As the craze for Deepseek and Grok3 continues to sweep the Web2 world, the AI ecosystem of Web3 is facing the largest historical drawdown, with many AI tokens having retreated by at least 80% from their highs a month ago, and the Altcoin ecosystem of Virtual Protocol (VIRTUAL) has also experienced a plunge - the VIRTUAL platform token plummeted 8.6% in a single day, and its incubated tokens such as GAME and LUNA have fallen by more than 10%.

The previous deployment of Virtuals on Solana was seen by the market as a positive, but now it inevitably makes one think of a new recruit who, full of ambition, finds himself on the retreat train the moment he steps onto the battlefield.

But this is not without warning. From the peak in January to the trough in February, the experience of Virtuals is like a crypto version of "The Big Short", revealing the cruel interplay of speculative bubbles, technological ideals, and market cycles. As the largest AI agent platform on the Ethereum ecosystem Base, Virtuals had planned to expand its business to Solana, trying to replicate the success of AI agents in the Solana ecosystem. However, the recent scandals surrounding Solana, especially the turmoil around Meme coins and conspiracy groups, have plunged Solana's ecosystem into a crisis of trust. Although Virtuals seems to be seeking new opportunities, the plunge in the entire AI agent track and the Altcoin market indicates that the market winter seems to be accelerating, whether it's the Solana or Ethereum ecosystem.

I. Solana Branch Opening Meets Cold Reception: The "Incompatibility" of Multi-Chain Expansion

On January 25, Virtuals announced its foray into the Solana ecosystem, and the market once saw this as an important step in the "AI agent empire". The team planned to replicate the successful model on the Base chain through five major initiatives, including the Meteora trading pool and the SOL Strategic Reserve (SSR). However, the data from Solana's debut on February 12 burst this bubble:

- AI agent graduation rate only 8.3%: In the Solana ecosystem, only 13 out of 156 new projects reached the graduation standard, with more than half of the projects priced close to zero, and only 5 projects with a market capitalization of over $1 million;

- Liquidity dilemma: User participation on the Solana chain is sluggish, with most projects having less than 100 holding addresses, in stark contrast to the 222,000 active wallets on the Base chain.

This scenario is reminiscent of a popular restaurant blindly expanding its branches - thinking that its signature dish (AI agents) would conquer the new market, only to find that Solana users prefer local specialties (such as Meme coins $TRUMP and ai16z). Even more ironically, Virtuals' "cross-chain abstract swap" solution designed for cross-chain operations is still at the whitepaper stage, and users can only use SOL to purchase AI agents on Base or ETH to purchase Solana agents, with an operational threshold comparable to asking a Sichuan chef to make sushi.

II. The Ebb of AI Agents: From "Technological Revolution" to "Cannon Fodder Toys"

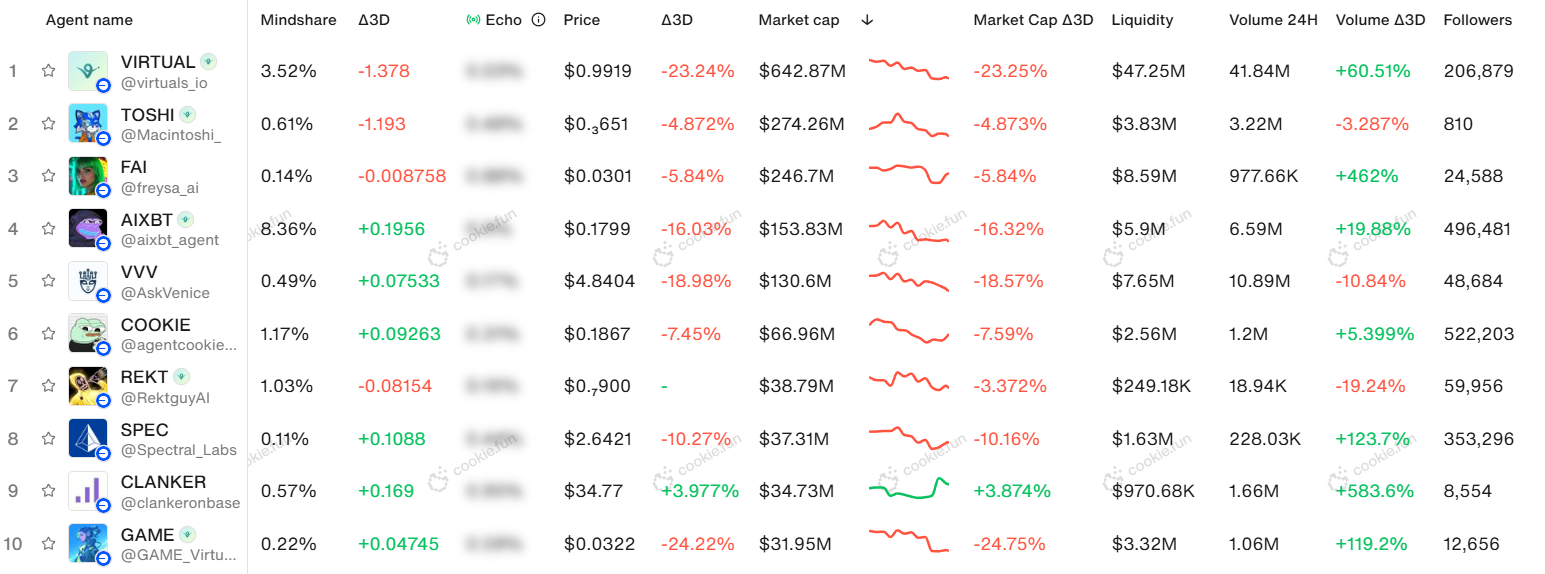

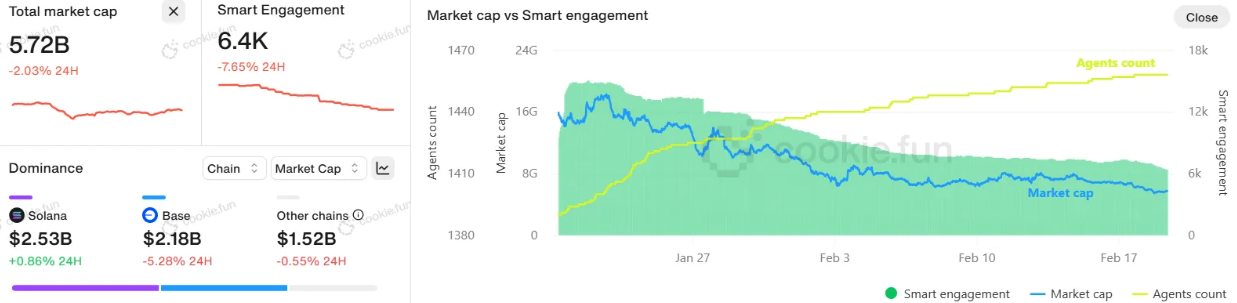

The plight of Virtuals is essentially a microcosm of the bursting of the AI agent track bubble. According to data from Cookie.fun, the market capitalization of the entire AI agent track has shrunk by 65.3% in the past month, a trend consistent with Messari's earlier prediction: "The prosperity of the AI agent framework will peak in Q1 2025, due to the lack of real demand support."

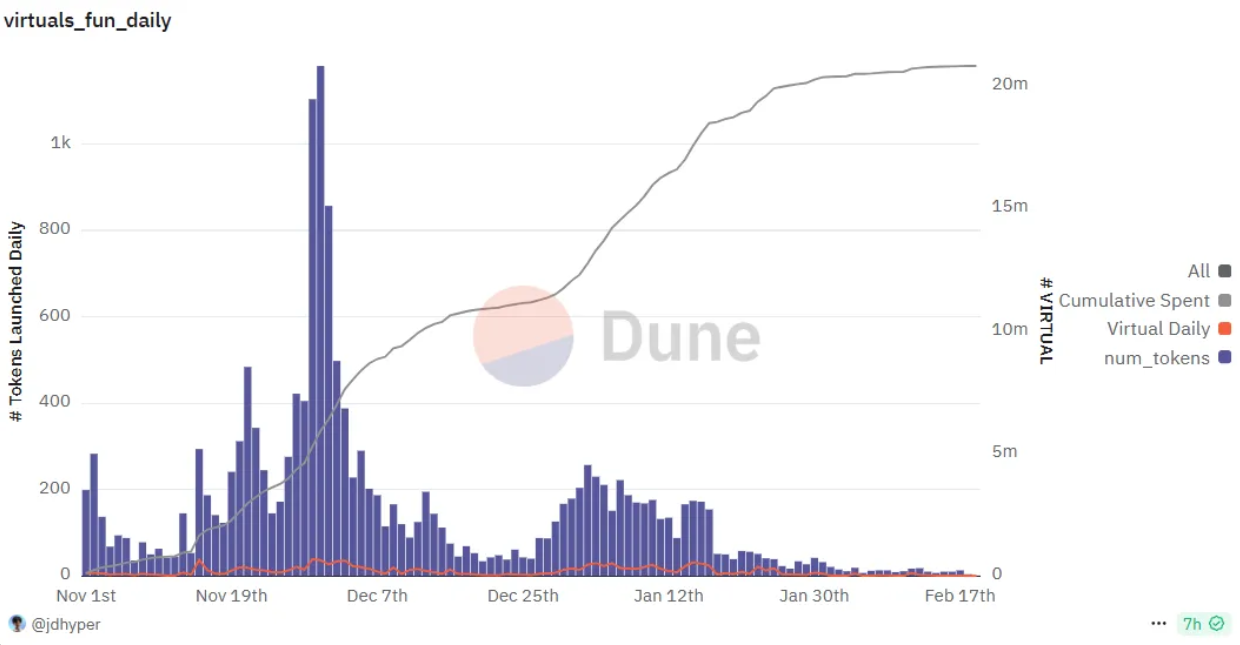

During the boom period, the frenzy of the AI agent track was like the "Trump pump" in the stock market. In December 2024, thanks to the AI narrative and the "Trump pump", the VIRTUAL token skyrocketed 500% in 30 days, with its market capitalization once exceeding $5 billion, becoming the "NASDAQ of AI agents". At the same time, the platform's cumulative revenue exceeded $37.76 million, with a trading volume of $6.74 billion, seemingly becoming an overnight star in the crypto industry.

However, with the bursting of the bubble, the cost of being "naked" is beginning to emerge:

Token economy involution: The $48 million buyback plan launched in January did temporarily boost the token price, but it also exposed the fragility of relying on fee sharing - when trading volume plummets, the burning mechanism becomes a "blood pump";

Agent homogenization: The 16,000 AI agents on the platform are mostly social KOL tokens (such as AIXBT) or "virtual idols" riding the trend, with functions limited to retweeting or generating cheesy love messages, still far from "disruptive AI". Meanwhile, the number of new agents is also shrinking rapidly, with only 4 new agents launched on February 18.

This situation inevitably reminds one of the NFT avatar craze in 2021 - when speculators found that their "digital monkeys" could neither chat nor do manual labor, a sell-off became inevitable.

III. Ethereum to the Left, Solana to the Right: The Prisoner's Dilemma of Ecosystem Consumption

Virtuals' cross-chain strategy, originally intended to deploy on both the Base (Ethereum L2) and Solana chains, has exposed its dilemma of being caught between the two in the public chain competition, like a sandwich cookie.

- The embarrassment of the Base chain: As the "star student" of the Ethereum ecosystem, Virtuals' expansion to Solana was seen by the Ethereum community as a "betrayal" of the mother chain. This multi-chain layout has exacerbated the Ethereum community's anxiety about the "blood-sucking effect" of L2, especially as Ethereum itself is working to address scalability and cost issues.

- The cold reception of Solana: Although Virtuals has tried to incentivize the Solana ecosystem by converting 1% of the fees to SOL, Solana users clearly prefer local projects, especially competitors like ai16z (market cap $2.55 billion). As an "outsider", Virtuals has always struggled to gain widespread recognition from the Solana community, almost becoming a "paratrooper".

This situation inevitably reminds one of a son-in-law trying to please both his mother-in-law and his mother, only to end up dissatisfying both and being kicked out.

IV. Retail Investor Revelation: The "Cognitive Collapse" of Speculation and Value

For ordinary investors, the roller coaster ride of Virtuals provides several profound warnings to the market:

- Narrative ≠ Value: The grand vision of AI agents must be supported by actual use cases. If the token economy simply relies on the circulation of transaction fees, it will ultimately become a "casino on the chain" and cannot be sustained.

- Multi-chain ≠ Security: While cross-chain expansion may appear to open up the market, it actually diverts the team's resources, especially in a market downturn, as excessive deployment only increases the risk of a broken capital chain - the more branches, the greater the crisis.

- Whales ≠ Allies: Although VIRTUAL has attracted the favor of large whale investors, these whales' sell-offs are often faster than retail investors. Over the past month, VIRTUAL has fallen by 46.3%, with these whales' rapid exits exacerbating the market's panic sentiment.

From this, we can see that there is often a huge cognitive gap between the speculative behavior of the market and the value of virtual assets. In the world of virtual assets, many investors have fallen into the "value illusion", thinking that the bubble will keep expanding, only to eventually face the ruthless "fission".