ETH Bit Dip when the MVRV-Z index reached the lowest level in 17 months. Moreover, on-chain data shows that large investors and whales are accumulating more ETH, signaling a potential price surge in the near future.

1. Is ETH in a Dip? What On-Chain Data Says

One of the important indicators to assess the value of Ethereum is the MVRV Z-Score. This tool helps determine whether ETH is undervalued or overvalued compared to the network's intrinsic value. Currently, this index is at the lowest level in 17 months, similar to October 2023 - when ETH surged nearly 160% from the bottom to $4,000. This suggests that ETH may be in an accumulation phase and undervalued.

Ethereum MVRV Z-Score. Source: Glassnode

Additionally, the expansion of Layer 2 solutions like Arbitrum, Optimism, ZkSync, and Base has attracted a large number of new users, but the current market capitalization of ETH has not yet fully reflected this potential. This suggests that ETH may be undervalued compared to its actual value created by the ecosystem.

2. Ethereum Whales Are Accumulating Strongly

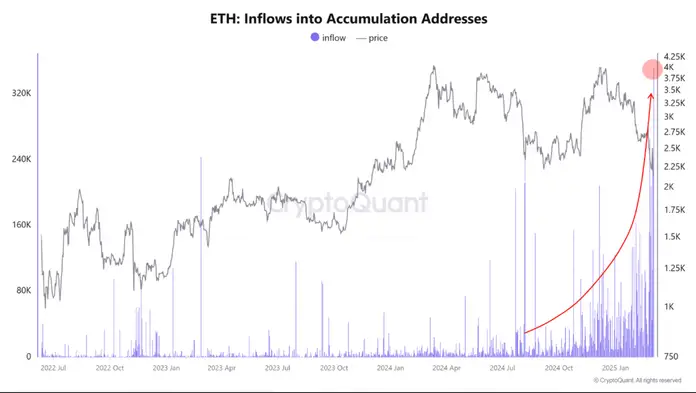

Data from CryptoQuant shows that capital is flowing strongly into ETH, with wallet addresses continuously accumulating and reaching the highest values ever. In particular, large investors and whales, those holding between 1,000 and 10,000 ETH, have increased their purchases since July 2024. This is also the time when Ethereum ETFs began operating in the US, adding more confidence for institutional investors.

Most of these accumulation phases occur when the ETH price is declining, indicating that large investors are taking advantage of the opportunity to accumulate with the expectation that the price will rise significantly in the future. This is in line with the prediction that ETH could reach $4,000 or higher by 2025.

ETH Capital Flows. Source: CryptoQuant

3. The Trump Administration and Significant Support for Ethereum

Not only are the on-chain data above positive, but Ethereum is also receiving strong support from the Trump administration. A company affiliated with Trump, World Liberty Financial, has spent $47 million to buy Ethereum, demonstrating confidence in the blockchain's potential. Notably, on March 2, President Trump stated that "Ethereum will become an important part of the US government's strategic cryptocurrency reserve fund, alongside Bitcoin".

President Trump also believes that Ethereum is the core platform in the US government's decentralized finance (DeFi) development plan. With its security, stability, and high performance, Ethereum can play a crucial role in building a new DeFi ecosystem. If this trend continues, Ethereum will consolidate its leading position and become a safe haven asset in the cryptocurrency space.

4. Technical Analysis of ETH

Currently, ETH is trading around $2,185 (at the time of writing), and on the weekly chart, the price is holding above the EMA 200. If ETH can maintain the support level above the EMA this week, the chances of a reversal will be very high.

Conversely, if ETH fails to hold the price above the weekly EMA, the price may drop deeper to the next support levels of $1,600 and $1,100.

Weekly ETH Chart

5. Summary

Based on the on-chain data and the accumulation behavior of whales, ETH may be at or very close to the Dip. The MVRV Z-Score and the capital inflows from large investors indicate that ETH is undervalued compared to its intrinsic value. If it can hold the critical support levels, ETH has the potential to rebound strongly and reach higher prices in the future.

Please note that the views expressed in the article are the team's own perspectives at HMC Insights, and not investment advice. Investors should continue to accumulate knowledge and practical experience to make the most accurate decisions for themselves.

To stay up-to-date with news, knowledge, and market insights, you can follow the team's Social platforms for the latest updates!