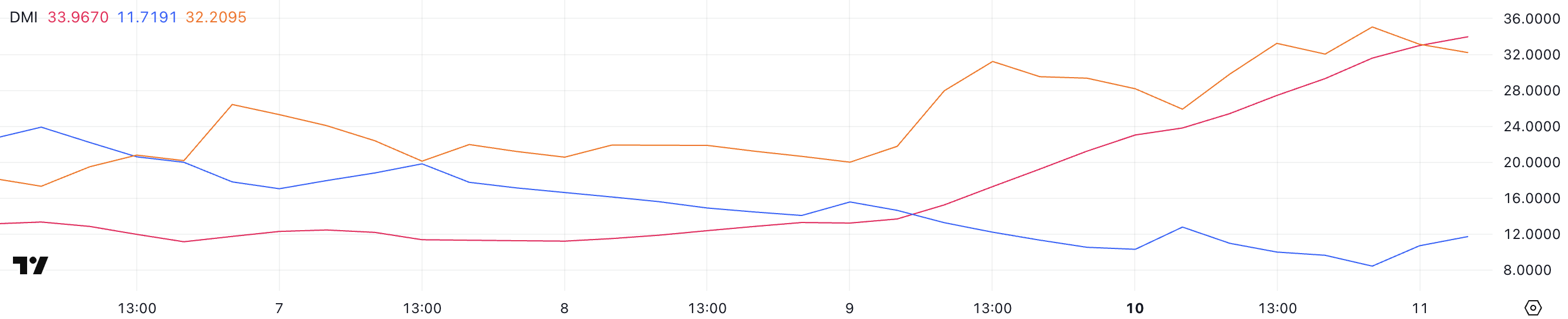

SOL DMI Indicates Selling Pressure Remains

The Solana Directional Movement Index (DMI) chart shows the Average Directional Index (ADX) currently at 33.96, a significant increase from 13.2 two days ago.

ADX measures trend strength, with values above 25 indicating a strong trend and below 20 indicating a weak or non-existent trend. This rapid rise confirms that the downtrend in SOL is strengthening.

The +DI (Positive Directional Index) has fallen from 15.5 two days ago to 11.71, but rebounded slightly to 8.43 yesterday. Meanwhile, the -DI (Negative Directional Index) has risen from 25.9 two days ago to 32.2, though it has slightly declined from 35 a few hours ago.

The relative positioning of the +DI and -DI lines, with -DI significantly higher than +DI, suggests that sellers remain in control.

The recent decline in -DI from 35 to 32.2 may indicate a short-term easing, but the rapidly rising ADX reinforces that the current downtrend is still in place.

The slight rebound in +DI may suggest some buying pressure, but it is not enough to reverse the momentum in favor of buyers. Unless +DI crosses above -DI or ADX starts to decline, the downtrend in SOL is likely to continue, with sellers dominating the short-term price action.

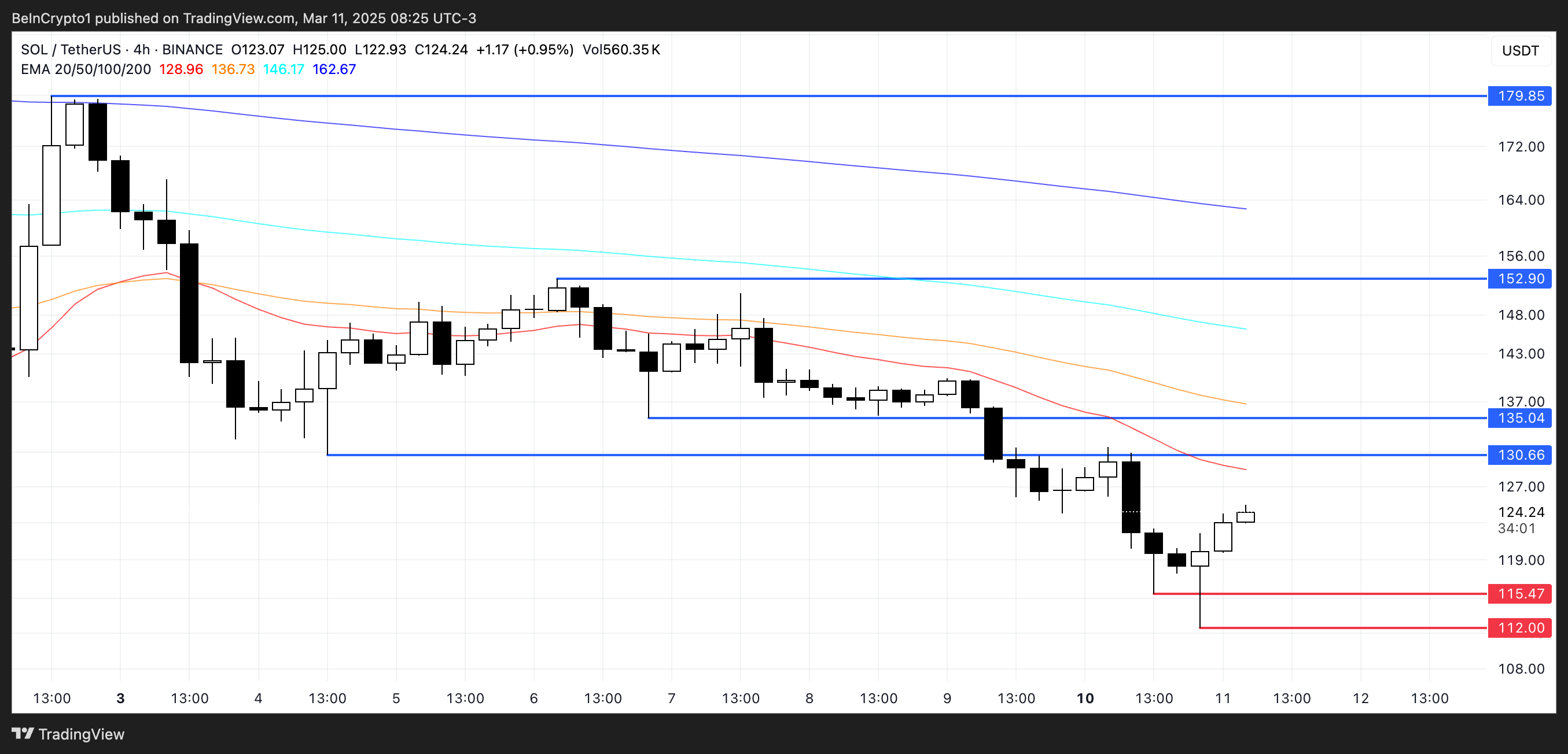

Will Solana Fall Below $110?

The Solana Exponential Moving Average (EMA) lines are still indicating a bearish trend, with the short-term EMA below the long-term EMA.

This alignment suggests that the bearish momentum remains dominant. While the price is currently attempting a recovery, this bounce may face resistance around $130 and $135 if it gains strength. These are key levels that need to be breached for a potential trend reversal.

If this resistance is successfully overcome, SOL could rise to $152.9. A strong buying pressure breaking above this level could open the door for a rally back to the $179.85 high last seen on March 2nd when SOL was added to the U.S. crypto strategic reserve.

However, if the bearish structure persists and selling pressure resumes, Solana could retest the support levels of $115 and $112, which previously acted as major price bottoms.

Failure to hold these support levels could lead to deeper declines, potentially pushing SOL below $110 for the first time since February 2024.

Given the current positioning of the moving averages, the downtrend will likely continue to dominate unless Solana can reclaim the key resistance levels and establish an upward crossover, which would signal a shift in market sentiment.