Author: Frank, PANews

The tokenization of US stocks has become a hot topic in the recently sluggish market.

On March 8, the Swiss token issuer Backed launched the Coinbase stock token wbCOIN on the Base chain, allowing users to trade it for USDC on CoWSwap, and claimed that it is 1:1 pegged to the value of the $COIN stock and has legal claims. Although Backed emphasized that it has no official association with Coinbase, this move has sparked heated discussion in the community: Will the tokenization of US stocks usher in a new growth cycle? In the context of the continued market downturn, can the "old wine in new bottles" of stock tokenization become a new narrative to build a bottom?

Narrative First, Value Later: The Contrast of Hot and Cold in the Tokenization of US Stocks

With the pro-crypto Trump administration taking office, the litigation between the US SEC and Coinbase also came to an end. In early 2025, Jesse Pollak, the head of the Base protocol, stated on X that Coinbase was considering introducing the tokenized $COIN stock to the Base network, targeting US users. But Coinbase still needs time to launch this business in a compliant manner.

Backed's swift action, however, has stolen a march. According to official information, Backed was founded in 2021 and was initially supported by institutions such as Gnosis and Semantic. Backed's headquarters and operations are mainly focused on the global market, and its products are issued under the EU regulatory framework, complying with the requirements of MiFID II, and have passed the EU prospectus.

However, wbCOIN is not Backed's first stock tokenization product. As early as July 2024, Backed collaborated with INX to launch the tokenized stock trading of NVIDIA. In addition, Backed has also launched tokenized products for assets such as the S&P 500 and Tesla. It's just that these products were not the focus of the market when they were launched, and now the market urgently needs some reasonable narratives to rebuild confidence.

However, it's not just because Backed's products can't be targeted at the US market or the market is sluggish. The trading heat of wbCOIN after its launch is obviously not as high as the topic heat. As of March 11, the TVL of wbCOIN is about $4.42 million.

Aerodrome's data shows that its trading volume is only $3,352, not even as hot as a newly issued MEME coin.

This sluggish performance is not just because wbCOIN has been online for a short time - another product BNVDA, which went online earlier, also has a trading volume of only $113 and is equally ignored.

Although the concept is hot, the current US stock tokenization market is still in its early stage, with very limited scale and activity. Perhaps the tokenization product from Coinbase will generate greater trading heat.

Tokenization of US Stocks: Old Wine in New Bottles, Compliance is the Primary Threshold

In fact, moving US stocks onto the blockchain is not a completely new idea. Before the recent wave of attempts, the crypto industry and traditional financial institutions had already explored it, but most of them ended in failure.

The once-prominent FTX exchange also provided tokenized trading services for US stocks, including Tesla and GameStop, during 2020-2022. However, FTX's collapse in 2022 abruptly ended this business. Afterwards, there were rumors questioning whether FTX's stock tokens were fully backed by the corresponding stocks, further undermining market trust in exchanges issuing tokenized stocks.

In 2021, Binance also tried to launch tokenized stock products corresponding to Tesla, Coinbase, Apple and other US stocks, allowing users to purchase fractional shares of these stock tokens. However, the tightening regulation in various countries soon led the UK and German financial regulators to successively warn that these products might violate securities laws. In less than three months, Binance announced the removal of all stock tokens.

In addition, Bittrex Global, an exchange that once featured tokenized stock trading, also chose to shut down its trading platform and go into bankruptcy liquidation after facing regulatory pressure and SEC lawsuits.

From this, we can see that in the previous round of attempts, compliance barriers were the main reason for the failure of exchanges to issue tokenized US stocks. And now that the market is revisiting the tokenization of US stocks, there are several factors at play:

1. With the Trump administration's emphasis and support for cryptocurrencies, the tense relationship between cryptocurrencies and regulation has also eased.

2. The market has entered a sluggish period, and the market needs some narratives with real value support to return.

3. Technological and compliance solutions are more mature. Compared to the previous reckless growth, the current crypto market is more focused on compliant design and technological assurance. For example, Backed's each token is issued with an EU-approved prospectus that clearly defines the token holders' rights to the underlying stocks. On the technical side, oracles and public chains have seen a qualitative improvement in performance.

One-thousandth Share and Trillion-dollar Expectations: The Realistic Dilemma of Stock Tokenization

Although the growth rate is impressive, the actual market size of tokenized stocks is still vastly different from institutional forecasts. Essentially, the tokenization of US stocks, or other securities, can be classified as RWA (Real-World Assets) assets. The only difference is that cryptocurrencies and US stocks are both high-volatility, high-liquidity financial assets, while the trading scale, capital size, and quality fundamentals of US stocks are what the crypto world is longing for.

The industry has extremely optimistic expectations for the future of stock tokenization, with some authoritative institutions predicting that the tokenized asset market could reach tens of trillions of dollars by around 2030: for example, BCG estimates that the global tokenized assets could reach $16 trillion by 2030. The Security Token Market report even forecasts that $30 trillion in assets will be tokenized by 2030, with stocks, real estate, bonds and gold being the main drivers.

As of March 11, the total on-chain RWA assets globally were about $17.8 billion, of which the total value of stock-related assets was about $15.43 million, accounting for less than one-thousandth, with a monthly trading volume of only $18 million. Clearly, in the RWA track, stock tokenization is still an immature market.

However, in terms of growth rate and risk resistance, tokenized stocks still have certain competitiveness. In July 2024, the on-chain total value of tokenized stocks was only around $50 million, and it has grown by about 3 times in half a year. This growth rate is significantly higher than the capital inflow of other altcoin assets during the same period.

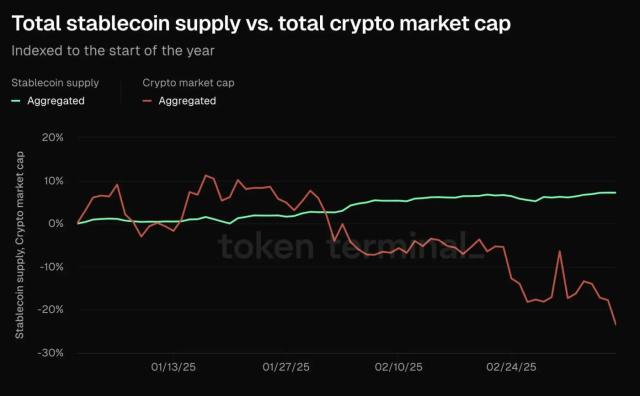

Recently, the crypto market has seen a significant correction, with Bitcoin falling below $80,000 and the overall crypto market capitalization returning to the level of the first half of 2024, a drop of 30% in the past three months. But the performance of tokenized stocks during this period has been much better, still maintaining at historical highs. This shows that the overall volatility of the US stock market is much less affected by a single asset than the crypto market, and the different asset classes have asynchronous volatility patterns, making the overall market appear more stable. This also provides a new value anchor for tokenized stocks.

For current investors, the tokenization of US stocks is neither a savior in a bear market nor a fleeting concept. It's more like a seed that needs patient waiting to sprout - under the triangular support of compliance, technology and market sentiment, whether this seed can grow into a towering tree may be hidden in the next policy release from the SEC, Coinbase's next compliance move, or the capital flow of retail and institutional investors in the next bull market. The only thing that can be certain is that this experiment is far from over.