On February 28, 2025, the crypto community's attention once again focused on StakeStone - the leading cross-chain liquid staking protocol. On this day, the StakeStone team released a thought-provoking tweet: "If users hold STONE / SBTC / STONEBTC / BERASTONE and other assets, they need to continue holding them," accompanied by a camera photo. This dynamic quickly sparked heated discussions, with the market generally interpreting it as a signal that an airdrop snapshot is about to be launched.

Three days later, StakeStone released another major news: the StakeStone Foundation has officially opened the X account, marking a critical step forward in the project's governance and ecosystem building. This series of actions not only adds new imagination to StakeStone's cross-chain liquid staking narrative, but also makes the market full of expectations for its future.

As the pioneer of the Omnichain LST (Liquid Staking Token) protocol, StakeStone has become the underlying infrastructure connecting the Layer 1 and Layer 2 ecosystems since its inception in May 2023, thanks to its innovative technical architecture and cross-chain compatibility design. During the crypto market downturn, the StakeStone team quickly identified the core pain point of liquidity fragmentation and proposed the "one-time deposit, multi-yield" solution, providing users with a one-stop liquid staking service.

Next, we will delve into the background, technical advantages, ecosystem layout, and market expectations of StakeStone, revealing how it has become a key engine for the next growth cycle of the crypto industry.

I. Project Overview: The Disruptor of Cross-Chain Liquid Infrastructure

Before discussing StakeStone, let's briefly review the concept of reStaking. The core of reStaking is to re-stake the already staked assets, usually on other platforms or protocols. For Ethereum, this enhances security; for investors, it is a way to unlock more yields. LRT (Liquid Redeemable Token) is essentially a reStaking certificate, with the process as follows: stake ETH to get LST (Liquid Staking Token), then re-stake LST to get LRT, and each certificate represents a staking, but the original asset is still ETH. Essentially, this is a model of constantly stacking liquidity to capture yields, which can be used for reStaking, lending, and other financial operations.

In simple terms, stake ETH to get LST, then re-stake LST to get LRT, and repeat the process of "nesting dolls" to continuously stack liquidity and capture yields. You can use LRT for more financial operations, such as reStaking and lending, and each additional staking layer provides another opportunity to leverage liquidity to generate yields.

StakeStone (STO) is different from traditional reStaking solutions, as it is a cross-chain LST staking protocol that provides native staking rewards and liquidity for Layer 2, supports leading staking pools, and is compatible with reStaking, and will integrate with EigenLayer in the future. STO was created in May 2023 during the crypto market downturn by an experienced team, focusing on solving the problem of liquidity fragmentation in the blockchain ecosystem.

II. Market Pain Points: Liquidity Fragmentation and Yield Dilemma

The crypto ecosystem currently faces two core challenges:

Cross-chain liquidity fragmentation: Traditional LSTs (Liquid Staking Tokens) like stETH and rETH are limited to a single chain, unable to meet the liquidity demands of the multi-chain ecosystem. For example, users who have staked ETH on Ethereum find it difficult to directly migrate their rewards to Manta, Scroll, and other Layer 2 networks to participate in DeFi activities, leading to low asset utilization.

Imbalance between yields and risks: The yield sources of existing staking protocols (such as Lido and Rocket Pool) are limited, and users need to manually manage the allocation strategies across different staking pools, which is complex and difficult to maximize yields.

StakeStone's solutions directly address these pain points:

- Cross-chain liquidity distribution: Through LayerZero technology, StakeStone builds cross-chain compatible STONE tokens that can seamlessly circulate across more than 20 networks, including Ethereum, Manta, Base, and BNB Chain.

- Automated yield optimization: StakeStone introduces the OPAP (Optimized Portfolio Allocation Proposal) mechanism, which dynamically adjusts the allocation of underlying assets in staking pools, reStaking protocols (such as EigenLayer), and DeFi strategies to maximize yields.

III. Product Architecture and Technical Advantages

1. Core Functions

- Liquid staking and reStaking: Users deposit ETH/BTC and receive the interest-bearing tokens STONE (for ETH staking) or SBTC (for BTC staking), with the token value growing as the underlying yields accumulate. StakeStone supports integration with protocols like EigenLayer for multi-layer yield capture.

- Cross-chain liquidity market: STONE, based on the LayerZero OFT standard, can be used as a universal collateral on networks like Ethereum, Berachain, and Sonic, participating in DeFi activities such as lending and derivatives trading.

- Vault smart treasury: Provides a "one-time deposit, multi-yield" one-stop service, such as the Vault in collaboration with Berachain, which allows users to simultaneously capture staking rewards, ecosystem airdrops, and liquidity mining incentives.

2. Technical Innovations

- OPAP mechanism: Automatically optimizes the asset allocation among LST, LRT (Liquid Redeemable Token), and DeFi strategies based on real-time analysis of market data (such as staking pool yields and on-chain activity), allowing users to obtain dynamically adjusted optimal yields without manual operations.

- Non-custodial and transparency: All assets are managed by smart contracts, which are verifiable on-chain, eliminating centralized custodial risks.

- Modular and compatible design: Supports the future integration of new yield-generating scenarios, such as AI consensus and DePIN, to expand the sources of rewards.

IV. Team and Financing

1. Core Team

- Charles K (Co-founder): A serial Web3 entrepreneur, he has led the development of CEX and hardware wallet products, and is skilled in financial derivatives design and cross-chain architecture.

- Rose Li (CSO): With a finance background from the University of Sydney, she has experience in traditional hedge funds and quantitative trading, responsible for strategic resource integration and institutional partnerships.

- Ivan K (CMO): Previously worked at leading internet companies, he is responsible for StakeStone's global community expansion and brand marketing, promoting the "RWAFi" (Real-World Assets + DeFi) concept.

- Chris Core (Chief Architect): A blockchain protocol expert, he designed the StakeStone Vault and OPAP smart contract system.

Financing Progress and Institutional Backing

StakeStone, with its clear business model and technical innovations, has received continuous investment from top-tier capital:

- Early Financing (March 2024): Strategic investment from Binance Labs and OKX Ventures, with the amount undisclosed.

- Series B Financing (November 2024): Led by Polychain Capital, with Binance and OKX as co-investors, raising $22 million at a valuation of around $200 million.

- Strategic Partners: Including EigenLayer (reStaking protocol), Berachain (high-performance L1), Pendle (yield derivative platform), etc., forming a cross-chain yield enhancement ecosystem.

Institutional Evaluations:

- Polychain Capital: "StakeStone's cross-chain liquid staking model will reshape the competitive landscape of the LST sector, becoming the underlying yield aggregator in the cross-chain era."

- Binance Labs: "Its OPAP mechanism and modular design provide the indispensable liquidity infrastructure for Layer 2 networks."

V. Market Expectations and Future Plans

1. Key Metrics (as of March 2025)

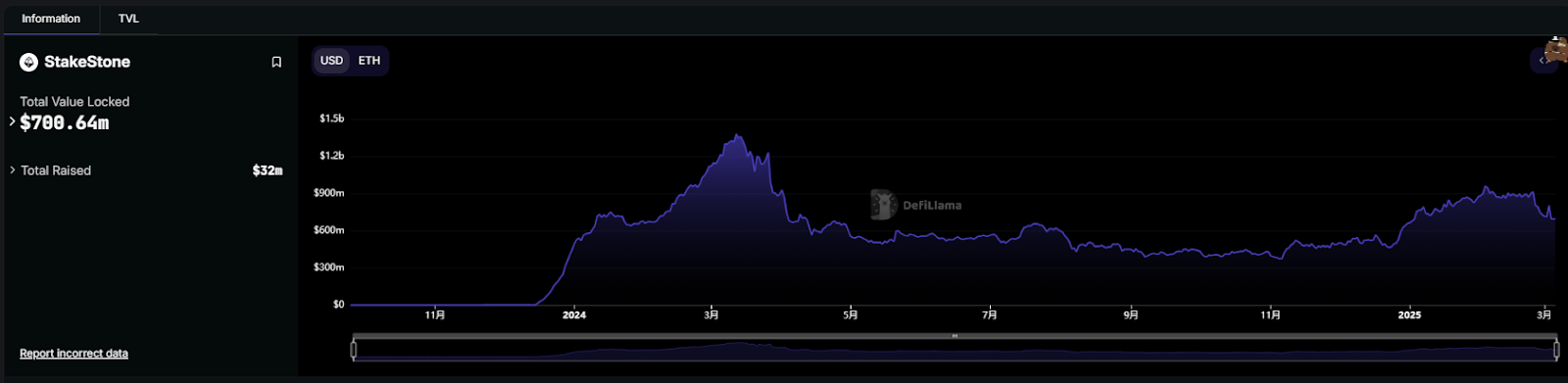

- TVL: $700 million (68% ETH, 22% BTC, 10% multi-chain assets);

- Number of users: Over 280,000 addresses participating in staking;

- Yield performance: STONE annualized yield stable at 5.8%-7.2%, higher than Lido's wstETH (4.5%).

2. Milestone events

- 2024.09: Open EigenLayer Season 2 Stakedrop token claim, airdrop worth over $30 million;

- 2025.02: Jointly launch Vault service with Berachain, realizing "one-time staking, two-layer network (Ethereum + Berachain) earnings";

- 2025.02.28: Official hints at airdrop snapshot, requiring users to hold STONE/SBTC and other assets.

3. Token economic model

- Token name: STO (cross-chain liquidity certificate), veSTO (governance token);

- Total supply: 1 billion;

- veSTO rights: Governance voting rights, bribery revenue sharing, STO staking reward bonus (up to 3x).

Expected market capitalization: Referring to the similar protocol ETHFI (FDV $4 billion), the initial FDV of STO is expected to be $25-30 billion, with a circulating market value of $2-4 billion, possessing low market cap and high growth potential.

Conclusion: Ushering in a new era of cross-chain liquidity

As Ethereum enters the PoS era, the scale of staking continues to grow, and ETH and its LST have become the preferred stable assets for many users, as well as the core underlying assets for multiple protocols. At the same time, various Layer 2 and emerging networks are constantly emerging, leading to fragmented liquidity between the mainnet and different networks. For users, it is difficult to both obtain stable returns by staking ETH and pursue Alpha returns on Layer 2. The emergence of reStaking not only creates a demand for ETH liquidity in small networks, but also provides users with the possibility of additional earnings.

Therefore, StakeStone is not only a high-quality project, but also shows unique advantages in the LSD track, and its future development is worth looking forward to!