China issued 300 billion yuan in special government bonds to boost consumption, and also implemented interest rate cuts and reductions in bank reserve requirement ratios as monetary policy measures to strengthen economic stimulus.

Historically, loose stimulus measures and monetary policies have often coincided with bullish trends in the Bit market.

On Wednesday, China increased its fiscal and monetary stimulus efforts, promising to take more measures to boost consumption and mitigate the impact of the escalating trade war with the US. Such central bank stimulus measures typically increase global liquidity and may flow into various risk assets, including Bit.

Historically, the loose stimulus policies of major economies have often coincided with bullish trends in the Bit market. A study by S&P Global found that Bit market bull and bear markets have occurred during periods of extremely loose monetary policy or significant tightening.

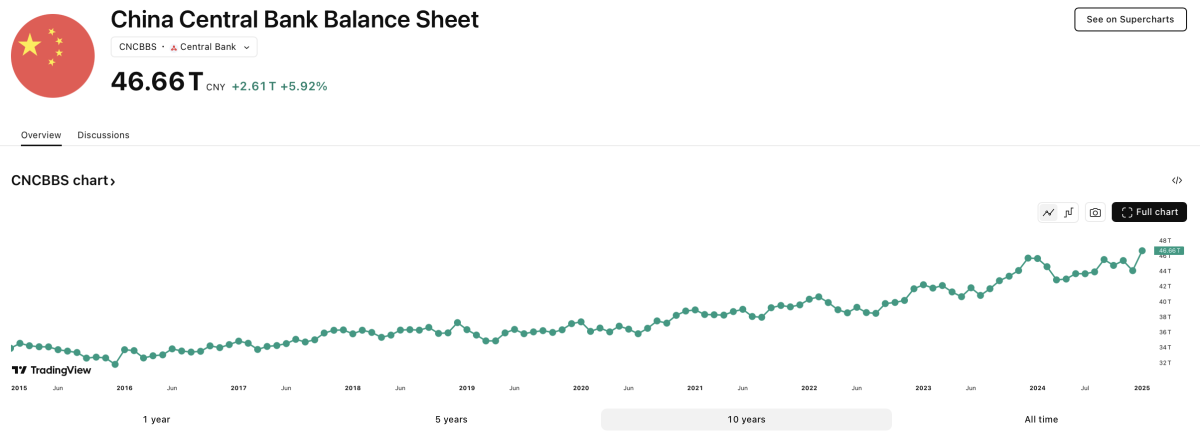

In September 2024, Bit rose 12.3%, one of its best September performances. This surge coincided with China's previous stimulus measures, including lowering short-term interest rates and reducing bank reserve requirement ratios to support the real estate and stock markets. Additionally, TradingView data shows a positive correlation between Bit prices and the People's Bank of China (PBOC) balance sheet over the past eight years.

A Nexo spokesperson emphasized the potential impact of China's latest stimulus measures on alternative assets.

"In 2015 and 2020, when China increased monetary stimulus and injected excess liquidity into the market, that liquidity ultimately flowed into the alternative asset markets," the spokesperson told The Block. "Such stimulus policies may have a broader impact on global markets, increasing investor interest in stocks and alternative assets."

However, the spokesperson also warned that China's strict regulatory controls limit direct participation in the Bit market. "Some liquidity may be absorbed by state-supported investment alternatives, or funds may flow into traditional safe-haven assets like gold."

On Wednesday, China's annual government work report announced a 5% GDP growth target, a fiscal deficit target of 4% of GDP, and plans to boost private consumption through various measures.

"China is currently in a state of slow positive economic growth, rather than economic prosperity," Nansen's chief research analyst Aurelie Barthere told The Block. She added, "While China has sent positive signals about AI investment, overall, China's economic development has less impact on the Bit market than policy changes in the US."

China Responds to Trump Tariff Impact

According to Reuters, Chinese Premier Li Keqiang warned in his opening address at the annual session of the National People's Congress that "a profound transformation unseen in a century is accelerating." The trade war initiated by US President Donald Trump continues to threaten China's industrial sector. This challenge is also exacerbated by weak domestic consumption and a deteriorating real estate market burdened by high debt, making the Chinese economy increasingly fragile.

Regarding global economic growth, analysts remain cautious about the appreciation of risk assets.

"From a purely macroeconomic perspective, Bit's performance is mainly influenced by global growth expectations," said André Dragosch, Bitwise's head of European research. "And due to the rise in tariff uncertainty, these growth expectations have recently been revised downward."

Crypto and financial market analyst Richard Ptardio also warned of potential volatility ahead.

"With US inflation data and the Fed's interest rate decision looming, we need to be prepared for more market turmoil," he told The Block in an interview. "Over the coming months, Bit may enter a prolonged sideways consolidation, which might be the best outcome in the current environment."