Author: David Han, David Duong, Coinbase; Translator: Tong Deng, Jinse Finance

Abstract

AI agents have become one of the most promising narratives in the AI x crypto space, but the field is still in its early stages and difficult to navigate due to rapid technological development and the proliferation of agents.

Investor interest in AI agents is mainly reflected in two aspects - the core infrastructure for launching and hosting agents, as well as the individual agents themselves.

We believe that the crypto space's AI agent domain has huge growth potential as its functionality continues to expand. However, at least for now, expectations for AI agents may exceed the actual development of the technology.

AI agents have become a revolutionary topic not only in the crypto space, but also in the broader technology domain. The concept of autonomous entities that can analyze market news sources or other external data and make real-time decisions has captured the imagination of many institutional investors. Elsewhere, some tech industry leaders believe that AI agents may eventually replace the massive software-as-a-service (SaaS) industry. That is, trained AI agents can, in principle, perform any task involving a digital interface.

We believe that the crypto track can play a core role in the future, becoming the primary value transfer mechanism for AI agents. The programmatic nature and permissionless design of crypto support the scaling and deployment of virtually limitless such agents, enabling broader use cases from managing on-chain portfolios to paying for offline services. Given this potential opportunity, the market capitalization of crypto-based AI agents reached over $20 billion at the start of January, before approaching $8 billion by the end of the month.

The recent decline may indicate that expectations for AI agents have begun to exceed the actual development of the technology. While we expect this theme to reshape the crypto x AI landscape in the long run, its near-term applications are constrained by integration and agent differentiation challenges, as well as the uncertain long-term utility of agent tokens. In other words, realizing the full potential of AI agents may take longer than many imagine.

Understanding the Difference: Agents vs. Models

Many popular AI tools, including chatbots like ChatGPT or image generators like Stable Diffusion, are wrappers around generative AI models. They are defined by a bounded set of inputs and outputs, typically in the form of text, audio, and images. AI agents extend the direct functionality of these models by introducing a new class of applications that represent "a combination of reasoning, logic, and access to external information" (per Google's definition).

Specifically, AI agents can access and interact with a broader set of data and tools, enabling them to drive more complex behaviors, from searching multiple databases to planning trips and booking flights. With the integration of on-chain wallets, the scope of AI agent activities is greatly expanded by incorporating payment services into their toolkits.

Crucially, AI agents can also leverage their reasoning capabilities to act autonomously in dynamic environments. The triggers for AI agents are not limited to manual user prompts - they can be based on various concurrent data streams, including posts on X (formerly Twitter) or Twitch chats. Similarly, their responses can include multi-step outputs, such as placing orders, making payments, and sending confirmations to relevant parties.

Agents typically consist of (1) a core LLM model as their reasoning engine, (2) short-term and long-term memory components, (3) potential role or personality frameworks, and (4) most importantly, the ability to access a broader internet and other tools through application programming interfaces (APIs). As a result, the decisions made by agents can directly impact the real world.

The AI Agent Boom is Here

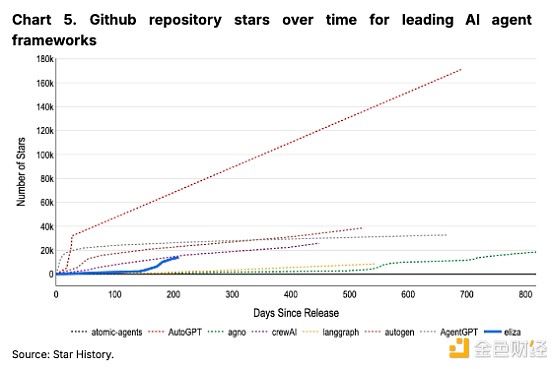

The infrastructure and tools for building AI agents are rapidly evolving, becoming one of the most closely watched technology trends in the past year. Multiple developer frameworks for constructing AI agents (including but not limited to CrewAI, LangGraph, AutoGen, phidata, Atomic Agents, AgentGPT, and AutoGPT) are competing for market adoption, with the top 15 code repositories on Github in January 2025 all related to AI.

The attention and excitement around AI and its agent applications have also extended to AI-related tokens in the cryptocurrency space. Since Q4 2024, much of the recent growth in token values has been associated with the agent AI theme, which currently accounts for 29% of the value of all AI-related crypto tokens. Within the agent AI ecosystem, agent tokens occupy the majority of the valuation, accounting for $4.5 billion in market capitalization, while tokens related to launchpads and frameworks account for $2.9 billion, according to data from cookie.fun (a platform that tracks AI agents in the crypto space).

We believe that the excessive focus on agents, relative to their underlying infrastructure, is partly driven by the meme-like nature of many "agents", which aligns with the increased meme coin activity observed for much of 2024. In fact, one of the earliest AI-related tokens to achieve viral spread gained notoriety because it was endorsed by the AI agent behind the famous X account truth_terminal (now with over 250,000 followers), rather than having a strong underlying project or governance structure.

That said, some AI agent tokens provide more utility by granting access to token-gated chat terminals or services where the agents can offer differentiated perspectives on various topics, such as the state of the crypto markets. At the same time, AI infrastructure tokens tend to be more based on the revenue of specific projects, often used to pay fees and for governance.

So far, most AI agents, launchpads, and other infrastructure have found their home on high-throughput, low-cost blockchains - particularly Solana and Base. Solana accounts for $4.2 billion in agent AI token market capitalization, Base for $3 billion, and the remaining chains collectively for $1.5 billion. We believe this is partly because the low-cost architecture is necessary to support the widespread adoption of AI agents. Additionally, we think the strong developer ecosystems that have formed on leading chains have driven a virtuous cycle of idea sharing and adoption.

Competing for Mindshare: Social Influence

The current AI agent landscape has several leading agents that have already begun to dominate the field. The most prominent AI agent to date, aixbt, has gained attention by operating an X account (now with over 465K followers) dedicated to interacting with the crypto audience on the platform. It has a token-gated terminal where users holding sufficient amounts of project tokens can access a private chat space to engage with the agent's real-time "thoughts".

Other leading agents, such as zerebro (with 119K followers), follow a similar pattern of gaining attention in the space through prominent social media profiles. Zerebro is particularly focused on on-chain art generation, with its native token used to pay for the creation of images, and its chat terminal controlled by NFTs.

However, not all AI agent tokens have the appearance of utility. One of the top AI tokens by follower count (tracked by cookie.fun) is Fartcoin, the idea for which was conceived through a dialogue with the aforementioned truth_terminal AI agent. In other words, the origin of the token itself is related to the AI agent, although the long-term utility of the token beyond meme significance remains unclear.

Here is the English translation of the text, with the specified terms translated as instructed:We believe that the interplay between memes and the token utility of AI agents has attracted traders from speculators to value investors across the space. That said, given the rapid development of the field, we believe the ultimate scope and capacity of any single token remains largely unknown. In other words, whether meme coins associated with AI agents will evolve beyond pure speculation and/or exhibit any utility beyond community governance or access gating remains an open question. We will discuss this further in the risks and future section below.

Following the Money: Launchpads and Infrastructure

After becoming one of the best-performing crypto sectors in November and December 2024, AI agent tokens suffered a significant setback in January 2025, partly due to the market becoming severely saturated in such a short time. This led to some market consolidation. As many of these tokens compete directly with memecoins in the attention economy of cryptocurrencies, it remains challenging to plan for value accretion in this space. In the short term, we find that direct protocol revenue tends to concentrate on the trading interfaces and launchpads deploying the AI agent tokens, rather than the tokens themselves, despite their relatively small market caps.

On Base, Virtuals Protocol has been the leading AI launchpad, supporting the simplified launch of AI agents and tokens across gaming and various application domains. (Note: Virtuals announced expansion to Solana on January 25.) Virtuals agents can be created without any coding. Users only need to fill out a simple form and spend the required amount of Virtuals platform tokens. Upon submission, a baseline agent will be initialized on the Virtuals infrastructure, with the associated token minted on-chain. Initially, the tokens are deployed in a bonding curve, and once they reach a certain liquidity threshold, they are transferred to a Uniswap pool. (Note: This bears some similarity to token releases on pump.fun and their transfer to a Raydium pool.)

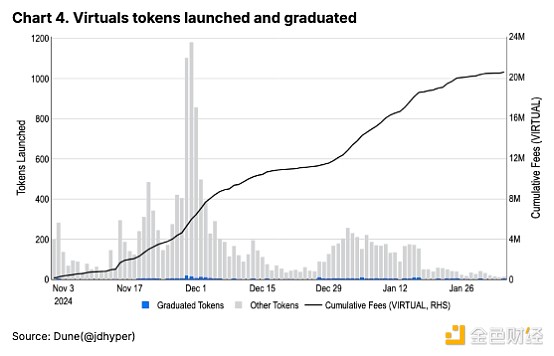

To date, Virtuals has launched nearly 16,000 agent tokens, generating over 20 million Virtuals tokens in fees. That said, the number of agents launched has decreased in recent weeks, down from a peak of 1,181 per day to an average of 31 in the last week of January. Additionally, the number of tokens with sufficient liquidity to transfer to a Uniswap pool has fallen to an average of one to two per day. Overall, only 334 (2%) of the 15,985 tokens launched have achieved sufficient liquidity to transfer to a Uniswap pool, indicating fierce competition for attention and capital.

We believe the primary reason for this decline is the difficulty in creating new agents that are sufficiently differentiated from existing ones. While Virtuals agents can be customized in their cognitive, speech, and visual cores, parsing the changes between agents launched on Virtuals has become an increasingly arduous task - akin to the memetic competition of memecoins. Nevertheless, we believe that as AI agent integrations expand and use cases are further explored, launchpads like Virtuals will play a crucial role in the proliferation of agents within this ecosystem. In fact, the aforementioned aixbt was launched on Virtuals.

A key alternative to the Virtuals launchpad is the ElizaOS agent framework. In contrast to the streamlined deployment of mature launchpads, agent development frameworks like ElizaOS only provide the technical scaffolding required to build agents. That is, more technically inclined agent creators can use ElizaOS to launch highly customized agents across different blockchain networks, as model hosting, verification, and other engineering tasks are left to the creators. That said, AI agent hosting companies like Fleek also support no-code deployment of models based on the ElizaOS framework.

As a pure AI agent development framework, ElizaOS has no native token. However, the ai16z governance token on Solana (now renamed to the ElizaOS token) is often viewed as a proxy for adoption of this technology, as the creator of the ai16z decentralized autonomous organization (DAO), Shaw Walters, is the founder of Eliza Labs, which oversees the development of ElizaOS. The ai16z DAO itself manages on-chain and off-chain investments, with AI fund managers (built using the ElizaOS framework) managing trades and positioning.

What is particularly noteworthy about the ElizaOS framework is that its codebase has been a subject of intense interest since its release, at one point becoming the most starred repository on Github. Developers can "star" a project if they find it particularly impactful, much like liking a photo or post on social media. The stars accrued by ElizaOS make it quite competitive among many other leading AI agent frameworks, including those launched by tech giants like Microsoft. (See Figure 3.) We believe this indicates a genuine interest from the broader software engineering community in the intersection of AI agents and on-chain activity, which is a core differentiating feature of ElizaOS as an AI agent framework.

Beyond Virtuals and Eliza, many other AI agent frameworks and launchpads have emerged, finding their own niches. For example, Griffain aims to create a network of agents tailored for DeFi activity. Meanwhile, the Arc agent framework's distinguishing feature is its lightweight, modular design, in addition to being built in Rust. We expect this space to evolve rapidly as these frameworks develop and new ones are adopted.

Risks and the Future

Additionally, we believe that the pullback in AI agent performance in January may signal an early maturation of the industry as more capital begins to flow towards DeFAI (Decentralized Finance + Artificial Intelligence) and/or other infrastructure.

DeFAI represents the convergence of artificial intelligence and crypto technology to enhance various DeFi functionalities. Its benefits include the ability to run automated yield farming strategies, use predictive algorithms for better risk management and fraud prevention. As many DeFi protocols start to ossify, the integration of AI capabilities with existing ecosystems can drive new innovations. Over time, the industry is poised to nurture new financial products and scale many DeFi platforms through the computational power of artificial intelligence.

However, the long-term utility of AI agent tokens beyond access gating and governance promotion remains unclear at present. The reality is that while AI agents have made remarkable strides, we have not yet reached the point of fully autonomous AI agents capable of handling complex real-world tasks without any supervision. Their reliability is still limited, and costs remain prohibitively high. Many AI agents also struggle to consistently handle data verification issues, which could raise legal issues or impact user confidence.

Nevertheless, the emergence of breakthroughs like the DeepSeek R1 model, which focuses on advanced "reasoning" tasks, may disrupt concerns about the speed-cost tradeoff. In fact, these models are evolving rapidly, and Deloitte predicts that within two years, half of all companies currently using generative AI may launch AI agents.

Ultimately, the transformative vision is that we may have a multi-agent system where autonomous AI agents strategically cooperate and/or compete to optimize for outcomes that may be more complex than what is currently possible. However, the nascency of the field makes predictions challenging. Additionally, with large tech companies like OpenAI only recently releasing their early AI agents, we expect more companies to follow suit soon. The development of centrally hosted AI agents - potentially integrated into traditional payment rails - may also introduce disruptive factors to the adoption of on-chain AI agents. We believe the trajectory of the field will be highly dependent on the flywheel of first movers and early adopters.

Conclusion

Over the past few months, AI agents have been one of the most discussed topics and trading opportunities in the field of liquidity tokens. Although the valuations of many major tokens have fallen significantly from their historical highs (witnessed as early as the beginning of January), we believe that the interest of developers and capital inflows into this field may provide a major driving force for the entire industry in the long run.

However, at the same time, we believe that it may be premature to predict the long-term value capture of AI tokens, as the crypto-currency and the broader technology field may disrupt this field. Furthermore, we believe that the current on-chain utility of the agents may not be sufficient to ensure a high number of users in the short term. Nevertheless, we believe that this field remains an important topic worthy of attention due to its rapid pace of innovation and its great long-term potential.