Bit has recently faced significant challenges due to price volatility. Despite these difficulties, cryptocurrencies are forming an upward trend.

Investors, especially short-term holders, are moving towards accumulation, supporting the possibility of recovery.

Bitcoin investors are optimistic

The Bitcoin realized losses are a key indicator of the current market difficulties. This week, the realized losses of all market participants amounted to $818 million in a single day, which is one of the highest figures on record. The only larger loss was the unwinding of the yen carry trade on August 5, 2024, totaling $1.34 billion.

These substantial losses show that many investors had to sell their positions below cost due to the downward market pressure. However, while many investors are feeling the weight of the current volatility, some are still maintaining their positions.

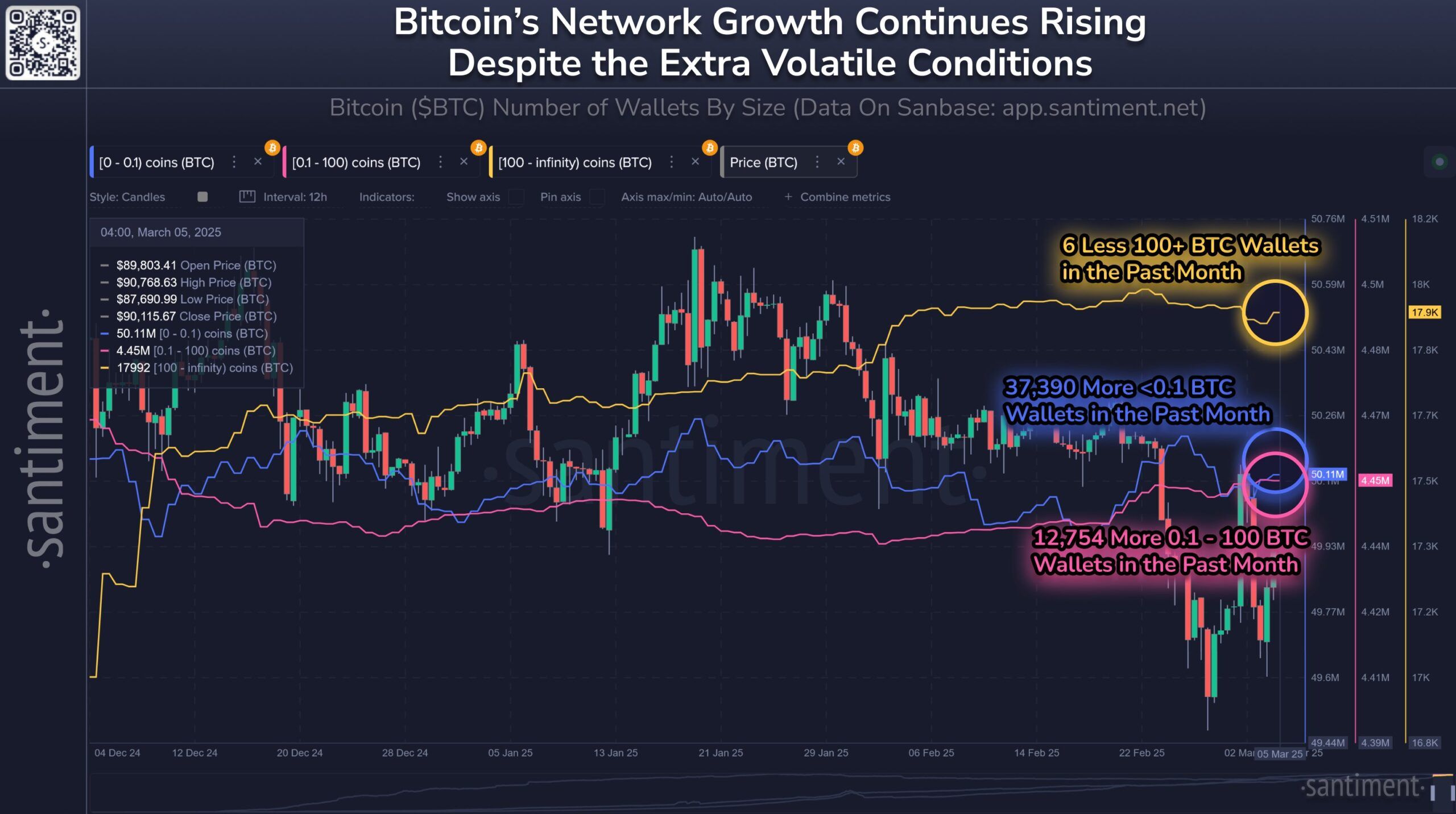

On a positive note, the growth of the Bit network is increasing. The number of short-term holders has increased, with 50,000 more wallets than a month ago. Specifically, 37,390 new wallets holding less than 0.1 BTC were added, and 12,754 wallets holding between 0.1 and 100 BTC were added.

The increase in Bit wallet numbers reflects the strong conviction of these short-term investors. Despite the current price fluctuations, their continued market participation indicates that many are looking beyond the current downtrend. This is an important factor supporting the potential recovery of Bit, suggesting that the holder base is strong, and interest in cryptocurrencies has not waned.

Potential for BTC price increase

The Bit price has recovered 6% in the last 24 hours, trading at $92,776 based on the latest update. The cryptocurrency is approaching the important $93,625 resistance level, which it has struggled to break through in recent days. If this resistance is successfully breached, it could signal the start of a bullish breakout, allowing Bit to rise higher.

If Bit can turn $93,625 into support, it could open the way for a move up to $95,761. This would represent a potential breakout from the descending wedge pattern that has dominated the market in recent weeks. This could then see Bit move towards the psychologically important $100,000 level, achieving a strong recovery from the recent volatility.

However, if Bit fails to break above $93,625, it could retreat back to the $89,800 support level. Failure to hold this point could further delay the recovery, with $87,041 acting as an important support level that could be tested. A break below this level would invalidate the bullish outlook and extend the current downtrend.