Original authors: Nassos Stylianou, Nikou Asgari, Dan Clark, Sam Joiner, Irene de la Torre Arenas

Translated by: Block unicorn

Holding Bit has become cool again. US President Donald Trump has vowed to make America the "global capital of Cryptocurrency", a statement that has helped push the price of Bit to a staggering six-figure high.

Wall Street banks and asset management firms are gearing up to enter the market in a big way. Investors hope that Trump can transform this often-mocked token into a mainstream financial asset and usher in a golden age for Cryptocurrencies.

The President has signed an executive order aimed at "promoting the leadership of the United States in the field of digital assets". This month, leading figure in Cryptocurrencies and AI, venture capitalist David Sachs, unveiled plans for upcoming legislation.

Enthusiasts are particularly excited about the prospect of Bit national reserves, which would cement the US government's recognition of the asset and could further drive up its price. Sachs said: "The first thing we need to consider is the feasibility of Bit reserves."

However, how such reserves would operate, and what it would mean for Bit, is currently unclear. If - or when - the price falls, will taxpayers end up footing the bill? In 2022, the collapse of the prominent exchange FTX triggered a wave of bankruptcies, with investors rushing to sell their Cryptocurrencies.

Some are already starting to worry: the famous US hedge fund Elliott recently warned that Trump's embrace of Cryptocurrencies will lead to an "inevitable crash" and "could cause serious damage in ways we can't yet foresee."

The price of Bit is currently trading near its all-time high since the token's birth in 2009 - but a closer look at the 16-year history since Satoshi Nakamoto mined the first Bits reveals that price surges are often followed by dramatic crashes.

Here are some key moments in Bit's history:

In 2009, the first Bit-to-dollar trade took place on the Bitcointalk forum, with a user exchanging 5,050 Bit for $5.02 via PayPal.

In May 2010, a Florida programmer named Laszlo Hanyecz used 10,000 Bit to purchase two Papa John's pizzas worth $20.

Bit reached $1 per Bit.

Bit's volatility first emerged, with the price crashing from $30 after the major trading platform Mt. Gox was hacked.

Cryptocurrencies stabilized, with Bit price fluctuations moderating in 2012.

Bit's first "halving" event: a pre-programmed code change that halved the mining reward, aimed at controlling inflation.

Driven by global economic uncertainty and the European banking crisis, Bit price surpassed $100.

Against the backdrop of positive statements from US regulators and China becoming a major market, Bit soared to $1,000 per Bit - later attributed by researchers to price manipulation.

After another hack, Mt. Gox suspended withdrawals and ultimately collapsed, causing Bit price to plummet.

Bit price bottomed out around $200 and stabilized.

The technology behind Bit, the Block, attracted the interest of major banks like Barclays and Goldman Sachs.

Bit's second halving event.

Bit price exceeded the price of an ounce of gold.

In a speculative frenzy ahead of the launch of the first Bit "futures" contract, Bit price surged to nearly $20,000.

The "Cryptocurrency winter": the 2017 bubble burst, with prices crashing significantly.

The third halving event.

Bit rebounded to $20,000 and was seen as a "safe haven" amid the financial uncertainty of the COVID-19 pandemic.

Bit hit new highs amid the excitement of Coinbase's Nasdaq listing, the first US Cryptocurrency exchange to go public.

Tesla purchased $1.5 billion worth of Bit.

China declared all Cryptocurrency activities "illegal" and expanded its bans on trading and mining.

El Salvador became the first country to adopt Bit as legal tender.

The Cryptocurrencies Terra and Luna crashed in value, triggering a market collapse.

The collapse of Sam Bankman-Fried's FTX exchange triggered panic and led to the downfall of many other Cryptocurrency companies.

In January 2024, a spot Bit ETF was launched, causing the price to surge.

The fourth halving event.

Trump is elected president. Bit price soars to $100,000 per Bit. (* Laszlo's 2010 pizza order is now worth $1 billion.)

Bit climbs to $109,000, as the US is expected to issue an executive order supporting Cryptocurrencies.

Clearly, support from US officials has been beneficial for the price of Bit.

Clearly, support from US officials has been beneficial for the price of Bit.

Last year, the top US securities regulator approved the launch of regulated funds holding the Cryptocurrency, paving the way for pension funds, endowments, and other large asset managers to invest in the token. The Trump administration's embrace of the Cryptocurrency industry encouraged them to do so.

"This was basically unimaginable two years ago," said Vanderbilt Law School associate dean Yesha Yadav. She added that before Trump's return to Washington, Bit's price "was driven by novelty and excitement, whereas this time there is real institutional support."

Many believe the price can climb further. Larry Fink, the billionaire founder of the world's largest asset manager BlackRock, recently said Bit could reach $700,000 if more sovereign wealth funds consider holding it.

"Bit has found a way to work with governments," said Matt Hougan, chief investment officer of Cryptocurrency asset manager Bitwise. He added that Trump's support "has eliminated Bit's last existential threat."

Now, some lawmakers are pushing the government to go even further. Wyoming Senator Cynthia Lummis is leading the creation of a Bit strategic reserve.

Strategic Reserve

Reserve assets are typically a key resource that can be used in times of crisis. For example, the US currently has an emergency oil reserve that can be tapped to address oil supply shocks, while many countries hold gold reserves.

Lummis says the rising value of Bit could be used to pay down US debt. In July, she introduced a bill seeking to have the US purchase 200,000 Bit per year from the market for five years, until the reserve reaches 1 million Bit.

Because Cryptocurrencies are largely anonymous, tracking who Washington is buying Bit from would be extremely difficult - criminals and hostile governments could potentially profit from these purchases.

"This raises major national security implications, because the types of investors involved in Cryptocurrencies are themselves problematic," said Danielle Brian, executive director of the nonprofit watchdog Project On Government Oversight.

"This is a very strange idea," said Hillary Allen, a professor at American University Washington College of Law. "What we need is something that won't be eroded by inflation, we need hard currency and real reserve assets. Absurdly, there is nothing less 'hard' or less real than Bit," she added.

Here is the English translation of the text, with the specified terms retained and not translated:The US government currently holds nearly 200,000 Bits of Bitcoin, which were seized through criminal investigations. Previously, the US government had auctioned off some of the Bits of Bitcoin it held - however, many hope the government can now resist selling these Bits of Bitcoin.

More optimistic individuals like Lummis hope the US will start actively buying more Bits of Bitcoin, which could drive up the price of Bit. "Any action that doesn't involve selling the existing reserve is positive," Hogan said.

Supporters say Bit will be an effective store of value because its supply is limited. Due to the algorithm written into the Bit production code, the total number of Bits will forever be capped at 21 million. They believe this scarcity increases the value of Bit, as holding Bit now means they will be worth more in the future - which also distinguishes Bit from other cryptocurrencies.

Although the nature of cryptocurrencies means ownership is anonymous, there is indeed some public information.

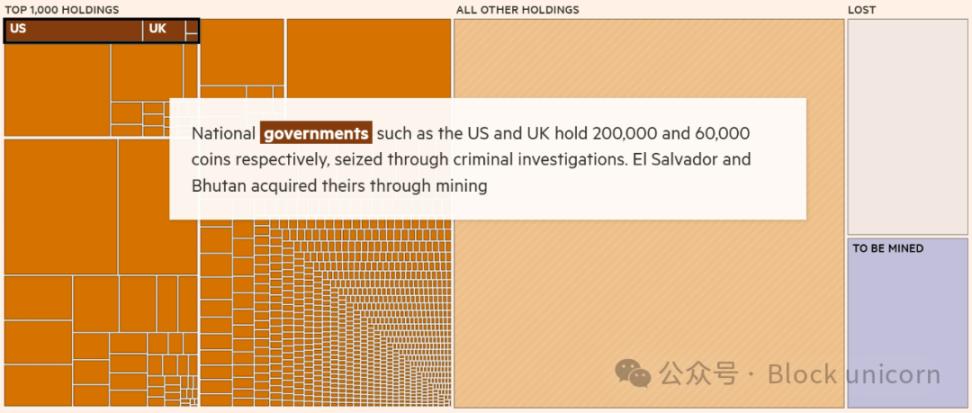

Grouping the largest 1,000 Bit holders by ownership type can give us a clearer picture of the major participants.

The governments of countries like the US and UK hold 200,000 and 60,000 Bits of Bitcoin respectively, which were seized through criminal investigations. El Salvador and Bhutan have acquired Bits of Bitcoin through mining.

Several asset management companies, including BlackRock, now operate Bit exchange-traded funds (ETFs), with BlackRock holding over 550,000 Bits of Bitcoin.

Centralized cryptocurrency exchanges hold tokens on behalf of their clients, with Coinbase holding over 1 million Bits of Bitcoin.

Some companies have already purchased Bits of Bitcoin - the most prominent being Michael Saylor's Strategy, formerly known as MicroStrategy, which has transformed from a software company into a Bit HODL company.

The mysterious Bit founder Satoshi Nakamoto holds around 1 million Bits of Bitcoin, which have never been traded - nearly 5% of the total supply, worth nearly $100 billion.

Outside the top 1,000 holders, there are about 800,000 Bits of Bitcoin whose owners' information is unknown.

It is believed that 1.5 to 2.5 million Bits of Bitcoin have been lost, with their owners unable to access them.

There are also over 1 million Bits of Bitcoin that have yet to be mined.

The US is not the only country considering investing in cryptocurrencies. The Czech central bank is considering adding Bit to its reserves, but other countries are staying away.

European Central Bank President Christine Lagarde recently stated that she is "convinced" that "Bit will not enter the reserves of any central bank member of the Eurosystem."

She added that "reserves must have liquidity, safety and reliability" and that "they should not be tainted by suspicions of money laundering or other criminal activities."

Bit's volatility is much higher than other financial assets

30-day rolling standard deviation of price and index levels (%), source: Financial Times calculations, London Stock Exchange Group • Bit and gold prices in US dollars

Few still view Bit as a currency. Its historically extreme volatility is the primary issue - for example, we need coffee prices to be the same in the morning and afternoon, requiring a stable currency for users to trust its value.

Secondly, Bit holders are often reluctant to spend their Bits when they believe the price will continue to rise. Bit's blockchain is also difficult to scale, as it cannot process large volumes of transactions in a short time.

Therefore, the experiment of using it as legal tender has failed. El Salvador tried this in 2021, but faced strong opposition and low adoption.

"The original vision was to be a peer-to-peer electronic cash, not an asset to balance a portfolio," said Christine Smith, CEO of the Blockchain Association lobbying group. "Over time, it has undergone some changes... I don't really view Bit as a payment method," she added.

Instead, Bit is most likely to be used as an investment.

"Historically, its price has been going up, and you can't deny that, although there have been many instances where people have said, 'This is the end of Bit,'" said Omid Malekan, an adjunct professor at Columbia Business School.

Institutional Investment

For Bit to become a mainstream financial asset, it needs large-scale participation from Wall Street banks, fund managers, pension plans, and other major institutional players.

Until recently, most were hesitant to hold these tokens for themselves or their clients, fearing regulatory backlash.

Now, under Trump's leadership, who wants to make the US a "Bit superpower," these concerns are fading. "We may see further integration of cryptocurrencies with traditional finance," Ely said.

US regulators have made it easier for banks and asset managers to custody cryptocurrencies, and have started reducing litigation against digital asset companies. Meanwhile, Trump's cryptocurrency task force is studying how best to regulate token issuance and facilitate banking services for cryptocurrency companies and traders, all of which will make the industry more aligned with traditional finance.

"If the rules are put in place and made a reality... the banking industry will come in big on the trading side," Bank of America CEO Brian Moynihan recently said, highlighting Wall Street's desire to profit from cryptocurrency trading.

Bit transactions to surge in 2024

Volume of Bit transactions, daily total and 30-day rolling average (millions), source: CCData

Investors have already been buying large amounts of Bit indirectly through the regulated exchange-traded funds launched last year, which have attracted over $110 billion in funds.

"Investors have gone from thinking holding a crypto position was a mistake to realizing not having exposure to Bit is a mistake," Smith said.

Bit has transformed from its original mission - to establish an alternative financial system free from government and corporate scrutiny. Now, Bit's believers are cheering its potential acceptance by what may be the largest institution - the US government.

But policymakers are concerned that if systemically important investors like pension plans and central banks start holding Bit, and its price crashes, the impact on the rest of the financial system will be widespread, with crypto companies potentially needing bailouts.

The volatility of cryptocurrencies, the risk of price crashes, and the use of leverage mean that as it becomes more mainstream, it "could disrupt the broader financial system's stability" and create "systemic risk... with severe negative impacts on the real economy," the New York Federal Reserve warned.

If the government's held value plunges, investments are seen as unwise, and the Bit collapse could affect the broader U.S. and global economy. Spillover effects on the Bond market are a potential risk.

"The origin story of all this is a rejection of central banks and traditional finance, and what I ultimately fear is that it will end up being propped up by central banks and governments," said Allen.