What Happened?

This morning at 6 AM, Argentine President Javier Milei announced on his official X account the launch of a Meme coin called LIBRA, including the smart contract address (Bo9jh3wsmcC2AjakLWzNmkJ3SgtZmXEcSaWTL2FAvUsU).

As soon as the news broke, the market quickly erupted in frenzy, with the LIBRA price skyrocketing to $4.61, corresponding to a $4.6 billion market cap in just 40 minutes. However, the good times were short-lived, as the Bit price then experienced a violent sell-off, plummeting over 88% in just a few hours, currently trading at $0.526. Even so, its market cap still stands at a staggering $500 million, with a trading volume of over $1.3 billion in just 5 hours since its launch. This sudden "presidential Bit launch" frenzy has quickly sparked widespread skepticism: is this wild price volatility the inevitable result of market speculation, or is there a deeper scandal at play? So far, the Argentine government has not responded to this matter.

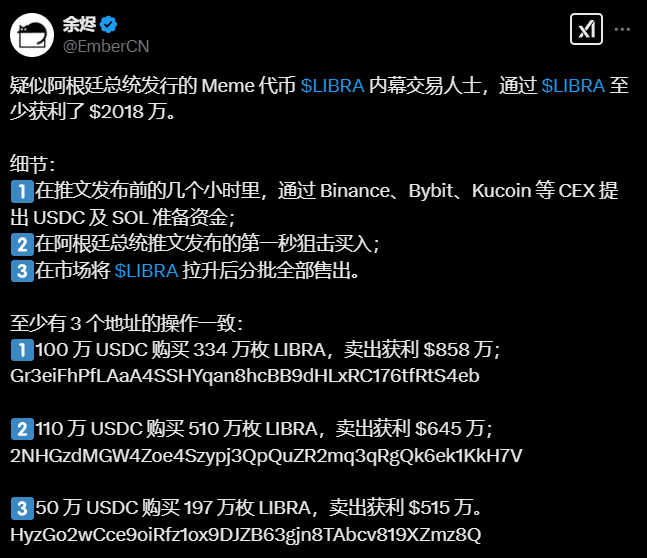

Insider Traders Make $20 Million

Blockchain data analysis quickly revealed the irregularities behind this frenzy - at least 3 mysterious addresses started moving actively just hours before President Javier Milei's LIBRA tweet. These addresses withdrew hundreds of millions of dollars worth of USDC and SOL from exchanges like Binance and Bybit, and precisely bought LIBRA at the very moment the tweet was published, subsequently selling in batches as the Bit price spiked to $4.61, ultimately netting a staggering $20.18 million in profits.

The most representative trade came from the address "Gr3eiFh...S4eb", which deployed capital before the LIBRA tweet, using 1 million USDC to purchase 3.34 million LIBRA, and then cashed out $8.58 million at the peak, realizing nearly 8.5x gains. The other two addresses also made incredible profits of $6.45 million and $5.15 million respectively. This series of "millisecond-level precision" operations has been identified by on-chain analyst Ember as a typical insider trading behavior, not only exposing the pre-project capital movements, but also further fueling market doubts about LIBRA's legitimacy.

While insider trading is not uncommon in the crypto market, using the flow of a national leader to conduct such blatant arbitrage is unprecedented.

Team Cashes Out $87 Million, Liquidity Pool Drained

If the "insider trading" style of precise arbitrage was already alarming enough, the subsequent actions of the LIBRA project team were even more outrageous, making it clear they were out to fleece the market. On-chain data shows that the project team quietly withdrew $87 million worth of USDC and SOL from the liquidity pool within 4 hours, directly leading to a severe liquidity crunch in the market and the Bit price plummeting over 88% in a near-free fall.

According to blockchain analysis platform Bubblemaps, the LIBRA team set up a single-sided liquidity pool on the Meteora platform, meaning the majority of the liquidity came from buyers rather than the project's own assets. The team then massively withdrew the stablecoin USDC and SOL, directly causing a sharp reduction in LIBRA's market depth, making it impossible for buy-side orders to absorb the selling pressure and leading to the coin's price collapse. This move not only severely undermined LIBRA's market stability, but also exposed the project's extreme centralization risk - data shows that 82% of the LIBRA supply is concentrated in the hands of a suspicious entity, while the official has yet to disclose any details of the token economics.

The Community Expects Regulation

LIBRA has gone from the initial "presidential endorsement" to a crisis of trust in less than half a day. The traces of insider trading, the team's massive cash-out, and the liquidity pool drainage operation have all made the market suspicious of this "national-level Meme Bit experiment". The deeper problem is that this is not only a speculative frenzy in the crypto market, but may also inflict irreparable damage to the credibility of the Argentine government in the emerging financial field.

Although the LIBRA website claims the project aims to "promote Argentina's economic growth", its highly opaque token distribution mechanism and market manipulation behaviors have already sparked strong dissatisfaction among global investors. Analysts point out that this incident may become another typical case of crypto market manipulation, and may prompt global regulators to accelerate the scrutiny of celebrity tokens, preventing the recurrence of *"rug pull"* scenarios.

At the same time, the anger of retail investors on social media has already erupted, with many saying they chased the high and suffered heavy losses in just a few hours, even directly accusing the "government of leading the way in harvesting people's wealth". In the X (Twitter) and Telegram discussion areas, the voices of anger are echoing:

- "Retail investors should unite, if there is no regulation, we are just meat on the chopping board, don't buy any meme anymore! This industry urgently needs regulation to protect retail investors, or it will be doomed sooner or later."

- "Playing like this, the circle will be ruined sooner or later, who dares to enter the market?"

- "You can't even trust the president anymore, what a world..."

- "It's undeniable that all Bit launches can never be truly fair, including Trump's, it's just that Milei played it too ugly."

From Musk's DOGE to Trump's MEME, the celebrity effect has always been an important driver in the crypto market. But the rapid collapse of the LIBRA incident has also made the market begin to re-examine - are those tokens launched under the celebrity halo innovation, or naked capital harvesting? This farce not only casts a shadow over Argentina's national credibility, but also once again puts the entire crypto industry in the spotlight of regulatory scrutiny.