Methodology

Methodology

This study focuses on two main points:

- Analyze the internal structure of game sub-sectors;

- Construct a panoramic map of the current mainstream market projects.

To this end, we have screened out the top projects with a market capitalization of over $50 million, and included large games that have not yet issued tokens but have high visibility and attention in the community. If certain projects involve multiple fields, they are classified into the most relevant vertical track.

Game Ecosystem Map

Game Ecosystem Map

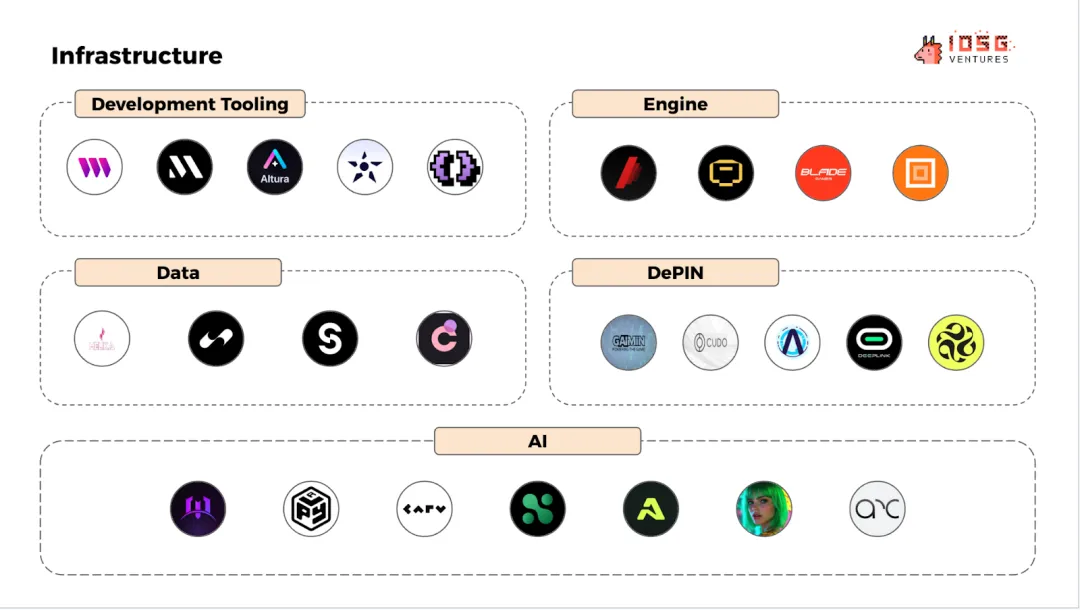

As of January 2025, the Web3 gaming ecosystem can be divided into three major vertical domains: infrastructure, games, and ecosystem.

#

Infrastructure

Infrastructure covers the technical foundation of Web3 games, including development frameworks, game engines, AI tools, data management systems, and DePIN (decentralized physical infrastructure network).

To avoid excessive layering, the classification standard in this category is relatively broad. For example, the "data" category includes both data analysis platforms and game data rights confirmation protocols (such as IP protocols).

#

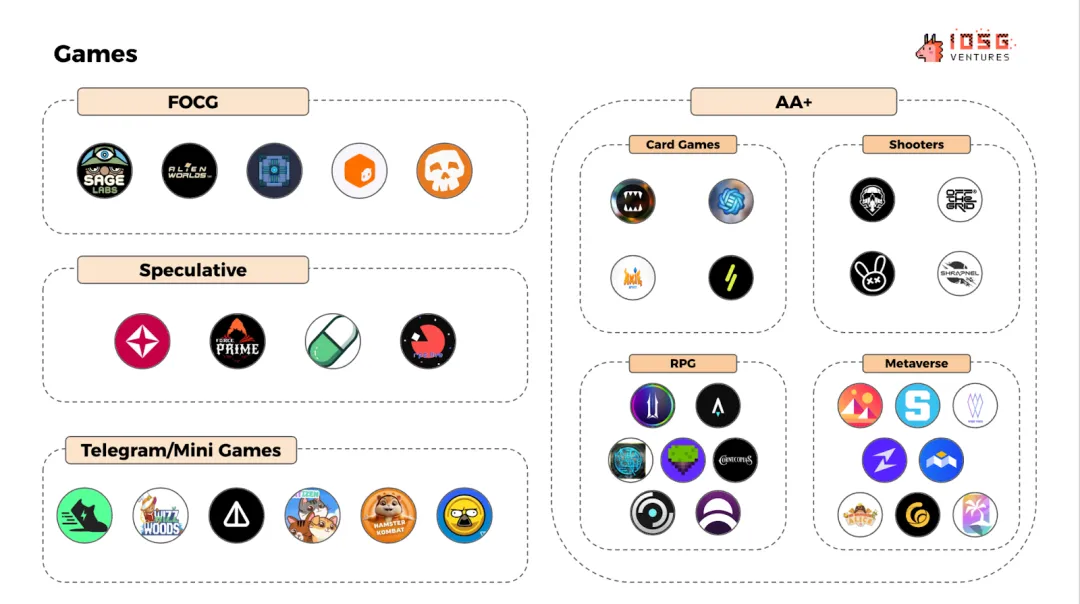

Games

It includes all playable Web3 game types, and is further divided into different gameplay categories. Among them, "AA+ games" represent higher-quality vertical tracks.

#

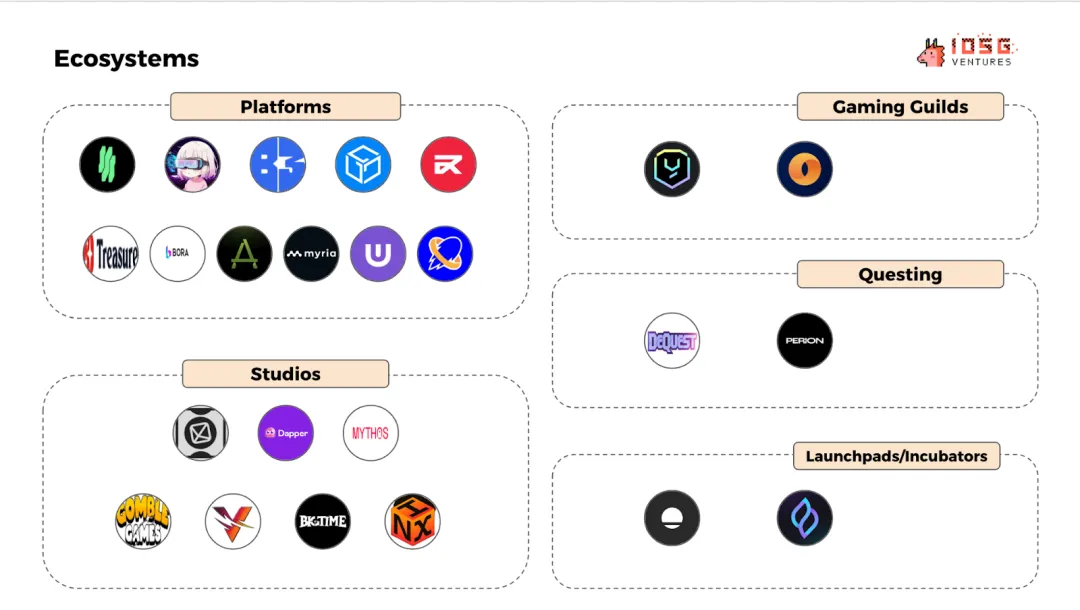

Ecosystem

Ecosystem projects aim to build network effects, covering platforms, studios, game guilds, task systems, and incubators/launch platforms. Platforms mainly refer to aggregated entry points that provide game distribution channels.

Please refer to the appendix at the end of the article for the specific project names.

Market Panorama

Market Panorama

Overall Trends of Web3 Games

#

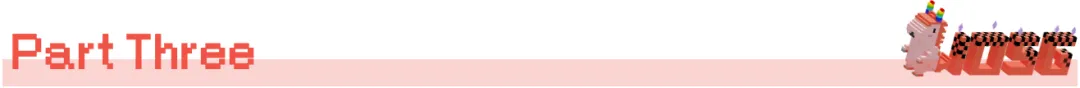

Annual Trading Volume

Although the trading volume remains high, it has declined from the peak in 2022.

#

#

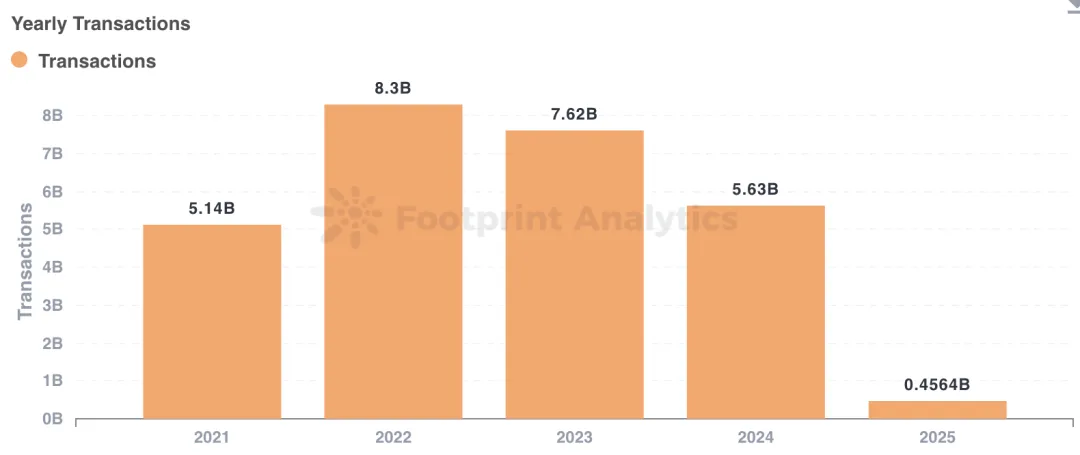

Annual Capital Scale

It has plummeted from $84 billion in 2021 to $5.58 billion in 2024.

- 2021-2022: Speculative sentiment drove capital inflows, with Non-Fungible Tokens (NFTs), GameFi tokens, and "play-to-earn" models dominating the market, but lacking sustainable user stickiness.

- 2024-2025: Speculative capital has decreased, and the actual player participation has increased, indicating that the industry is transforming towards real gaming demand.

#

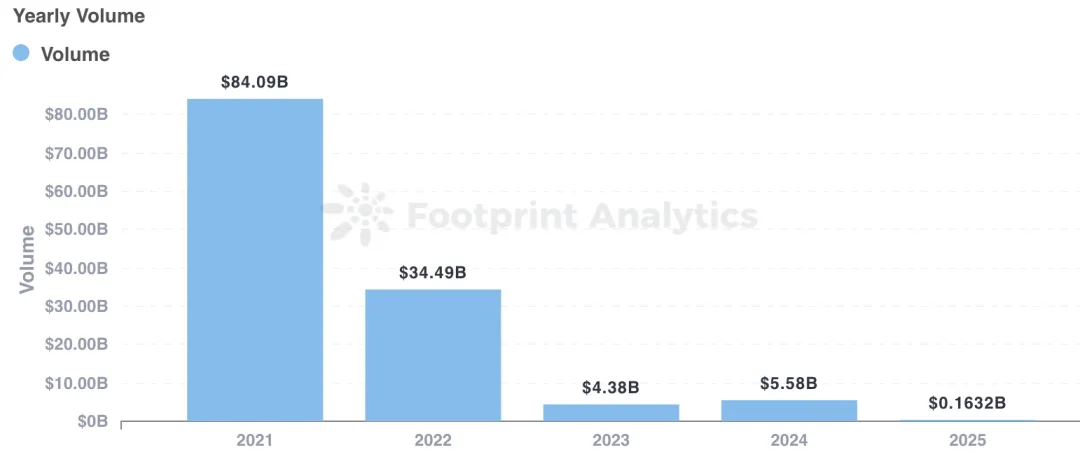

Daily Active Players

The user base continues to grow, and the adoption rate of games is steadily increasing.

#

#

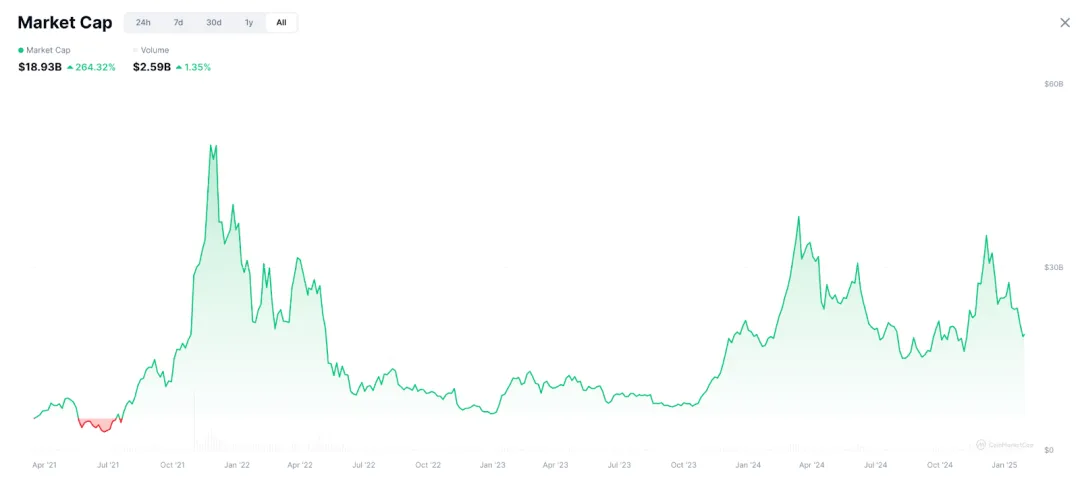

Web3 Game Market Capitalization (CoinMarketCap Data)

After excluding the abnormal peak at the end of 2021, the current market capitalization is not significantly different from the early stage, reflecting the improvement in the industry's health:

- Early Stage (2021-2022): High speculation, with fewer users but NFT and token speculation driving up market capitalization.

- Current Stage (2024-2025): Speculation has subsided, and the market is dominated by real players.

Game Type Trends

Game Type Trends

#

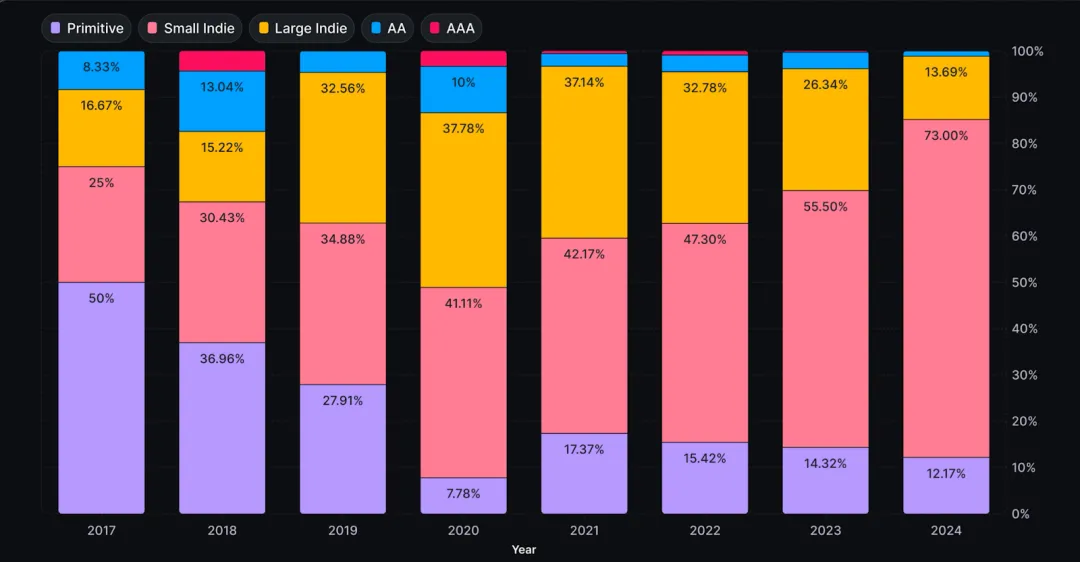

Developer Structure

The proportion of independent developers has increased, mainly due to the reduction in venture capital and the maturity of development tools. With the improvement of tools, the number of games is expected to experience explosive growth in the future.

#

#

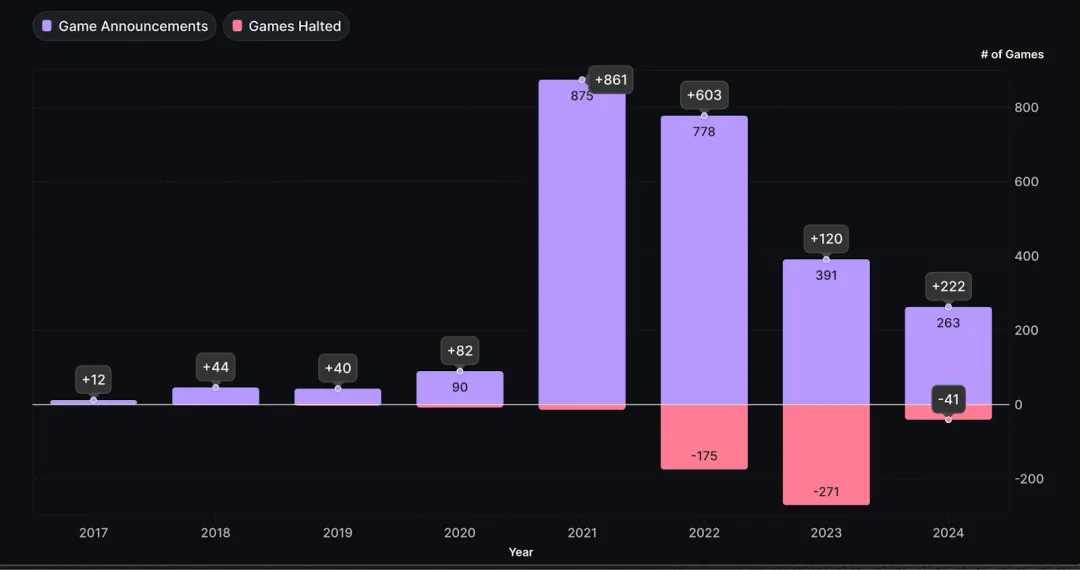

Project Survival Rate

With the end of the 2023 bear market, the interest of studios and publishers in Web3 games has rebounded, and the number of new projects has increased significantly.

Web3 Ecosystem Dynamics

Web3 Ecosystem Dynamics

#

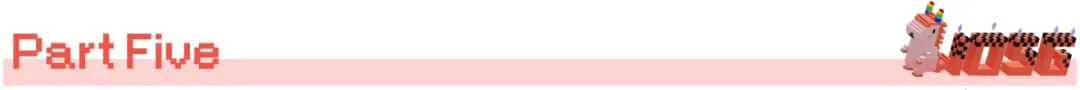

Performance of Top Chains

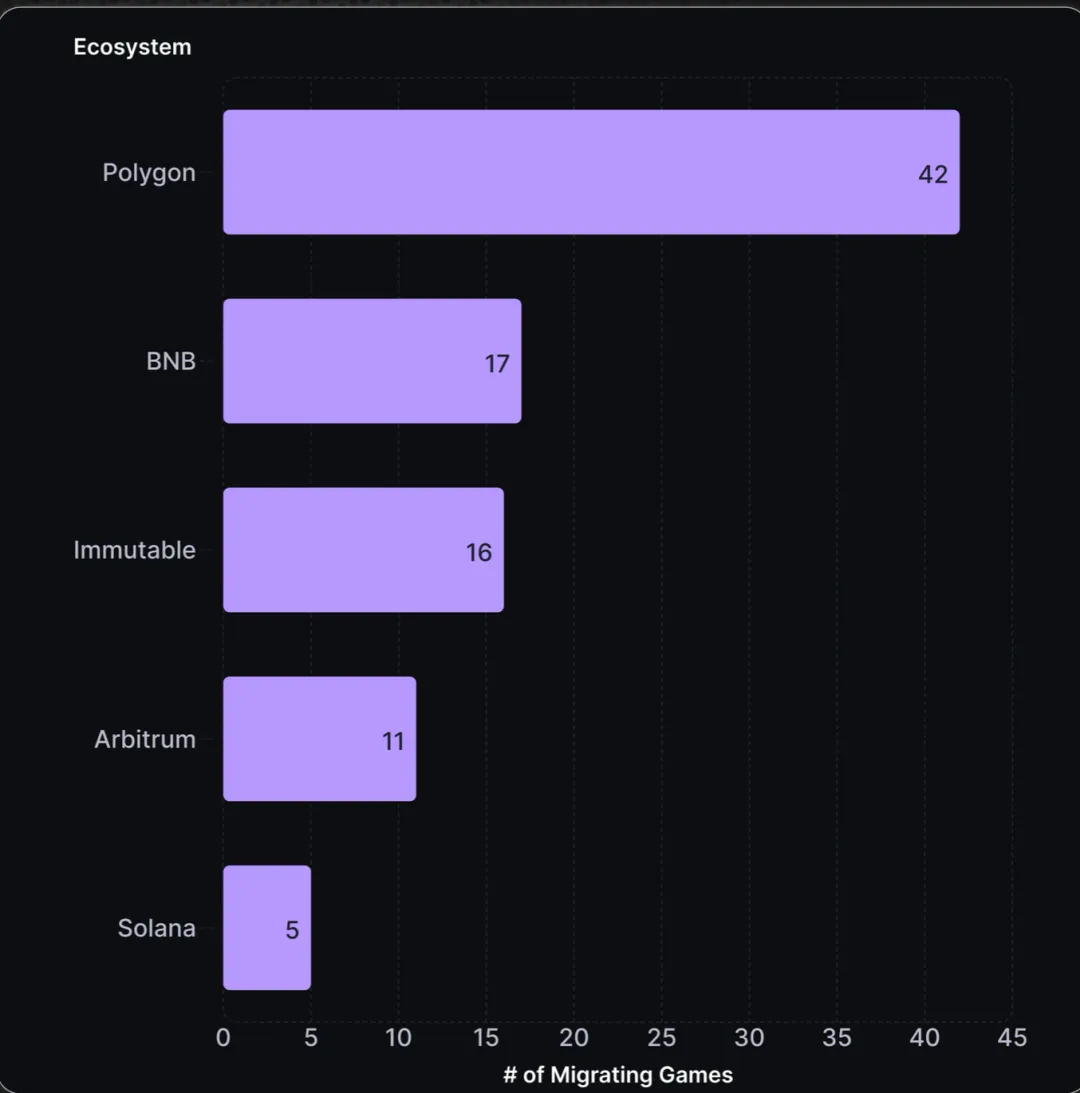

Immutable and Arbitrum ecosystems have seen the fastest growth in the past 12 months:

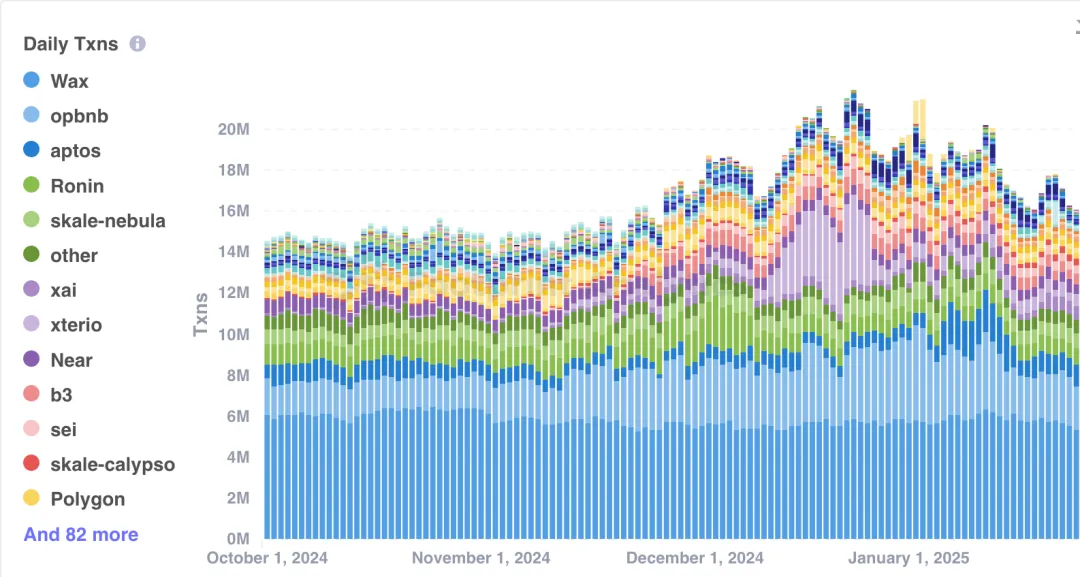

- Immutable: Added 181 new games (up 71% year-over-year), with 33% of the projects migrating from Polygon.

- Arbitrum: Added 119 new games (up 68% year-over-year) using the Orbit framework, including 23 dedicated Web3 game chains.

#

#

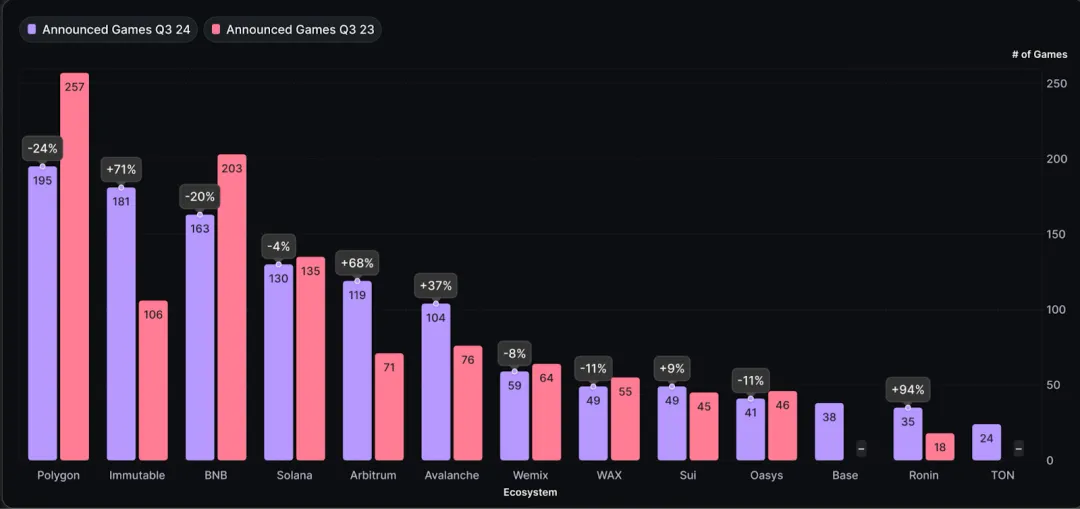

User Distribution

In terms of user base, WAX and BNB Chain still occupy a dominant position.

#

#

Migration Trends

Polygon has become the chain with the most outgoing projects, indicating fierce ecosystem competition and the need for further stability improvement.

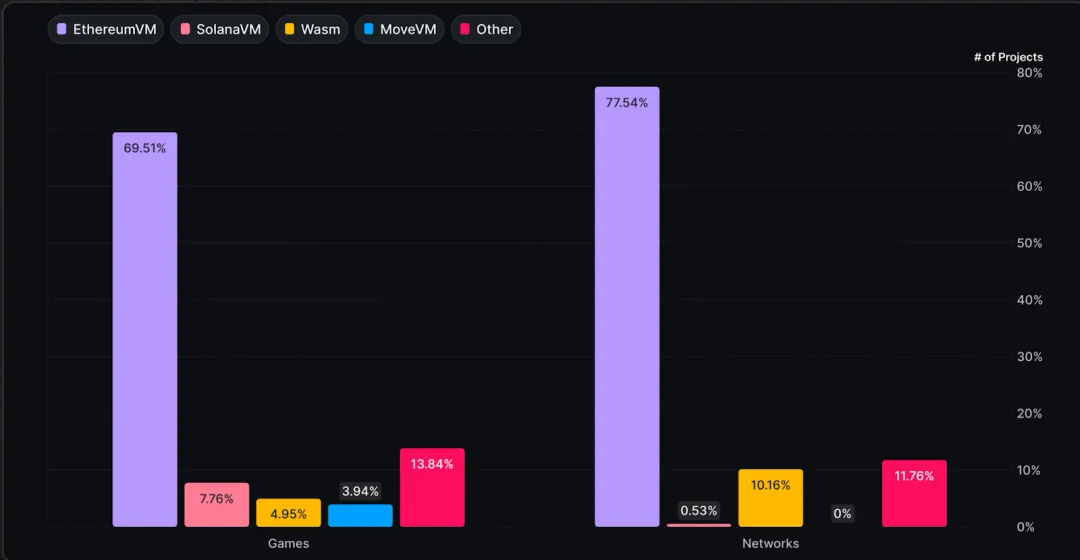

Smart Contract Development Environment

Smart Contract Development Environment

#

EVM Dominance

81% of new game chains are still based on the Ethereum Virtual Machine (EVM), mainly because:

- The development tools for non-EVM chains are not yet mature;

- The migration cost is relatively high.

#

#

Developer Preferences

Project teams are actively seeking better development environments, forcing ecosystems to continuously innovate to maintain competitiveness.

Conclusion

Conclusion

Web3 games are transitioning from speculation-driven to being centered on real users and sustainable development. Although the transaction scale has declined, the growth in daily active users indicates that the industry is maturing.

Infrastructure Layer:

The improvement of tools has attracted more independent developers, and DePIN and AI technologies have further strengthened the technical foundation.

Ecosystem Competition:

Immutable and Arbitrum have become the main migration destinations, while EVM chains still dominate the market.

Future challenges lie in ecosystem stability, project retention rates, and the development of high-quality games. The next stage will focus on:

- Innovation;

- On-chain deep integration;

- User experience optimization.

Decentralized games will enter a new stage of development.

Appendix

Appendix

Infrastructure

- Development Tools: thirdWeb, Metaplex, Altura, Stardust, reNFT

- Engines: MUD, Blade Games, Cartridge, Reflekt

- AI: PlayAI, Carv, Aethir, Arc, Neural, Freysa, MomoAI

- Data: Story Protocol, Helika, Chromia, Spaceport

- DePIN: Deeplink, Gaimin, Shaga, Beamable, Cudos

Games

- FOCG: Pirate Nation, Primordium, Alien Worlds, Downstream, Sage Labs

- Speculative: Duper, RPS.live, Force Prime, Pump.fun

- AA+:

- Card: Parallel, Axie Infinity, Gods Unchained, Splinterlands

- Shooter: My Pet Hooligan, Shrapnel, Off the Grid, Deadrop

- RPG: Metacene, Pixels, Cornucopias, Illuvium, Star Atlas, Mines of Dalarnia, Fusionist

- Metaverse: Zentry, Decentraland, Sandbox, Nifty Island, Wilder World, My Neighbor Alice, Mobox, (RACA) Radio Caca

- Telegram/Mini-games: Notcoin, Hamster Kombat, Catizen, Wizzwoods, WATC, STEPN

Ecosystem

- Gaming Guilds: YGG, Merit Circle

- Platforms: B3.fun, Gala Games, Game7, SuperVerse, BORA, TreasureDAO, Myria, Ultra, Ancient8, Sonic

- Studios: Nexus Interactive, Big Time, Mythos, Vulcan, Dapper Labs, Gomble, Ready Games, Playmint

- Quest Systems: Perion

- Incubators: Seedify, Everyrealm