A Bitcoin whale named "Spoofy" bought over $340 million worth of BTC on the Bitfinex exchange when the Bitcoin price dipped below $90,000.

On February 27, community members reported that this whale accumulated 4,000 Bitcoins (BTC $86,448) when the Bitcoin price was fluctuating between $82,000 and $85,000. At the current price, this position is worth around $344 million.

Crypto analyst Saint Pump identified this whale as Spoofy, stating that it is one of the largest traders in the market.

Spoofy has had a significant impact on the Bitcoin market. As early as 2017, this trader was accused of manipulating the market through "spoofing" - placing large buy orders to attract market attention, then canceling the orders before execution to influence price movements.

Spoofy's Bitcoin Trading Record

During the prolonged bear market triggered by the 2022 Luna and FTX collapses, Spoofy took advantage of the market crash to accumulate a large amount of Bitcoin. Crypto analyst Saint Pump stated that Spoofy bought a total of 70,000 BTC when the Bitcoin price was between $40,000 and $16,000.

This whale then gradually sold off its positions as Bitcoin prices rebounded to the $40,000 to $70,000 range between 2023 and 2024.

More recently, Spoofy built a position of 24,000 BTC in 2024 and chose to sell and cash out when the price surged to $70,000 to $108,000, driven by the pro-crypto stance of former US President Donald Trump.

Biggest Bitcoin Losses Come from Crypto Newbies

Unlike experienced traders like Spoofy who buy the dips during market crashes, new investors often panic and sell at a loss.

CryptoQuant founder Ki Young Ju stated that the current panic sellers are likely just "crypto rookies." He pointed out that 30% corrections in Bitcoin bull market cycles are quite common. For example, Bitcoin price plunged 53% in 2021 but then rebounded to set a new all-time high. He added that buying high and selling low is "the worst investment strategy."

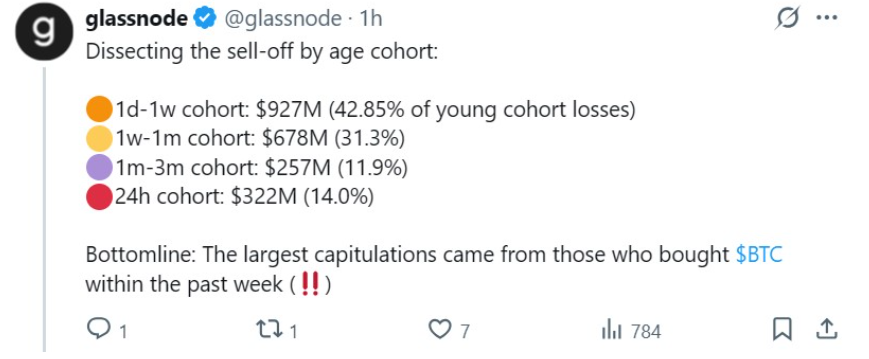

The latest data from blockchain analysis platform Glassnode illustrates this phenomenon. On February 27, Glassnode reported that recent investors have realized over $2.16 billion in losses. The largest capitulation selling came from investors who bought Bitcoin within the past week.

Glassnode's data also showed that investors who held Bitcoin for 3 months to 1 year have "almost negligible" losses. Specifically, those who held for 3 to 6 months lost around $6.5 million, while those who held for 6 to 12 months lost around $3.2 million.